With the Federal Reserve pumping trillions of dollars into the US economy with hopes of saving it from complete collapse, it appears that the money did produce a noteworthy effect amid the soaring unemployment rates.

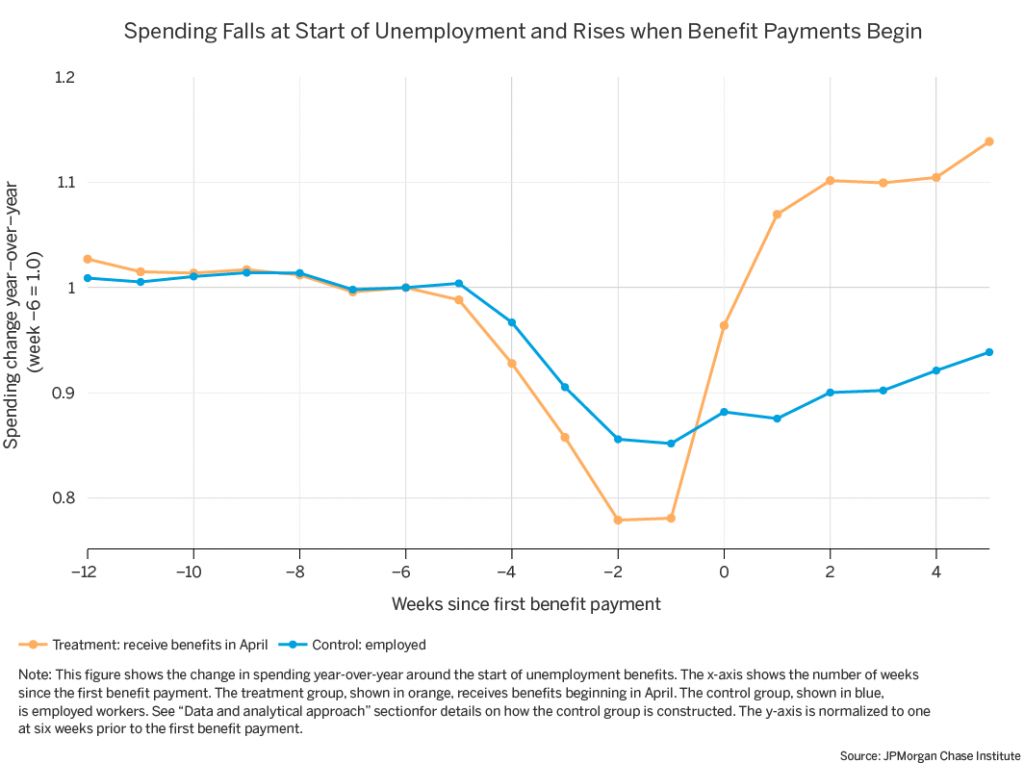

The additional $600 in weekly unemployment benefits has not only helped those who suddenly found themselves jobless remain afloat, but also has caused them to increase their spending in the meantime. In fact, according to analysts at JPMorgan Chase Institute, households ended up spending on average 10% more than before the pandemic. The researchers found the consumer behaviour to be rather puzzling, given that in a typical recession, households that receive jobless payments tend to reduce their spending by approximately 7%.

However, with the $600 unemployment top-up slated for phase-out by the end of July, the increased spending that has upheld the fragile economy may soon come to an end. As much of the country continues to battle soaring coronavirus infection rates and no decrease in jobless claims, the 30 million Americans and counting that no longer have a steady source of income may significantly impede consumer activity – and ultimately, the US economy.

Information for this briefing was found via Reuters, CNBC, RT News, and JPMorgan Chase. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.