To control the region’s energy crisis, the European Commission intends to propose a mechanism to reduce price volatility on the largest gas market in the bloc. The union’s executive arm is looking into imposing a dynamic price cap on transactions on the Dutch Title Transfer Facility, whose primary index serves as the benchmark for all gas traded on the continent.

“This will help avoid extreme volatility and price hikes, as well as speculation which could lead to difficulties in the supply of natural gas to some member states,” the commission said in a draft document seen by Bloomberg News.

Ursula von der Leyen, the president of the European Commission, stated earlier this month that the TTF no longer reflects the energy realities of the EU as a whole because Russia cut off supply to Europe and the proportion of gas coming from Moscow fell from 40% to roughly 7%.

According to the draft proposal, the package would also include a temporary intra-day price spike cap mechanism to prevent extremely high volatility in the energy derivative markets. The goal is to “ensure sounder price formation mechanism,” safeguarding the area’s energy companies against significant surges and assisting them in medium-term supply security.

The commission’s plan also identified the dynamic price cap would be implemented while the EU develops a new complementary benchmark for liquefied natural gas. By the end of 2022, the new index would begin, and by the beginning of 2023, the benchmark was anticipated to be ready for use.

In the earlier version of the gas measures the union was reportedly considering, it included putting price caps on natural gas used for power generation, capping a price ceiling on gas imports from Russia, and suspending trading on power derivatives markets.

The move, materializing the long-rumored action on energy prices, is seemingly in response to Russian state-owned Gazprom keeping the Nord Stream 1 pipeline offline indefinitely due to an alleged leakage.

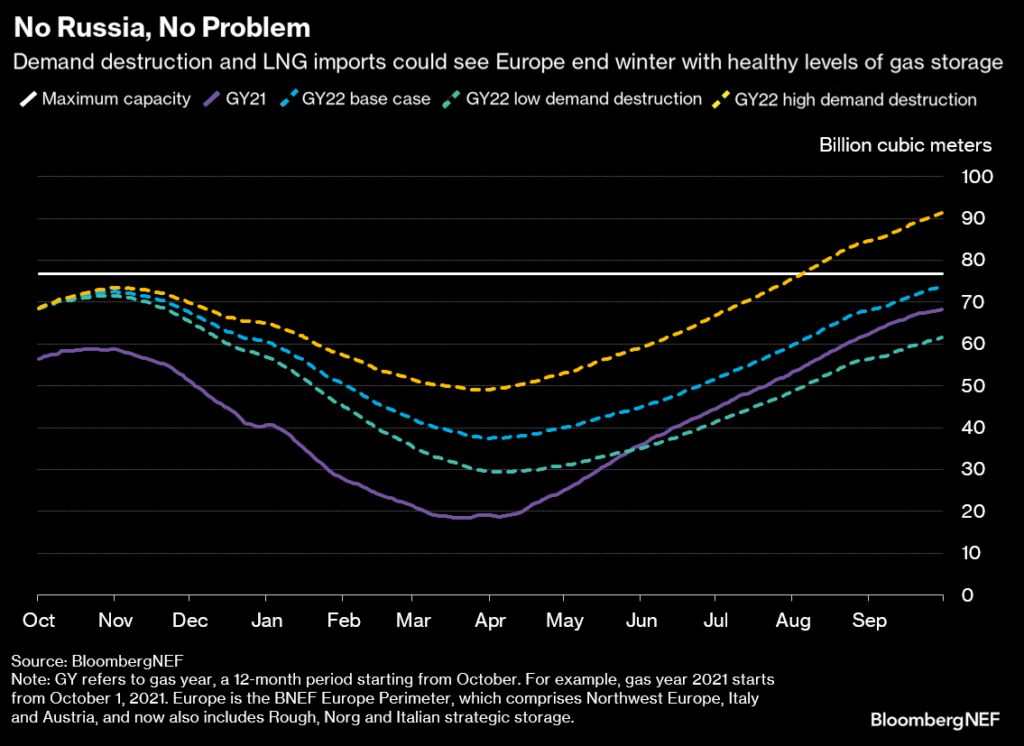

Without Russia, the continental bloc has been looking for ways to shore up their energy reserves ahead of the winter season–fast-tracking their shift from energy dependency on Moscow.

However, Russian President Vladimir Putin in his latest address at the Energy Week said that Russian gas could still be sent to Europe via one of the Nord Stream 2 pipeline’s remaining intact lines, but the decision is now in the hands of the European Union.

The commission seeks to expand its joint purchasing platform, which would coordinate the filling of gas reserves, in order to increase its resilience and influence in negotiations with alternative gas suppliers. According to the draft, it could be more challenging to reach the 90% filling target by November 2023 if storage resources run out at the conclusion of current winter.

The aim is to require member states to buy gas in bulk for at least 15% of their storage, and to allow corporations to organize a European consortium. Russian supply sources would be barred from taking part.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.