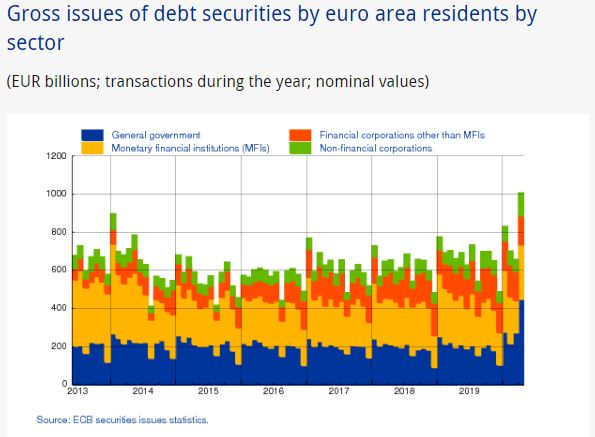

In response to the unprecedented economic impacts stemming from the coronavirus pandemic, the European Central Bank (ECB) has issued a record 1.3 trillion euros affixed with negative interest rates as a form of monetary policy.

According to the ECB, so far a total of 742 banks have applied to borrow a portion of the 1.3 trillion euros at a interest rate of -1% if certain conditions are met. In order to secure a loan at the -1%, banks are required to only lend to businesses and households, and not to residential mortgages while maintaining 2019 levels. If the criteria cannot be met, then the bank’s interest rate is increased to -0.5%.

It is being anticipated that approximately 760 billion euros from the ultra-cheap loans will go towards repaying previous ECB loans which have an approaching maturity date. However, the remaining 549 billion euros is expected to go towards purchasing bonds issued by the bank’s domestic governments, which will in turn earn the bank profit given the higher yield affixed to government bonds.

Thus, the ECB’s negative rates will ultimately support up to 1.5 trillion euros worth of additional debt accumulated by eurozone governments in response to the coronavirus pandemic. According to some analysts however, such a scenario will result in banks having their fate tied to their governments; Italian banks for example own approximately 425 billion euros of their country’s debt.

Information for this briefing was found via Financial Times. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.