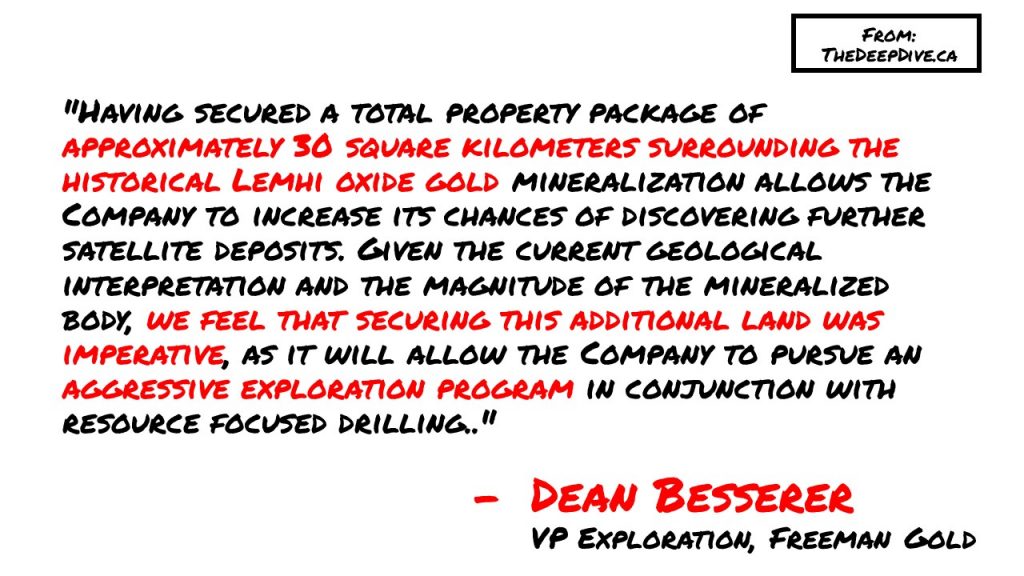

Freeman Gold (CSE: FMAN) this morning announced that it staked an additional 219 claims at its Lehmi Gold project in Idaho. The additional claims bring the total size of the Lemhi Gold project o over 7,515 acres of ground that has largely been unexplored despite historic discoveries of the resource.

The additional stake claims are said to be in highly prospective areas, in the vicinity as well as along strike of known near surface oxide gold mineralization. The additional claims have seen over 355 drill holes between 1980 and 2013.

In addition to the increased land claims, Freeman also announced this morning the appointment of Tom Panoulias to the role of VP, Corporate Development effective June 10. Panoulias is a capital markets professional, having spent over 15 years at the likes of Echelon Wealth, Fraser Mackenzie and Dundee Capital Markets. Prior to serving in the capital markets, Panoulias was a mining executive, holding senior roles at Kinross Gold and TVX Gold.

Freeman Gold last traded at $0.62 on the CSE.

FULL DISCLOSURE: Lodge Resources Inc is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Lodge Resources Inc on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.