Following a recent move to lift the SLR exemption amid a improving economic outlook, the US Fed has given banks more leeway by removing— as was largely anticipated— the limits on bank buybacks and dividends come the end of June.

If major US banks pass the next round of stress tests with adequate capital, they will be able to increase buybacks and dividend to shareholders as early as June 30, the Fed announced on Thursday. As a precautionary measure, the Fed restricted major banks from raising dividends at the beginning of the pandemic, causing them to accumulate additional capital for lending as the US economy lapsed into a recession.

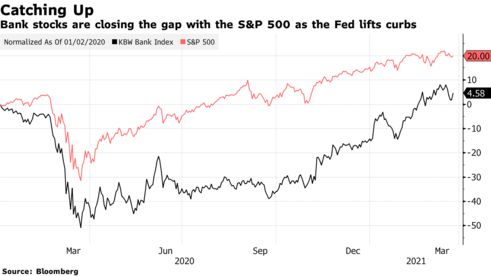

However, the restrictions took a toll on the banks’ returns, while also raising alarm over the potential for an onslaught of loan defaults— which evidently never materialized. With the positive outlook on the US economy broadening, the entire banking industry has able to close the gap between the S&P 500, especially after the Fed relaxed a constraint on buybacks in December.

A series of stress tests conducted back in December suggested that most major US banks— including Morgan Stanley and Goldman Sachs— met minimum requirements. It is expected the banks will pass the same evaluations in June, allowing them to return to their pre-pandemic business practices— distributing capital to shareholders.

Information for this briefing was found via the Federal Reserve and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.