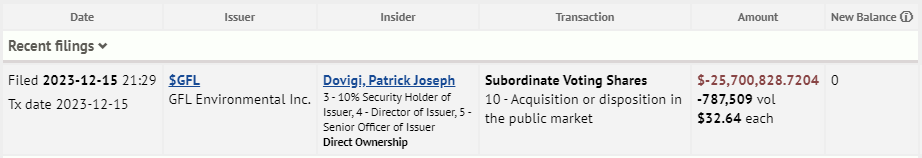

GFL Environmental (TSX: GFL) has seen its CEO, Patrick Dovigi, unload millions worth of subordinate voting shares on the market in the last week.

In total, Dovigi collected US$25.7 million from the sale of subordinate voting shares on Friday, via the sale of 787,509 shares. The sale follows the conversion of restricted share units, which were granted in September, to that of subordinate voting shares last week.

The sale brings Dovigi’s holdings in subordinate voting shares down to 0, while his restricted share units also sit at nil. He does however still retain ownership up over 11.7 million multiple voting shares in his holding company Sejosa Holdings Inc, with an additional 27,242 shares held in Sejosa II Holdings Inc.

Notably a portion of those multiple voting shares are repeatedly used for margin loans through the Bank of Montreal and the Bank of Nova Scotia.

GFL Environmental last traded at $43.92 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.