The EU is importing more Russian oil than before western leaders imposed crippling (or what were meant to be crippling) sanctions on the post-Soviet economy in response to Vladimir Putin’s military conflict in Ukraine.

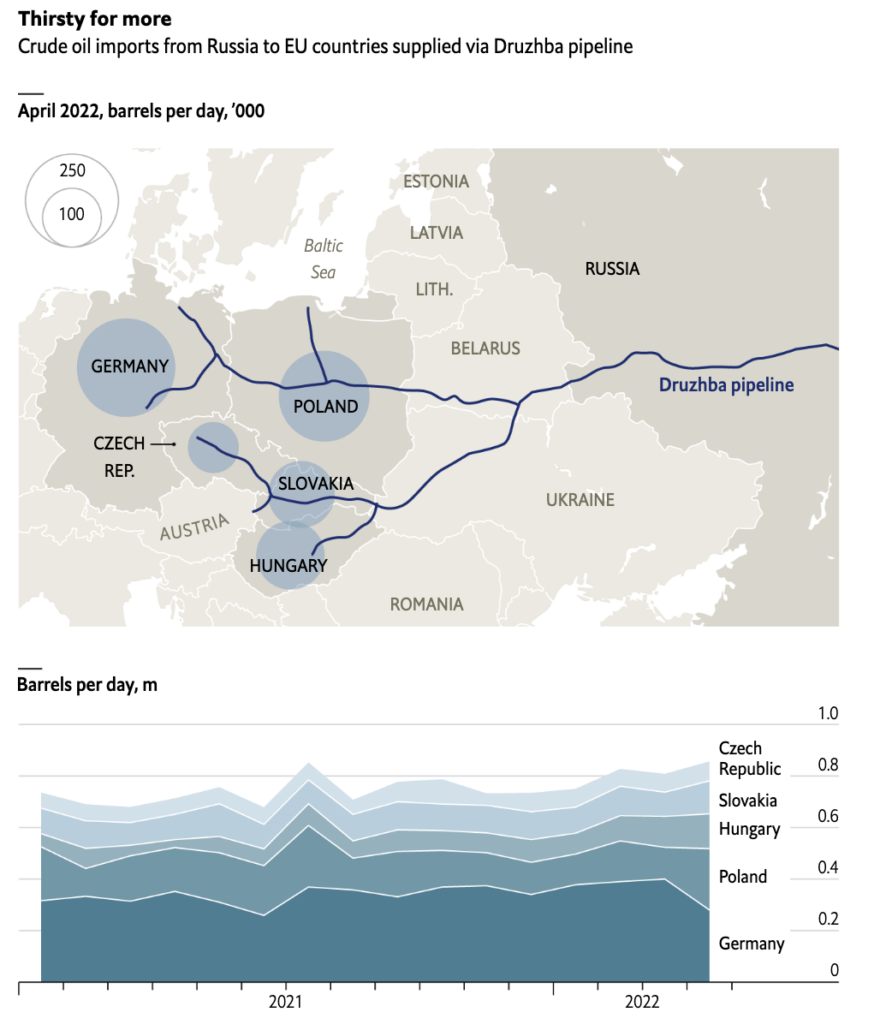

According to the Economist which cited data compiled by Argus Media, Russian oil shipments to the EU rose from 750,000 barrels per day to 857,000 barrels per day between January and April, marking a 1`4% increase. Evidently, the jump in output also comes at the same time that Brussels has been actively calling on leaders to completely halt all energy imports from Russia in an effort to further punish the Kremlin for its role in the Ukraine conflict.

The EU’s embargo on Russian oil imports currently only cover shipments of seaborne oil and petroleum products, which account for 75% of supplies from Russia. Exempt is crude supplied via pipelines to several countries in eastern and central Europe, prompting refineries in those regions to snap up “cheap Russian crude that most Western buyers are shunning.”

Germany is thus far the only country in the EU that has cut imports from Russia via the Druzhba pipeline since the beginning of the conflict in Ukraine. The pipeline is one of the largest and longest in the world, through which energy flows from the eastern part of Russia all the way to various refineries in Germany, Czech Republic, Hungary, Slovakia, and Poland.

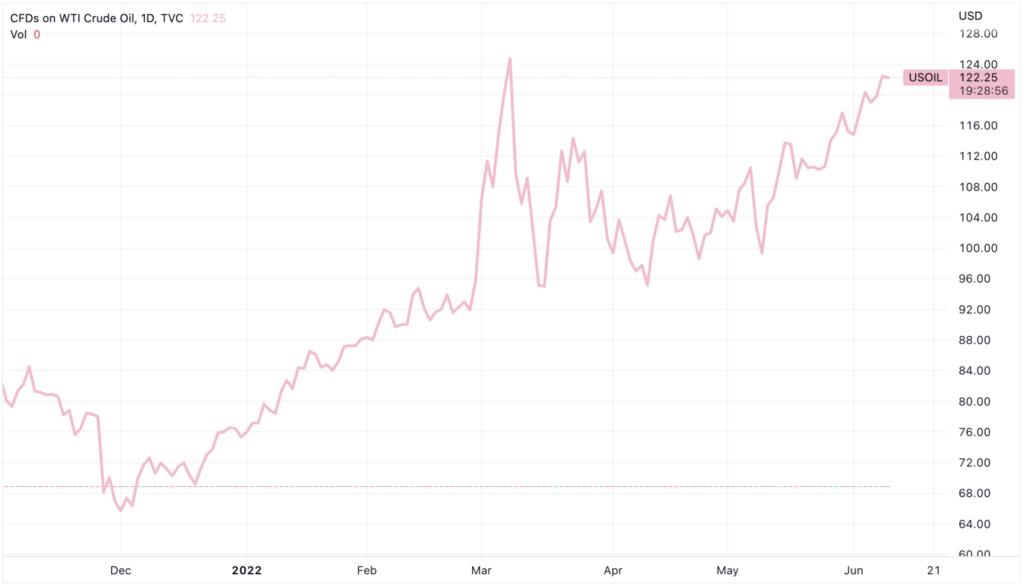

Western leaders’ ban on Russian oil has created an arbitrage opportunity whereby imports have become cheaper to the international benchmark Brent and WTI, creating “little financial incentive for refiners to ditch Russian supply,” read the Economist report. The data showed that refineries receiving Russian oil through the Druzhba pipeline enjoyed discounts of up to $40 per barrel compared to North Sea oil in May.

Information for this briefing was found via The Economist. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.