FULL DISCLOSURE: First Majestic Silver is a sponsor of theDeepDive.ca.

First Majestic Silver (TSX: AG) (NYSE: AG) has joined a small list of precious metals producers that managed to achieve their 2025 production guidance. The company this morning released their fourth quarter and full year production results, while also announcing 2026 guidance and an increase to their dividend due to improving financials.

First Majestic in the fourth quarter reported production of 7.8 million silver equivalent ounces, which rises even higher to 8.9 million silver equivalent ounces if using the updated 2025 guidance assumptions for metal prices. That figure includes record silver production of 4.2 million ounces of silver, alongside the production of 41,417 ounces of gold, 14.2 million pounds of zinc, 8.1 million pounds of lead and 235,886 pounds of copper.

On a year over year basis, silver equivalent production improved 37% versus the 5.9 million silver equivalent ounces produced in the fourth quarter of 2024, while silver production was up 77% year over year from 2.4 million ounces in Q4 2024.

WATCH: Why $100 Silver Right Now Would Be a Problem | Keith Neumeyer – First Majestic

For the full year, production hit 31.1 million silver equivalent ounces, coming in near the midpoint of the revised guidance that called for 30.6 to 32.6 million silver equivalent ounces of production in 2025. That figure however includes a 1.3 million silver equivalent impact as a result of rising silver prices which have impacted silver equivalent ratios relative to guidance metal pricing.

Broken out, 2025 production consisted of 15.4 million ounces of silver, an 84% improvement year over year and a new record for the company. The boost was attributed to the acquisition of Los Gatos, alongside a 19% improvement at San Dimas and an 18% improvement in production at La Encantada. Outside of silver, First Majestic produced 147,433 ounces of gold, 56.7 million pounds of zinc and 32.3 million pounds of lead.

Outside of production metrics, First Majestic in the fourth quarter completed 57,305 metres of drilling across its portfolio with up to 27 drill rigs active. The company also announced the sale of the Del Toro Silver Mine in December for gross proceeds of up to $60 million.

READ: First Majestic Sells Past Producing Del Toro Silver Mine For Up To US$60 Million

“2025 was truly a transformational year for First Majestic. The acquisition and successful integration of Gatos, improved operational performance at San Dimas and La Encantada, combined with world-class discoveries at Santa Elena could not have come at a better time. I am pleased to have First Majestic meet or beat our upwardly revised production guidance during this favorable metal price environment. Our team delivered when it matters most, achieving multiple production records and key milestones while maintaining our strong commitment to safety,” commented Keith Neumeyer, CEO of First Majestic.

2026 Guidance

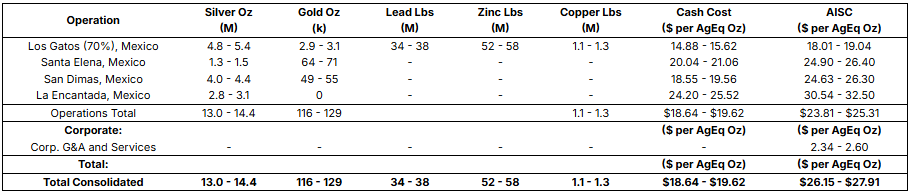

Looking to 2026, First Majestic is guiding to the production of 13.0 to 14.4 million ounces of silver, 116,000 to 129,000 ounces of gold, 34 to 38 million pounds of lead, 52 to 58 million pounds of zinc and 1.1 to 1.3 million pounds of copper.

Cash costs meanwhile on a silver equivalent ounce basis are expected to be $18.64 to $19.62 an ounce, while all in sustaining costs are expected to come in between $26.15 to $27.91 on a silver equivalent basis. Those figures are impacted by a lower silver equivalent conversion rate, which as per First Majestic, makes “reported cash costs and AISC per AgEq ounce appear higher, despite stronger underlying economics.” Using 2025 metals pricings, all in sustaining costs are expected to be at a $23.60 per silver equivalent ounce midpoint.

Those cost figures notably are based on $52 an ounce silver, $3,900 an ounce gold, as well as lead pricing of $0.90 a pound, zinc pricing of $1.35 a pound, and copper pricing of $4.80 a pound.

On the capital side, total capital expenditures in 2026 are expected to be between $213 and $236 million. Within that figure, $58 to $66 million is allocated to sustaining expenditures, while $154 to $171 million is allocated to expansionary expenditures.

Key initiatives to be undertaken this year include a plant expansion at Santa Elena to 3,500 tpd, and a mine throughput increase at Los Gatos to 4,000 tpd. Studies are also to be ongoing along with early stage mine development at the Navidad and Santo Niño discoveries, while fleet expansions are to take place at La Encantada to support higher mining and throughput rates.

Exploration in 2026 is expected to consist of 266,000 metres, the bulk of which at 117,000 metres is allocated to San Dimas. Santa Elena will also see 78,000 metres of drilling, while Los Gatos is expected to see 61,000 metres of drilling conducted. Underground development meanwhile is expected to total 50,000 metres, exceeding the 40,514 metres of development conducted in 2025. Similar to drilling, the bulk of that development is to occur at San Dimas, where 22,000 metres is planned, followed by 7,200 metres at Santa Elena, 12,000 metres at Los Gatos, and 8,700 metres at La Encantada.

Lastly, 2026 will also see increased returns for shareholders. First Majestic has modified its dividend policy, with dividends to now reflect 2% of net quarterly attributable revenues, versus the prior policy of 1% of net quarterly attributable revenue. The first payment under the increased policy is expected to occur for Q1 2026, with the policy applying to revenues earned from January 1, 2026 onwards.

“The increase to our dividend rewards shareholders while providing enhanced leverage to silver prices, as it is directly tied to the Company’s net revenues. I expect we will continue to benefit from improving economics in the years ahead, which will provide the Company with opportunities to make further increases to our dividend payments in the future,” said Neumeyer.

Full financial results are slated to be released on February 19, 2026. A conference call is scheduled for that same day at 11:30 a.m. Eastern.

First Majestic Silver last traded at $27.54 on the TSX.

FULL DISCLOSURE: First Majestic Silver Corp. is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of First Majestic Silver Corp. The author has been compensated to cover First Majestic Silver Corp. on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.