The economics for Freeman Gold’s (TSXV: FMAN) Lemhi Gold Project in Idaho keep improving. The company this morning released the results of a revised preliminary economic assessment, following an update to the price sensitivity analysis of the study.

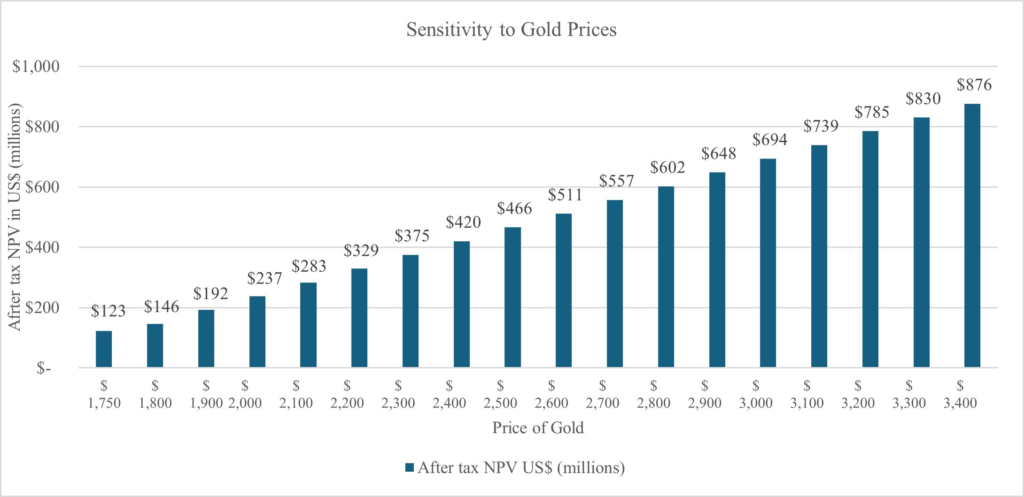

The revised PEA has outlined an after-tax net present value (5% discount) of $329 million and an IRR of 28.2% for the project based on a gold price of $2,200 an ounce gold. The revised figures meanwhile suggest a payback period of 2.9 years. Economics of course improve even more when utilizing a gold price of $2,900 an ounce, with the NPV rising to $648 million, while the IRR moves to 45.9% and the payback period falls to 2.1 years.

The original PEA, released in October 2023, comparatively had outlined an after-tax NPV of $212 million with an IRR of 22.8% and a payback period of 3.6 years, based on $1,750 an ounce gold.

The analysis is based on an operation that would produce on average 75,900 ounces of gold a year over an 11.2 year life of mine. The estimate is based on mill head grades averaging 0.88 g/t, with recoveries of 96.7%.

With total life of mine production of 851,900 ounces, at $2,200 an ounce gold, cash costs are estimated to be just $925 an ounce, while all in sustaining costs come in at $1,105 an ounce. Initial capital costs meanwhile have grown from $190 million in the prior report to $215 million today, while sustaining costs have moved from $101 million to $105 million.

“Significant changes in gold prices over the last 18 months motivated Freeman’s reassessment of its initial PEA model over a more fulsome range of scenarios. Using the current spot gold price, the Lemhi Gold Project will have an approximate US$1,871/oz cash margin using the updated all in sustaining cost of US$1,105/oz with significant additional upside at higher prices,” commented Freeman CEO Bassam Moubarak on the revised study.

Freeman Gold last traded at $0.09 on the TSX Venture.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.