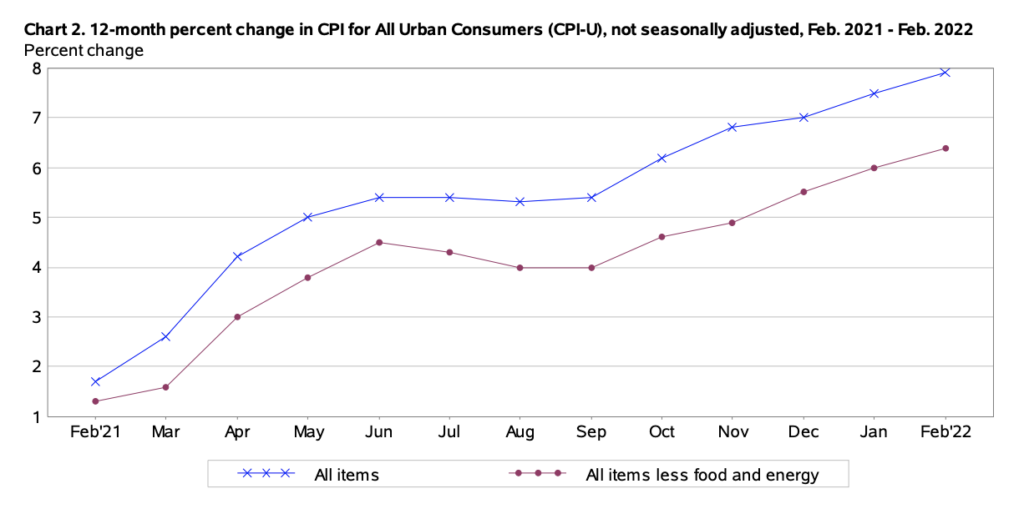

It appears that Fed officials have finally come to the realization that the hottest inflation print in 40 years needs a lot more than a splash of its 25 basis-point hike in interest rates in order to cool off, prompting the central bank to quickly shed its $9 trillion balance sheet and hightail it out of government bond markets.

According to March’s FOMC minutes released on Wednesday, the central bank is preparing to slash its assets by $95 billion per month in an effort to cool surging inflation that persistently remains above its 2% target range. Since the beginning of the pandemic, the Fed slashed borrowing costs to near-zero and embarked on an unprecedented shopping spree worth trillions of dollars in Treasuries and mortgage-backed securities to prevent a complete collapse of the US economy.

This is not Tesla, AMC, or even GameStop. It’s the Fed’s balance sheet pic.twitter.com/c31PKXGrlR

— Not Jerome Powell (@alifarhat79) March 3, 2022

However, two years later, the effects of ultra-low rates and a $9 trillion balance sheet have pushed inflationary pressures into every nook and cranny of the economy, and when coupled with other global macroeconomic and geopolitical events such as snarled supply chains, material shortages, and the Ukraine conflict— only a fool would believe a mere 25-basis point interest rate hike would suffice.

That is the epiphany that Fed officials finally had, and are now left scrambling to reduce Treasuries and MBS by $60 billion and $35 billion per month, respectively, agreeing that “caps could be phased in over a period of three months or modestly longer if market conditions warrant.” Last month’s proposal is expected to be finalized by the next meeting on May 3: “participants agreed they had made substantial progress on the plan and that the Committee was well placed to begin the process of reducing the size of the balance sheet as early as after the conclusion of its upcoming meeting in May,” read the minutes.

The minutes revealed that Fed officials also mulled a 50 basis-point increase given the sharper-than-expected inflationary pressures, but ultimately decided to hold off on the move given the developing situation in Ukraine. “Many participants noted that— with inflation well above the Committee’s objective, inflationary risks to the upside, and the federal funds rate well below participants’ estimates of its longer-run level—they would have preferred a 50 basis point increase in the target range for the federal funds rate at this meeting.” But, they ultimately decided that “a 25 basis point increase would be appropriate at this meeting.”

Central bank members conceded that the timeline of monetary policy tightening should move forward sooner than previously anticipated, after the war in Ukraine sent the price of food and energy soaring. In fact, even Fed Chair Jerome Powell acknowledged that a half percentage point increase is still a possibility come the next meeting. Investors, for the time being, are forecasting more than 7 rate hikes throughout the remainder of 2022.

However, the Fed also faces a very tough predicament, because while its racing to play monetary policy catch-up, the economic landscape has already drastically shifted. Policy makers are now embarking on a policy error of taking the punch bowl away from an economy that is rapidly slipping into a recession. Indicative of this is an increasingly flattening yield curve with the spread between the 2-year and 10-year hovering at an alarming low of 0.19, a significant decline in mortgage applications, and a weakening in Chinese manufacturing and services activities.

All of these signals are concurrently flashing red just as demand-induced price shocks are now transitioning into Russian-led supply price shocks, leaving the Fed frazzled trying to save face over what is proving to be the second-worst policy error in modern history: that is, leaving borrowing costs at near-zero for far too long.

Information for this briefing was found via the Federal Reserve. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.