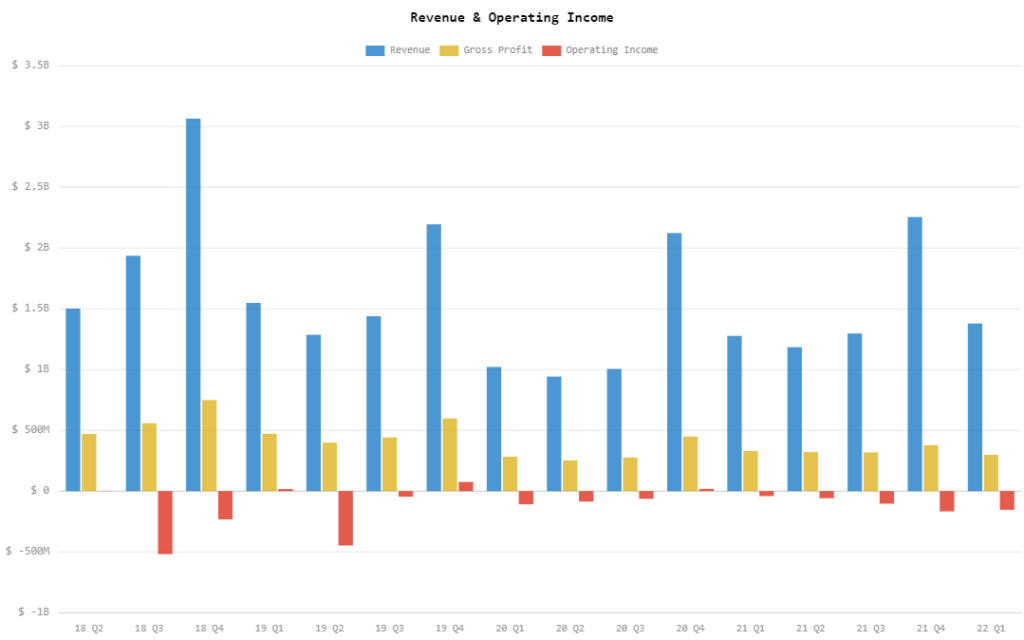

GameStop Corp (NYSE: GME) reported on Wednesday its financial results for fiscal Q1 2022, highlighting a quarterly revenue of US$1.38 billion. The topline figure beats the consensus estimate of US$1.32 billion, but is a drop from Q4 2021’s US$2.25 billion and an increase from Q1 2021’s US$1.28 billion.

The gross margin for the quarter came in at 21.7%, up from last quarter’s 16.8% but down from last year’s 25.9%. Still with SG&A expenses higher than gross profit, the company ended with an operating loss of US$153.7 million compared to the losses of US$166.8 million and US$40.8 million last quarter and last year, respectively.

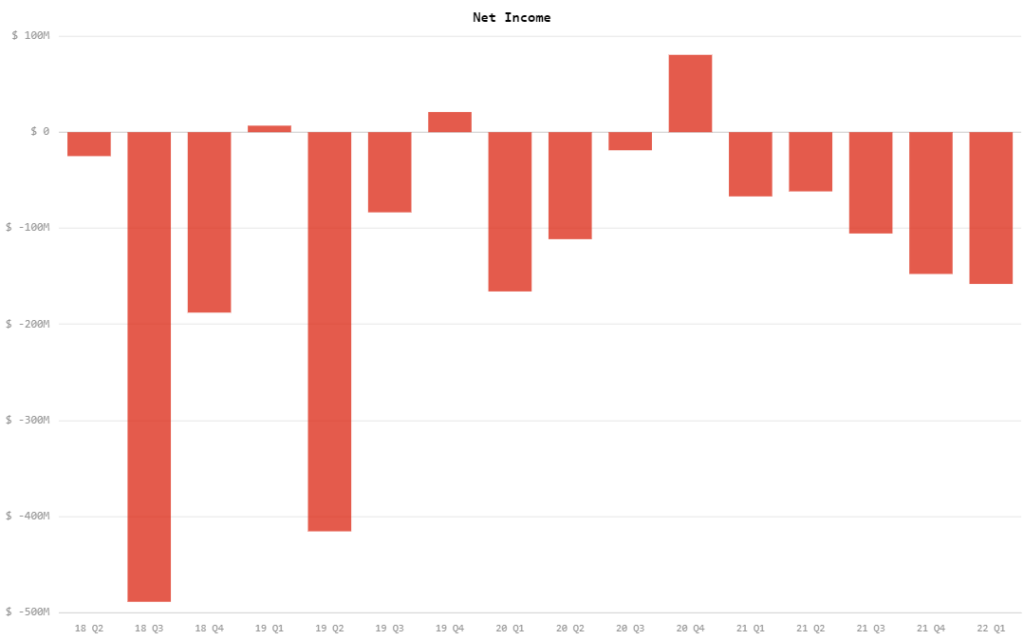

Consequently, this made the company end the quarter with a net loss of US$157.9 million, wider than the US$147.5 million net loss from the previous quarter and US$66.8 million net loss for the same comparable period last year. The quarterly loss translates to US$2.08 per share, which missed the estimate of US$1.45 loss per share.

Further, the firm’s adjusted EBITDA came in at a loss of US$125.5 million, marginally up from last quarter’s US$126.9 million loss but lower than last year’s US$0.7 million loss.

The company ended the quarter with US$1.32 billion in cash, cash equivalents, and restricted cash. This puts the balance of the current assets at US$2.33 billion while current liabilities ended at US$1.13 billion.

In April 2022, the company announced its plan to conduct a stock split, seeking permission to expand its share count from 300 million to 1.0 billion.

GameStop last traded at $121.40 on the NYSE.

Information for this briefing was found via Edgar and GameStop Corp. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.