Last week, BMO Capital Markets reiterated their 12-month price target of C$39 and Outperform rating on GFL Environmental (TSX: GFL), saying that the “Risk/Reward Looking Increasingly Favourable.” This comes after the company announced they have entered into an agreement to acquire the Canadian Stewardship Services Alliance and created the Formation of the Resource Recovery Alliance.

GFL Environmental has 12 analysts covering the company, with a weighted 12-month price target of C$40.05, with the street high coming in at C$47 and the lowest sitting at C$22.50 from Veritas Investment. Out of the 13 analysts, two have strong buys, six have buy ratings and the other four have hold ratings.

BMO’s analyst, Devin Dodge, says that at GFL’s current share price, GFL is the “highest growth company in the solid waste sector.” The company reportedly has the ability to leverage to a broader reopening and BMO expects M&A activity to be elevated during the second half of 2021, “which should allow GFL to exceed near-term acquisition growth objectives.” They believe that all waste companies will generate mid-single-digit volume growth in the second quarter. While the states have reopened at a much faster pace than other countries, GFL’s main market, Canada is still pretty much in lockdown which means that Canada’s volume recovery will lag the US by 1-2 quarters.

Dodge says that GFL is “well-positioned to generate industry-leading organic growth in late 2021 and into 2022,” primarily due to their non-solid waste business. They believe as Canada reopens, these “cyclical divisions” will help push GFL’s growth above the peer average of 5% in 2022. They also believe that M&A will heat up during the second half of 2021 as, “the potential for higher US tax rates appears to be bringing more sellers to the market looking to close deals by year-end.”

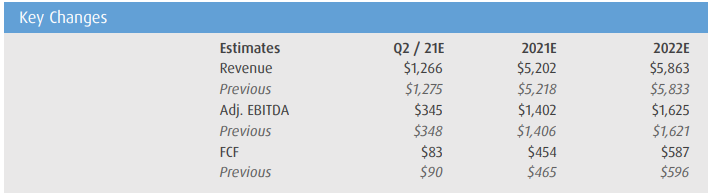

Below you can see BMO’s updated estimates for 2021 and 2022.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.