On October 6, Fortuna Silver Mines Inc. (TSX: FVI) announced its third-quarter production results. The company announced that it had produced a total of 101,840 gold equivalent ounces compromised of 66,344 ounces of gold, a 1.4% increase sequentially, and 1,837,506 ounces of silver, a 7.3% increase sequentially.

They say that the growth in gold production came in the form of 30,032 ounces from their Lindero Mine and 27,130 from their Yaramoko Mine. As for silver production, they attribute the growth to higher tonnage treated at the San Jose Mine.

They add that they believe they are in a good position to “achieve the upper range of silver annual guidance,” and say that gold production remains in line to meet the annual guidance range.

Lastly, the company said that their Latin American mines, “delivered another steady production quarter for all metals.” With total gold production rising 6.9% increase year over year.

In BMO Capital Markets’ note on the results, they reiterate their outperform rating and $5.25 12-month price target, which represents an upside of 40%. They say that the production results came in better than expected and that the company now looks well-positioned to achieve annual guidance.

The results say that silver production beat their estimate of 1,629 thousand ounces, or 13% higher than their estimate. At the same time, gold production aligned with their estimated 66.9 thousand ounce estimate.

BMO attributes the beat to the San Jose mine, which was projected to produce 1,372 thousand ounces, above the results by 13%. Silver grades also came in better than expected; BMO says their estimate was 72 gpt versus the results of 79 gpt.

For gold, Lindero production came in line with BMO’s projected 29.9 thousand ounces. In contrast, Yaramoko gold production missed BMO’s estimates slightly by 0.9 thousand.

Lastly, BMO says that Seguela continues to be on the path for mid-2023 first gold, even after delays in manufacturing and delivering certain SAG mill components.

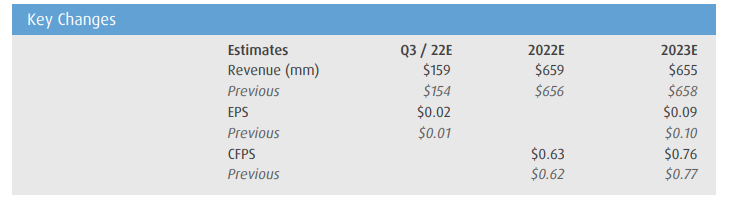

Below you can see BMO’s updated estimates.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.