In a bid to recover from its crippling collapse last year, bankrupt crypto exchange FTX has unveiled a strategic plan to navigate its sizable cryptocurrency holdings. The company aims to sell, stake, and hedge its crypto assets, with Galaxy Digital, a subsidiary of Mike Novogratz’s crypto conglomerate, poised to step in as an advisor according to recent court filings.

FTX, once a prominent player in the crypto landscape, is now under the leadership of restructuring expert John J. Ray III. The exchange is keen on returning funds to its creditors in fiat currency, rather than the more volatile Bitcoin (BTC) or Ethereum (ETH). However, the challenge lies in liquidating over $3 billion worth of crypto holdings without causing substantial market disruptions.

FTX have filed a motion to start staking, and to hedge BTC and ETH sales and liquidate its $3bn crypto holding

— Sunil (FTX 2.0 Champion) (@sunil_trades) August 24, 2023

FTX (A&M) is seeking authorisation to engage Mike Novogratz’s Galaxy to facilitate this pic.twitter.com/Hg0VIfC1Ae

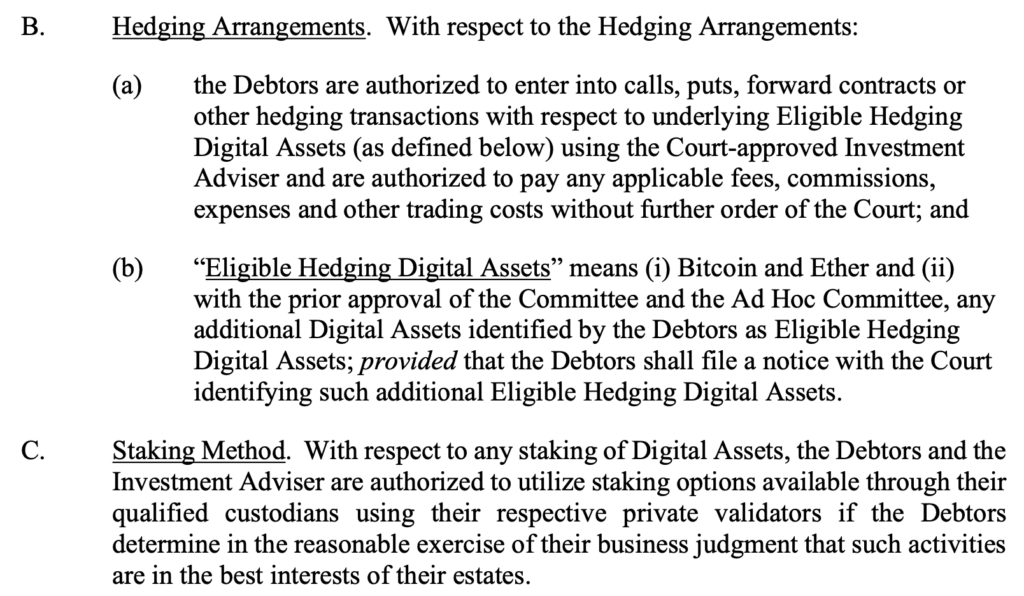

To mitigate potential losses, FTX is considering hedging its Bitcoin and Ether holdings. The court filing by FTX’s legal team states, “Hedging bitcoin and ether will allow the Debtors [FTX] to limit potential downside risk prior to the sale of such bitcoin or ether.”

Additionally, the company plans to stake certain digital assets, generating low-risk returns on dormant holdings.

“The Debtors submit that staking certain Digital Assets pursuant to the Staking Method will inure to the benefit of the estates—and, ultimately, creditors—by generating low risk returns on their otherwise idle Digital Assets,” the filing read.

The strategic partnership with Galaxy Digital holds the promise of expertise in managing and trading digital assets. Galaxy Digital’s extensive experience in relevant areas, along with its SEC-approved investment advisory status, make it a suitable candidate to guide FTX through this complex process.

The collapse of FTX in 2022 left Galaxy Digital with substantial exposure to the exchange. The recent court filings assure that conflict-of-interest procedures will be implemented to ensure that the asset management is carried out in FTX’s best interests.

FTX’s new direction is underpinned by the need to protect the value of its crypto holdings. Rather than executing a single mass sell-off, which could lead to plummeting prices and benefit short sellers, FTX intends to adopt a more measured approach. Weekly sales limits and careful market analysis are being considered to prevent such price shocks.

FTX’s request to entrust Galaxy Digital with the management of its recovered cryptocurrency tokens, valued at approximately $7 billion, is now pending approval by a Delaware bankruptcy court. The collaboration aims to maximize the value of FTX’s token portfolio by leveraging Galaxy Digital’s specialized knowledge of digital asset markets.

The plan also includes provisions for potential sales of crypto holdings, hedging strategies, and staking activities. Staking, in particular, could provide FTX with an avenue to generate passive yield income while minimizing risk exposure.

As FTX navigates the challenging waters of bankruptcy proceedings, the exchange has put forth a proposed restructuring plan that hints at the creation of a rebooted offshore exchange. Creditors might have the option to recoup a portion of their lost funds or opt for equity, tokens, and other interests in the revamped FTX.

Information for this briefing was found via Cointelegraph and sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.