Fortuna Silver Mines Inc. (TSX: FVI) yesterday reported its second-quarter production results. The company announced that it produced 62,171 ounces of gold and 1,652,895 ounces of silver for a gold equivalent production of 96,712 ounces. Fortuna says that the increase was driven by contributions from the Lindero and Yaramoko Mine.

The company expects to hit its annual guidance for silver and gold production and said that it has produced 3,323,023 ounces and 128,971 ounces of silver and gold during the first half of 2022, respectively. The company is currently guiding for silver production to come in between 6.2 to 6.9 million ounces and gold production to be between 244 to 280 thousand ounces of gold for an annual production of between 369,000 to 420,000 ounces gold equivalent.

Fortuna Silver currently has 7 analysts covering the stock with an average 12-month price target of C$5.83, or an upside of 72%. Out of the 7 analysts, 1 has a strong buy rating, 3 have buy ratings and the last 3 analysts have hold ratings on the stock. The street high price target sits at C$6.50 which represents a 92% upside to the current stock price.

In BMO Capital Markets’ note on the production results, they reiterate their outperform rating and C$6.25 12-month price target, suggesting that Fortuna Silver has an upside of 85%.

On the results, BMO says that the company slightly beat their 1,633,000 ounce silver estimate but came up short on the gold production, as they were expecting the company to produce 67,000 ounces of gold for the quarter. BMO says that the company’s Latin American operations, “had a solid production quarter, which mitigated the impact of COVID-19 related absenteeism from Q1/2022,” and now expects that Fortuna will meet its annual production guidance.

On specific mines, BMO says that Lindero’s production of 29,000 ounces of gold missed their 30,000 production estimate, but still represented a 49% year-over-year increase. They add that the higher production from the mine came from its three-stage crushing and stacking circuits which accounted for 99% of the ore placed.

The San Jose Mine meanwhile produced 1,385,000 ounces of silver and 8,300 ounces of gold, in line with expectations. Though silver and gold production was down 15% and 19%, respectively. BMO believes that this decline was attributed to a lower mill throughput and lower head grade.

Lastly, the Yaramoko Mine, which produced 24,600 ounces of gold, missed BMO’s estimate of 28,000 ounces by about 12%. They say that the miss was driven by lower-than-expected grades, which came in at 5.42 grams per tonne versus their estimate of 6.9 grams per tonne.

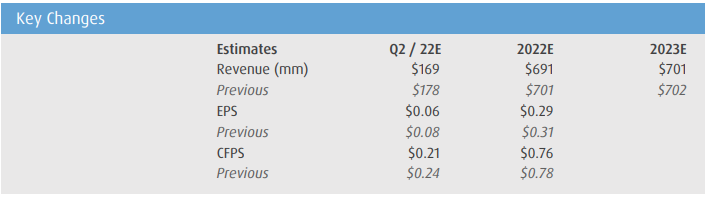

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.