You know those ultra-dovish monetary policies they told you not to worry about? Well, it’s time to start worrying about them, because as Fed Chair Jerome Powell himself finally said, it is “time to retire the word transitory regarding inflation.”

That’s right folks, in a surprising turn of events, Powell delivered the final nail in the coffin of team transitory, effectively announcing that the word no longer defines the current economic landscape and should be scrapped entirely. “It carries a time, a sense of [being] short-lived,” said Powell regarding the word in question. “We tend to use it to mean that it won’t leave a permanent mark in the form of higher inflation. I think it’s probably a good time to retire that word and try to explain clearly what we mean.”

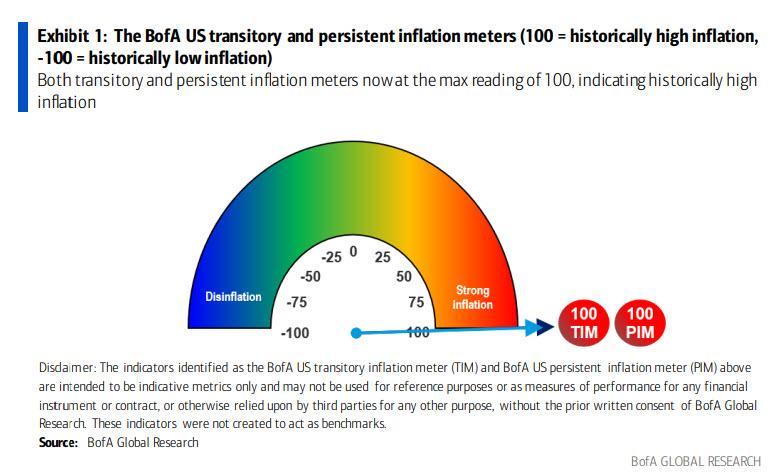

The latest Senate committee meeting marks the first time that Powell has officially and clearly admitted that inflation is not merely temporary, as himself and his Federal Reserve minions have repeatedly reassured. And although it certainly is a proper step in the right direction in terms of abandoning the transitory narrative, it comes a little too late, because as a recent Bank of America reading shows, both transitory and persistent inflation meters sit at an all-time high.

Indeed, October’s CPI reading hit a 30-year high of an annualized 6.2%, following consecutive months of inflation readings exceeding the 5% mark. As a result, Powell also acknowledged that the Fed will have to evaluate its current rate of bond purchases as well. “At this point, the economy is very strong and inflationary pressures are high and it is therefore appropriate, in my view, to consider wrapping up the taper of our asset purchases,” he explained.

Information for this briefing was found via Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.