The Federal Reserve is expected to conclude its two-day policy meeting on Wednesday, and markets are expecting yet another rate hike— albeit at a more modest pace this time.

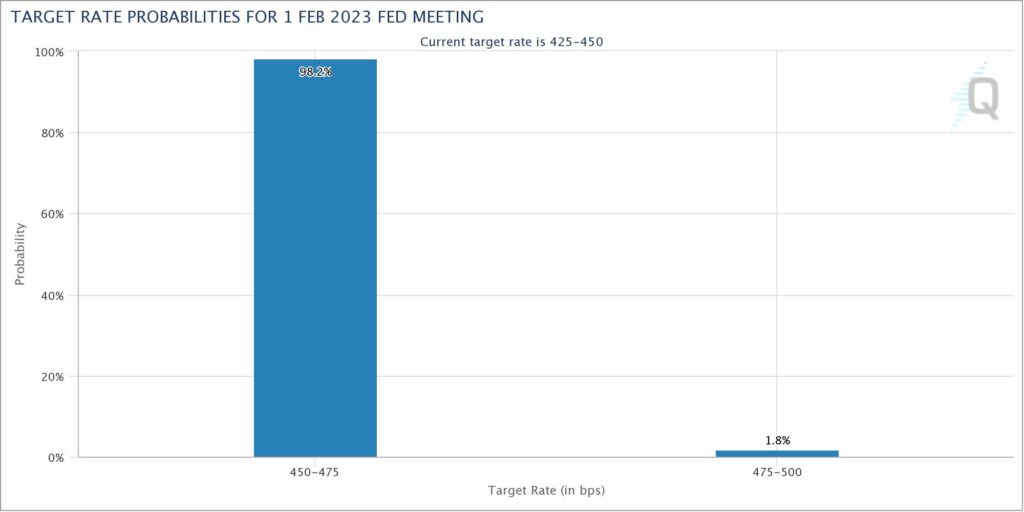

Markets are betting there is a 98% probability of a 25 basis-point rate hike, as policy makers trudge deeper into one of the most aggressive tightening cycles since the Volcker era. If rates do in fact increase for the eighth consecutive time, the Feds fund rate will sit at a range between 4.50% to 4.75%, making borrowers pay even more on credit card interest, student debt, and mortgage loans.

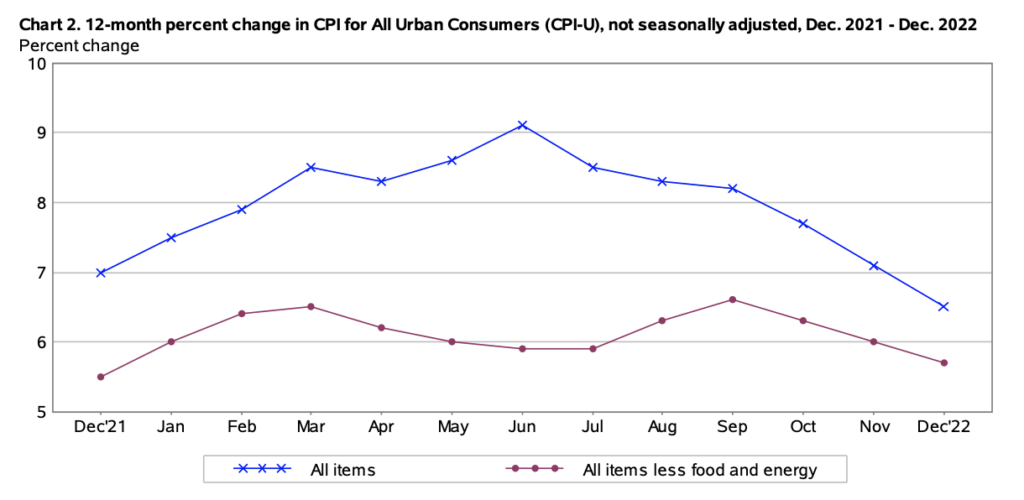

However, following four straight 75 basis-point moves and December’s 50 basis-point hike, incoming inflation data suggests price pressures are finally beginning to taper. The PCE index increased 5% year-over-year in December, and 0.1% from the month prior. However, core PCE, which doesn’t account for volatile components such as food and energy, rose 4.4% in 12 months, marking a slight decline from November’s 4.7% annual gain. On a three-month basis, core PCE was up 2.2%, and 3.7% during the six-month period ending in December.

“The argument is just whether you should pause after three months of data or pause after six months of data,” commented Fed Governor Christopher Waller earlier this month, as cited by Bloomberg. “From the risk management side— I need six months of data, not just three.” Indeed, Inflation stood at an annualized 6.5% in December, marking the smallest 12-month increase since October 2021. “The good news is that the worst is over,” said Columbia University Business School assistant finance professor Yiming Ma, referring to the Fed’s hiking cycle.

“The messaging shifts— before it was you’ve got to get moving quickly and hunker down because we’re going to be jacking rates,” said Deutsche Bank senior US economist Brett Ryan as quoted by Bloomberg. “Now it’s not about the pace, it’s about the end point and we have to feel our way around where the end point is.” A chorus of Fed officials forecast in December that interest rates would reach a peak between 5% and 5.25% to conclude the hawkish tightening cycle, suggesting two more quarter-point hikes are still pending.

The Fed meets this week, and while it will increase rates again, this time by a quarter point, it should also signal this may be the last rate hike for a while. That is, the Fed should pause its rates hikes to gauge whether its aggressive hikes of the past year are working. pic.twitter.com/m2IuoTADku

— Mark Zandi (@Markzandi) January 29, 2023

“Even after we have enough evidence to pause rate increases, we’ll need to remain flexible and raise rates further if changes in the economic outlook or financial conditions call for it,” said Dallas Fed President Lorie Logan in a speech.

⚠️BREAKING:

— Investing.com (@Investingcom) January 31, 2023

*U.S. STOCK FUTURES FALL AS WALL STREET BRACES FOR FED RATE HIKE, TECH EARNINGS$DIA $SPY $QQQ $IWM 🇺🇸🇺🇸 pic.twitter.com/M6tYuB2XAn

Information for this story was found via Bloomberg, CME Group, CNBC, Twitter, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.