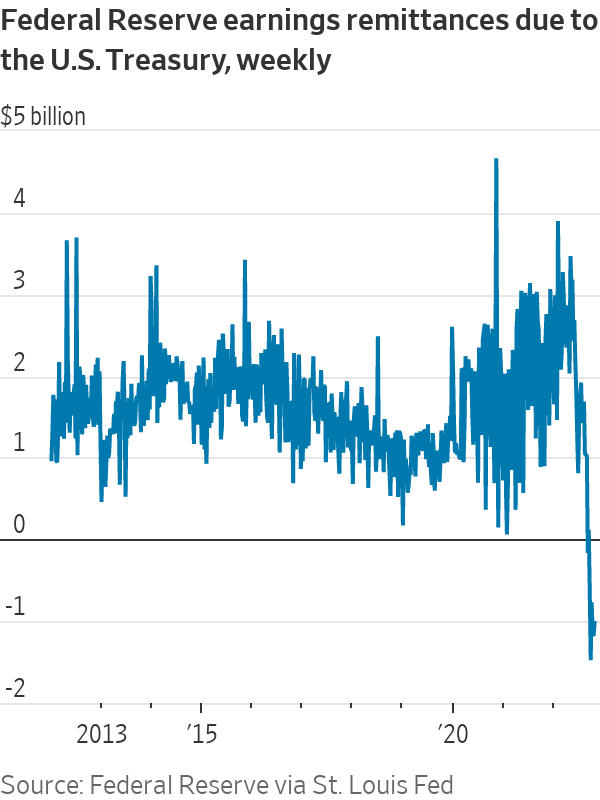

The US Federal Reserve is losing money as it pays more interest expense than it earns from interest income. The reason: The US Federal Reserve.

The Fed’s operating losses have increased in recent weeks because the interest it pays banks and money-market funds to keep money at the Fed now exceeds the income it earns. This deficit is on the $8.3 trillion in Treasury and mortgage-backed securities it has accumulated over the past 14 years through bond-buying stimulus programs.

However, these losses come after years in which the central bank generated around $100 billion in profits, which it sent to the Treasury. These remittances decreased federal deficits, and when they stop, the federal government may face slightly increased borrowing demands.

The losses have also no impact on the Fed’s ability to conduct monetary policy. But even if the net interest losses have no effect on the day-to-day operations, they may generate political headaches in the future, according to Barclays strategists in a recent study. Furthermore, they estimated that the distribution of Fed reserves and overnight loans through the reverse-repurchase facility might result in $325 billion in payments to significant financial institutions over the next two years.

Should it continue to sustain losses, the Fed can itemize a delayed asset on its balance sheet like an IOU. When the Fed runs a surplus in the future, it will pay out the IOU first before paying surpluses to the Treasury.

The Fed’s $8.7 trillion asset portfolio is largely made up of interest-bearing assets, including as Treasury and mortgage securities, with an average yield of 2.3%. The liability side of the Fed’s balance sheet includes bank deposits stored at the Fed known as reserves and overnight loans known as reverse-repurchase agreements.

The aggressive rate hikes implemented by the central bank expectedly impacted its own balance sheet. Economists believe that the Fed will proceed with a fourth consecutive 75 basis point interest rate hike on November 2, according to a poll by Reuters. They agree that the Fed should not slow hikes until inflation falls to half of the current 8.2%.

READ: US Inflation Still Surpassing Expectations, Reinforces Fed’s Hawkish Tightening Cycle

But the Fed, like most central banks, does not mark its assets to market and instead recognizes losses on its securities holdings only when they are sold. The Fed is currently passively reducing its asset portfolio by allowing up to $95 billion in securities to mature each month.

Information for this briefing was found via The Wall Street Journal. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.