It’s official: the Fed has lost complete control over inflation, prompting the White House to issue its own warning ahead of March’s highly anticipated CPI print.

While Fed Chair Jerome Powell laments in last year’s historic amount of lying when he promised inflation would all be transitory, the Biden administration is forced to embark on a damage control spree and mentally prepare markets ahead of tomorrow’s scorching-hot inflation print. White House Press Secretary Jen Psaki on Monday warned that upcoming Labour Department data will be substantially higher from February’s headline inflation due to the sudden jump in oil and gas prices following Putin’s Ukraine invasion.

https://t.co/LbrCJA2Qzc pic.twitter.com/rHcb6pPDz0

— Rob Paone (@crypto_bobby) April 11, 2022

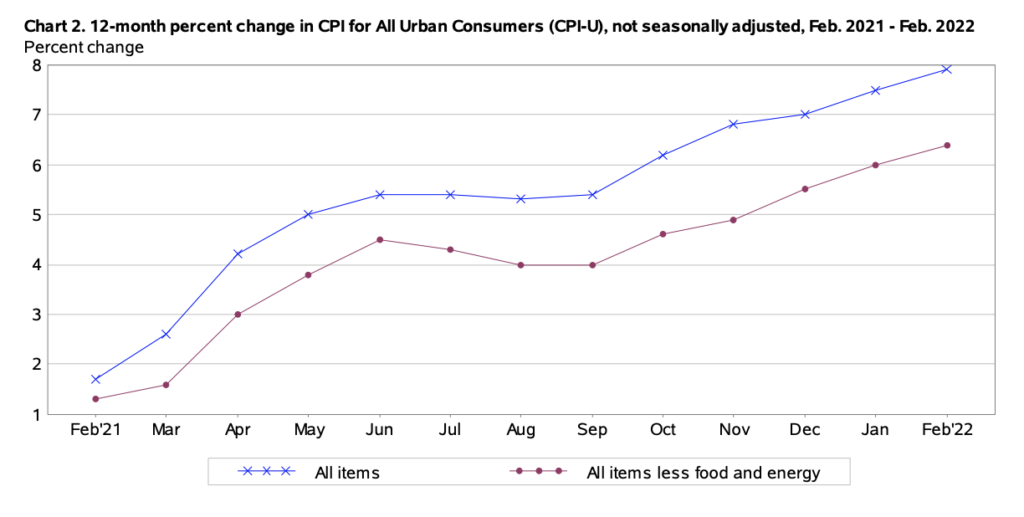

“We expect March CPI headline inflation to be extraordinarily elevated due to Putin’s price hike,” Psaki told the press, adding that there will likely be a “large difference between core and headline inflation,” due to “global disruptions in energy and food markets.” Forecasts are calling for a jaw-dropping 8.4% year-over-year increase in headline CPI, and a 6.6% jump in core inflation— which would both be the highest since January 1982.

Joe Biden has been quick to blame the rapidly deteriorating economic landscape on Vladimir Putin’s military operation Ukraine, assuring Americans that banning Russian oil imports “was the right thing to do,” even in face of the financial toll surging prices at the pump would have on consumers’ wallets. Although the Biden administration released about 1 million barrels of oil per day from the country’s Strategic Petroleum Reserve, it has done little— if anything at all — to cool fuel prices.

In the meantime, while the White House peddles the myopic narrative that the last year’s consecutive monthly increases in inflation were all the result of Putin’s February invasion of Ukraine, humiliated Fed officials are left coming to terms with what is turning out to be the wort policy error in modern history: failing to take decisive action and raise rates before the only thing left to correct inflation is a devastating recession.

And Putin dressed up like Jerome Powell and printed trillions

— Truinderdashdubbadapresher (@shawntcuff) April 11, 2022

To further illustrate just how much policy catch-up the Fed is facing, the central bank’s first opportunity to hike borrowing costs fell short of the half percentage-point increase markets were expecting, instead only raising rates by a paltry 25 basis points during last month’s meeting in face of February’s eye-watering 7.9% CPI print. But, FOMC minutes from March reveal the Fed is also preparing to shed its ballooned balance sheet by $95 billion per month come its next meeting in May, as they come to the realization that not enough was done during the last meeting.

Jerome Powell trying to engineer a “soft landing”

— Bucco “Buyback” Capital (@buccocapital) April 5, 2022

pic.twitter.com/YQYgUYXZQN

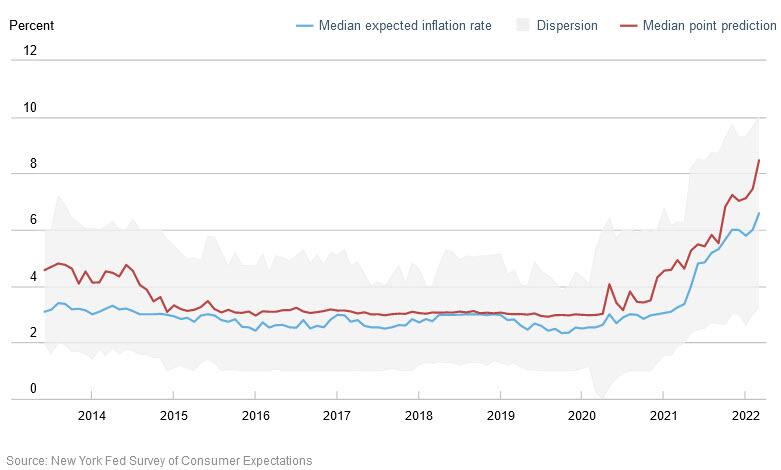

In the meantime, the latest Consumer Expectations survey from the NY Fed showed that Americans are now expecting inflation to hit 6.58% over the next year— the highest on the survey’s record. Likewise, the median expected inflation rate jumped to a staggering 8.5%— also a series high last month. To make the situation even more bleak, the NY Fed revealed that “more respondents reporting being financially worse off than they were a year ago. Respondents were also more pessimistic about their household’s financial situation in the year ahead, with fewer respondents expecting their financial situation to improve a year from now.”

It looks like things are about to go from bad to worse for the Fed…

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

CPI data is one BIG lie !! why doesn’t the media tell the truth about it ??