First Lithium Minerals Inc. (CSE: FLM) is a newly-listed Toronto-based junior exploration company that is developing its flagship OCA Project located in South America’s lithium triangle in northern Chile. The lithium triangle is the world’s largest brine lithium producing region and shares borders with Chile, Bolivia and Argentina. Chile is the world’s leading lithium producer.

The Overview

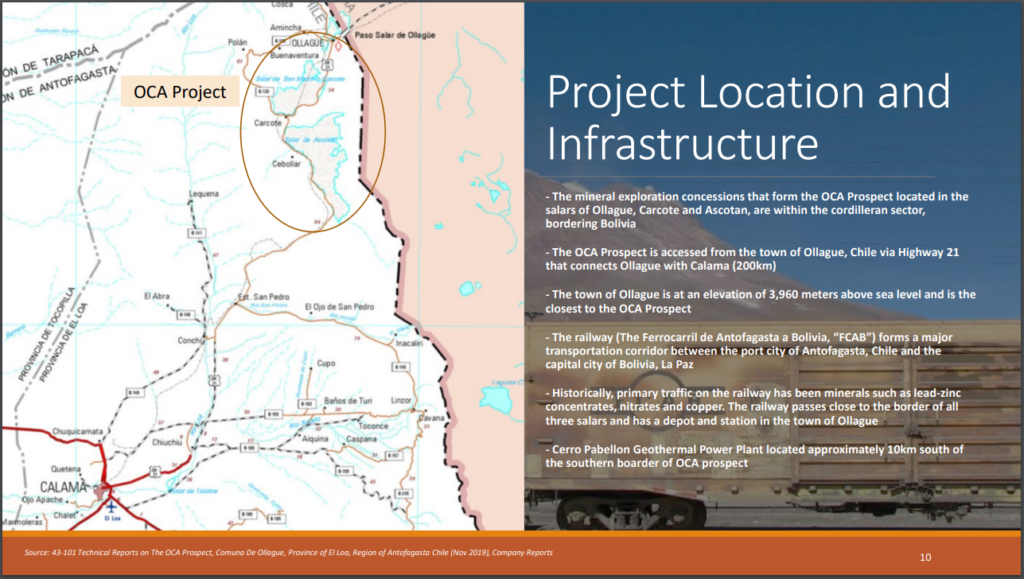

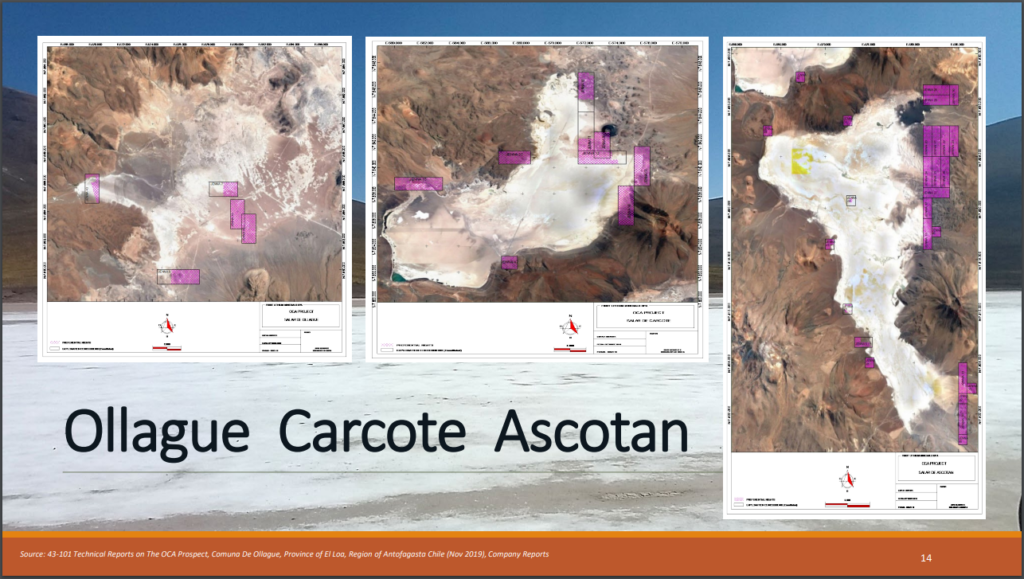

First Lithium’s OCA brine project comprises 40 mining exploration concessions covering 8,900 hectares on the edges of three salars in the eastern part of the Atacama desert in the Antofagasta Region of northern Chile. Notably, the location of the salars are strategic, as it enables First Lithium to build out plants and operational facilities or ponds on solid ground. The Ollague, Carcote and Ascotan Salars are situated within a single geological structure within the cordilleran sector near the Bolivia border. The company has been assembling its land position in the region since 2016.

The OCA Project is close to the town of Ollague, which is located 3,960 metres above sea level in the Andes Mountain range. The area has excellent infrastructure to support all aspects of mining. The Cerro Pabellon Geothermal Power Plant is located approximately 10 kms south of the OCA project’s southern border, while the Ferrocarril de Antofagasta railway runs from La Paz, Bolivia through the Ollague area, passing close to the border of all three salars, and continues to the port city of Antofagasta, Chile. It was built to transport many of the region’s minerals such as copper, lead and zinc. The road network meanwhile is excellent and a skilled labour pool is readily available.

The Lithium Market

The opportunity for First Lithium is timely as lithium demand is rising faster than new supplies can be produced, and this is expected to move the supply/demand balance deeper into a deficit by 2030. Demand is being driven by the electric vehicle (EV) market, for which lithium is the key raw material used in the manufacturing of the lithium-ion batteries that power EVs.

Benchmark Mineral Intelligence, a Lithium industry research firm, believes the lithium industry will require $42 billion of investment if it expects to meet 2030 demand, or roughly $7 billion per year between now and 2028. It projects that lithium demand will reach 2.4 million tonnes of LCE (lithium carbonate equivalent) by 2030, which is almost 1.8 million tonnes more than the 600,000 tonnes of lithium that it expects will be produced in 2022. These fundamental underpinnings for lithium bodes well for lithium explorers such as First Lithium.

Much of the world, especially European countries, are actively promoting a transition from fossil-fuel powered vehicles as they continue to shift to renewable energy technologies to meet carbon emission standards in the quest to achieve carbon neutrality by 2050. According to Bloomberg’s 2020 New Energy Finance study, it is expected that by 2050, electric vehicles will account for 65% of global passenger vehicle sales by 2050. China has the largest share of the global electric vehicle market and the Chinese government is aggressively promoting the shift to EVs to reduce its dependence on energy imports and to reduce its air pollution.

Chile and Argentina have historically accounted for 99% of China’s lithium carbonate imports. In 2017, Chile accounted for nearly 89% of China’s lithium hydroxide imports. Since then, Covid-19 related issues disrupted international trade patterns which caused a noticeable shift in China’s lithium hydroxide imports, whereas by 2021, Russia accounted for 54% and Chile 39% of China’s imports.

The OCA Project

First Lithium has been assembling its land position within the Ollague, Carcote and Ascotan Salars since 2016. Salars are essentially brine-laden seasonally flooded dry lakes that were formed high in the Andes Mountains by volcanic activity that deposited sediments in an area where annual evaporation is greater than the total seasonal rainfall. In the eastern part of the arid Atacama Desert that sits at an altitude of over 5,000 metres, the three salars were formed in the Loa River basin and are flanked by mountain ranges. This type of topography is common to most of the brine producing areas of the Lithium Triangle.

There are three different types of mineralization present at the OCA Project:

- Liquid – mostly chloride and sulfate brines

- Dendritic – sand, silt, clays found in the salar sediments

- Other salt compounds that have reached acceptable solubility and concentration criteria

In 2019, First Lithium conducted a sampling program on the OCA Project. The initial geophysical surface sampling of the sediments and brine returned an anomaly of high lithium grades which were documented in the Company’s NI 43-101 Report. Among the highlights are Salar Carcote returning 300 ppm lithium in sediments and 607 mg/l within the brine solution, while Salar Ascotan returned 207 ppm lithium in sediments and 451 mg/l within the brine solution.

Future Exploration

First Lithium will be executing its Phase I 2022 exploration program to conduct further hydrology research, surface mapping, as well as shallow geochemical brine sampling to determine potential high concentrations of brine for conducting a comprehensive Electromagnetic TEM geophysical survey. The Phase II exploration program will include shallow drilling to test the depths of the brine and continuity of chemical concentration.

The company will also conduct deeper drilling at depths greater than 300 metres. The geophysicists will conduct porosity and permeability analysis of the salar sediment structures and build a model for effective porosity. First Lithium will then complete a test well and conduct pumping tests to better understand the type of extraction processes and variables that will be dealt with when determining the economic viability of the project. This is very important because brine lithium extraction is essentially a chemical engineering process, rather than mining.

| Company | FX | Market Cap (mm) | Status | Avg Li Grade (mg/l) |

|---|---|---|---|---|

| Lithium Americas | CAD | $5,150 | Explorer | 607 |

| Lake Resources NL | AUD | $1,760 | Explorer | 211 |

| Lithium Power International | AUD | $211.2 | Explorer | 1,167 |

| Alpha Lithium | CAD | $180.0 | Explorer | 504 |

| Lithium Chile | CAD | $108.2 | Explorer | 360 |

| Wealth Minerals | CAD | $78.5 | Explorer | 360 |

| Lithium South Development | CAD | $43.4 | Explorer | 918 |

| Bearing Lithium | CAD | $37.1 | Explorer | 1,170 |

| Argentina Lithium & Energy | CAD | $18.9 | Explorer | 109 |

| First Lithium | CAD | $15.6 | Explorer | 331 – 607 |

| Ion Energy | CAD | $14.5 | Explorer | n/a |

In Closing

First Lithium Minerals has been operating in the mining friendly jurisdiction of Chile since 2016 and has advanced its flagship OCA Project in the interim. The company’s management team has extensive capital markets experience, a local technical team, and has a great relationship with the Chilean government. There are a number of other juniors exploring in the region including Wealth Minerals Ltd. (TSXV: WML), which has a market cap of $78.5 million, and Lithium Chile Inc. (TSXV: LITH) with a market cap of $108.2 million, whom both have projects in the Ollague salar, much like First Lithium.

First Lithium meanwhile has 88.68 million shares outstanding and a modest market capitalization of $15.6 million, which appears to be low relative to other companies at similar stages of development. FLM represents an opportunity for junior exploration investors in one of the world’s most prolific lithium brine producing regions.

FULL DISCLOSURE: First Lithium Minerals is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover First Lithium Minerals on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.