In a statement on Tuesday, the Federal Reserve bank the establishment of a temporary Repo Facility to help support the smooth functioning of financial markets in foreign countries called the FIMA Repo Facility. This new facility essentially prevents foreign central banks from forced liquidation of their treasury holdings into an illiquid treasury market during this volatile period.

The FIMA Repo Facility will allow FIMA account holders, which consist of central banks and other international monetary authorities with accounts at the Federal Reserve Bank of New York, to enter into repurchase agreements with the Federal Reserve. In these transactions, FIMA account holders temporarily exchange their U.S. Treasury securities held with the Federal Reserve for U.S. dollars, which can then be made available to institutions in their jurisdictions.

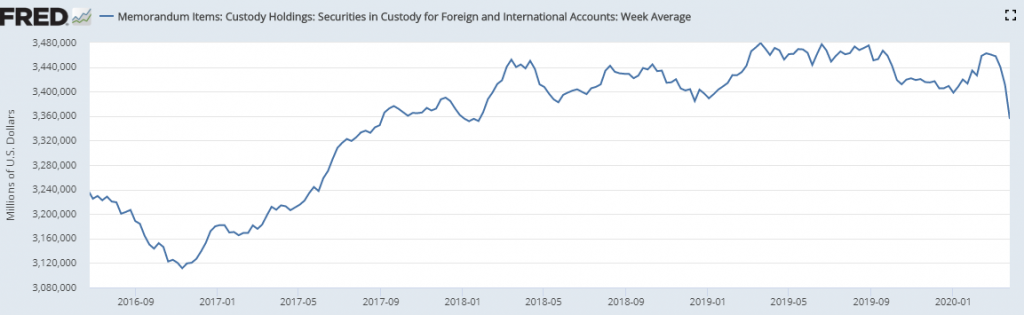

This coming as a response to over $100 billion of sold treasuries in the last three weeks by foreign central banks. According to weekly Fed custody data, this is looking like the biggest monthly drop on record. The foreign holders seek to unload government debt globally to raise cash amid the volatility, according to traders and market makers who spoke with Bloomberg, “Countries reliant on oil exports and smaller Asian economies have been selling U.S. debt, and central banks have been primarily offloading older, less-liquid Treasuries.”

The fall in custody holdings is a clear signal that foreign central banks — which have a lot of Treasury holdings — have been selling them to source dollars… They need access to dollars as a lot of their payments are in dollars and that has driven them to sell Treasuries.”

Subadra Rajappa, Head of U.S. rates strategy at Societe Generale (from Bloomberg)

The goal of the FIMA Repo Facility is to provide an alternative temporary source of U.S. dollars other than the sale of securities in the open market.

In the last month, the Fed has announced trillions of dollars of purchases of assets including treasuries in an effort to calm the treasury markets and avoid further economic fallout. This facility is in addition to various facilities announced over the last month ranging from facility aimed at corporate bonds, commercial paper, small business loans, and pretty much any type of asset for the super wealthy via the insidious TALF.

For a great explanation, I would like to give a special shoutout to George Gammon who has been crushing central banking coverage on his YouTube channel the last few months. Here he breaks down the new FIMA program:

Information for this briefing was found via Bloomberg and FRED Economic Data. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.