FULL DISCLOSURE: This is sponsored content for First Phosphate.

First Phosphate (CSE: PHOS) this morning delivered a positive preliminary economic assessment for its flagship Lac a l’Orignal property, months ahead of schedule.

The PEA, which focuses on an open-pit mining model for the primary production of phosphate concentrate, suggests the project would produce 425,000 tonnes of beneficiated phosphate concentrate per year, which would contain over 40% P2O5 content. Secondary production meanwhile would see 280,000 tonnes of magnetite and 97,000 tonnes of ilmenite produced each year over a proposed 14.2 year life of mine.

The production figures are significant, given that First Phosphate already has in place a memorandum of understanding with Prayon Technologies for an offtake agreement, which would see Prayon purchase up to 400,000 tonnes per year of phosphate concentrate, or roughly 94% of estimated annual production.

READ: First Phosphate Enters MOU With Glencore Division For Sulfuric Acid

The assessment estimates the project would have an after-tax internal rate of return of 17.2%, and an after-tax net present value (5%) of $511 million, based on 18-month trailing average phosphate pricing. After-tax cash flow meanwhile is estimated at $567 million in years one through five, resulting in a 4.9 year payback period.

“We’re now in a position to prudently evaluate next steps for the Company as we continue with our mission to apply a partnership-based approach to integrate vertically from mine to value-added production of purified phosphoric acid and LFP cathode active material for the North America LFP battery industry,” commented Peter Kent, President of First Phosphate, on the results.

Capital costs for the project are estimated at $550 million in initial costs, and $130 million in sustaining capital. Operating costs per tonne of process plant feed is estimated as being $30.43.

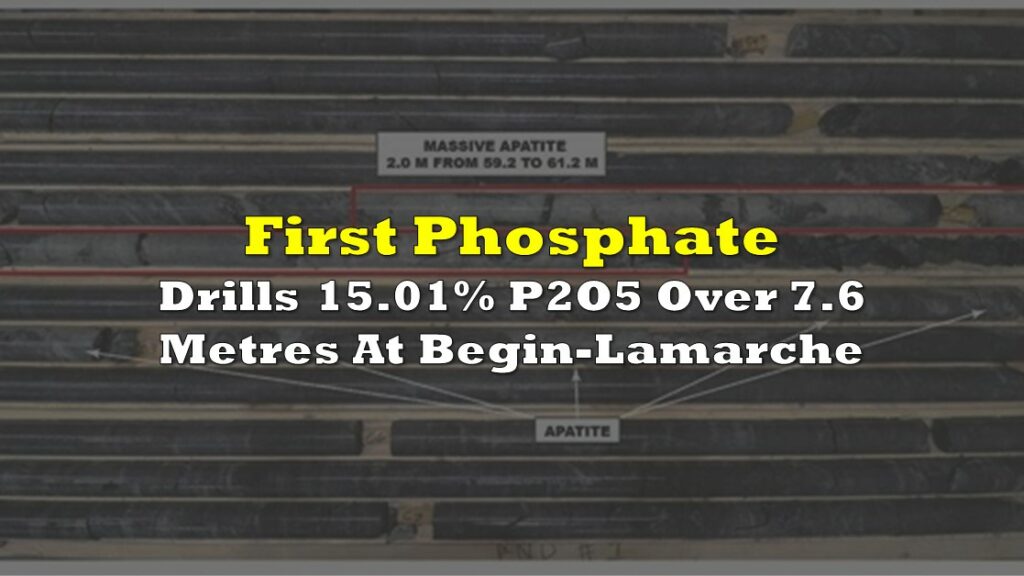

The preliminary economic assessment outlined a mineral resource of 821,000 indicated tonnes of P2O5 at 5.18%, and 1,682,000 inferred tonnes of P2O5 at 5.06%.

First Phosphate last traded at $0.38 on the CSE.

FULL DISCLOSURE: First Phosphate is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of First Phosphate. The author has been compensated to cover First Phosphate on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.