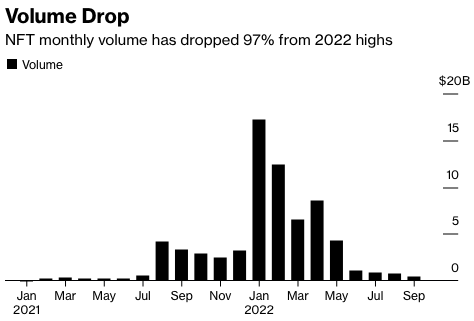

The nonfungible token craze seemed to have already seen its peak back in January 2022 as the digital asset continues to see a decline in its trading volume in the recent months.

NFT trading volume has fallen 97% since the start of the year–from US$17 billion down to around US$466 million in September 2022.

The collapse in trading volume is said to be part of the wider US$2-trillion loss during the so-called “crypto winter” as digital asset prices have fallen down to record lows.

This could spell concern for companies who just recently established their entrance in the NFT market, including GameStop Corp. (NYSE: GME). The company’s 2Q FY23 10-Q says that “revenues earned from our digital asset wallet and NFT marketplace were not material to the condensed consolidated financial statements for the three and six months ended July 30, 2022.”

But for Gareth Soloway, President and Chief Market Strategist of InTheMoneyStocks.com, the NFT market still hasn’t bottomed out, citing companies recent forays into the space.

“When you still see that kind of stuff going on, it tells you that you don’t have absolute fear and panic yet in the NFT world… ultimately, we still haven’t hit bottom,” Soloway said in a The Deep Dive interview.

The market strategist also added that NFT is “such an illiquid market” where people can launch assets that other people can pay for but the public doesn’t know the price. Then, a “lot of pumping goes on” where resellers can hike the price further.

“It’s just too much of a shady– kind of reminds me of The Wolf of Wall Street, 1980s kind of shadiness… I think there’s quality there [in the NFT market] in certain ways. I just don’t think for an average investor, there’s enough knowledge about it to make good informed decisions,” he added.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

The biggest reason for this fall in NFT trading was its non-potential value. People mostly don’t believe its potential in long run that’s why they try to avoid trading or exchanging NFT. Also it’s hard to quantify NFT value which is a big challenge in its own way.