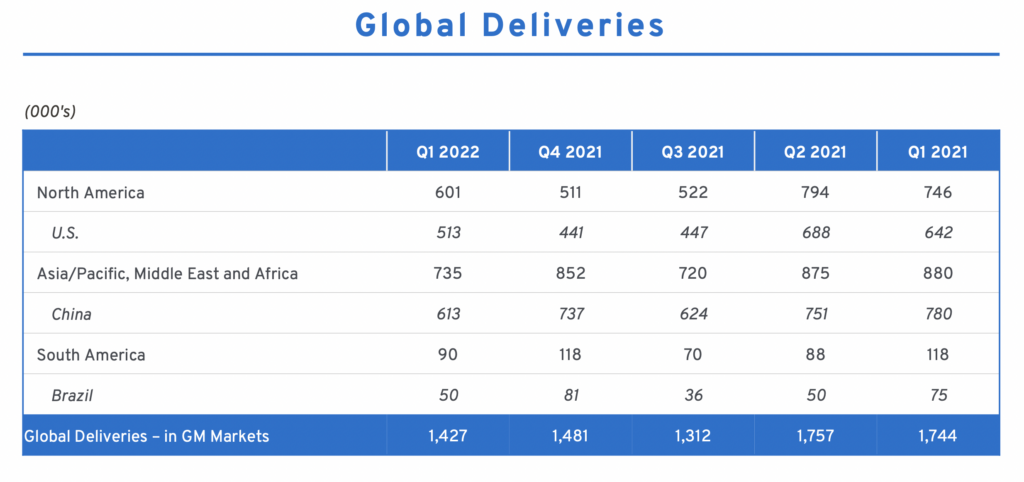

In a marked departure from the trends and factors which caused the earnings of a variety of companies to disappoint this earnings season, General Motors Company (NYSE: GM) reported solid 1Q 2022 earnings results on April 26. More precisely, the company demonstrated significant pricing power and reasonably good cost controls in the quarter which allowed the company to boost its adjusted diluted EPS guidance range for 2022 by US$0.25 to US$6.50 – US$7.50.

Importantly, neither inflation nor supply chain issues derailed the quarter as one may have expected. In addition, the company’s CEO Mary Barra reiterated that GM has a sufficient supply of semiconductors that will allow it to build 25%-30% more vehicles in 2022 than 2021 — despite an 18% decline in vehicle production in 1Q 2022 versus the year-ago period.

GM offset the lower unit sales in 1Q 2022 with significant price increases in the quarter. According to Cox Automotive, GM’s average transaction price in North America increased 14% in 1Q 2022 compared with 1Q 2021.

GM’s Chevrolet Silverado EV pickup truck has drawn impressive level of interest from consumers. The truck, commercial production of which begins in early 2023, already has 140,000 combined (refundable) fleet and retail reservations, up from around 110,000 at year-end 2021. To put that figure in perspective, Rivian Automotive, Inc. (NASDAQ: RIVN) has about 83,000 combined reservations (as of March 8, 2022) for its R1T electric pickup truck and R1S SUV.

GM’s balance sheet is solid. Its cash and marketable securities total US$26.3 billion, while its Automotive debt is US$16.9 billion.

| (in millions of US $, except for EPS and shares outstanding) | 1Q 2022 | 4Q 2021 | 3Q 2021 | 2Q 2021 | 1Q 2021 |

| Automotive Revenue | $32,823 | $30,349 | $23,424 | $30,744 | $29,067 |

| Operating Income | $2,196 | ($1,898) | $1,645 | $2,882 | $3,277 |

| Diluted EPS | $1.35 | $1.35 | $1.62 | $1.90 | $2.03 |

| Operating Cash Flow | $2,104 | $6,809 | ($49) | $7,162 | $1,266 |

| Cash | $26,256 | $28,676 | $23,940 | $29,131 | $29,380 |

| Automotive Debt | $16,892 | $16,818 | $17,022 | $17,318 | $17,552 |

| Shares Outstanding (billions) | 1.5 | 1.5 | 1.5 | 1.5 | 1.5 |

It is of course possible that GM will not meet its ambitious 2022 vehicle production goals; the second half of 2022 will have to be very strong to do so. Also, GM’s future chip supplies might not be as certain as the company contends.

General Motors shares, which trades at a P/E ratio of only 5.4x (based on the midpoint of company guidance), look inexpensive. The stock shares have plummeted ~40% since early January. Given its valuation and solid 1Q 2022 operating performance it is difficult to see the stock declining much more — despite the recent difficult stock trading environment in which investors have shown little tolerance for risk of any kind.

General Motors Company last traded at US$38.94 on the NYSE.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.