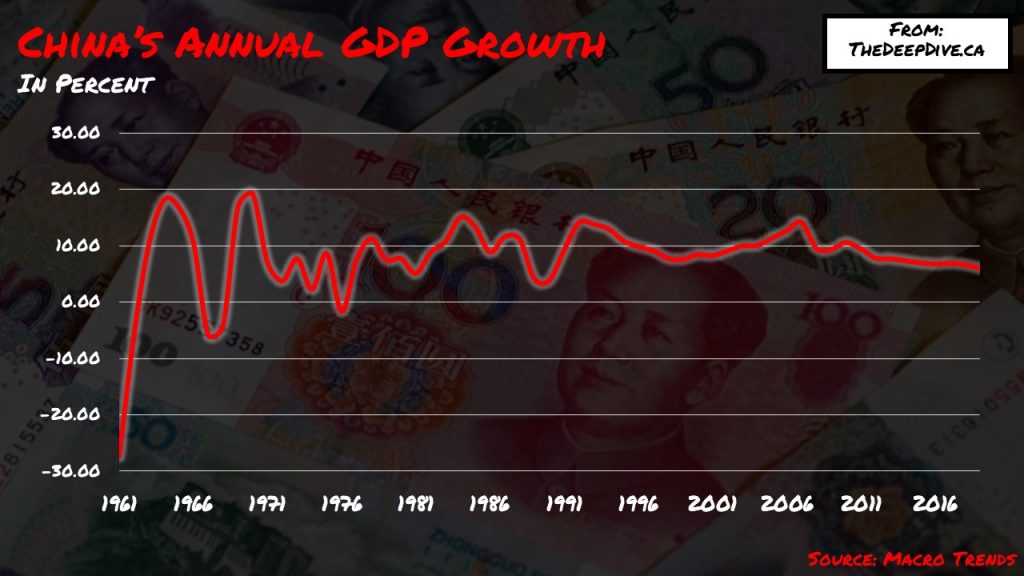

While much of the US economy continues to struggle through the coronavirus pandemic, it appears that China has seemingly been faring much better than anticipated. Fitch Ratings has recently reaffirmed China’s long-term foreign currency issuer default rating at A+, stating a stable outlook in light of the country’s successful external finances and robust macroeconomic responses.

Despite the several downfall caused by stringent coronavirus mitigation measures imposed during the onset of the pandemic, China’s economy has been able to steer on a path to a rapid recovery. In the second quarter of 2020, the country’s real GDP increased by 3.2% on a year-over-year basis, after suffering a downfall of 6.8% in the prior quarter.

According to Fitch, China’s economic recovery has been uneven given that the industrial sector has been outpacing consumer activity, but as monthly data continues to pour in, economic gains continue to gain momentum in light of continued low infection rates. Fitch upgraded its real GDP forecast from a growth of 1.2% in 2020 to 2.7%, and anticipates economic growth to reach 7.5% in 2021, followed by a slight decline of 5.5% the following year.

Information for this briefing was found via Fitch Ratings and RT News. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.