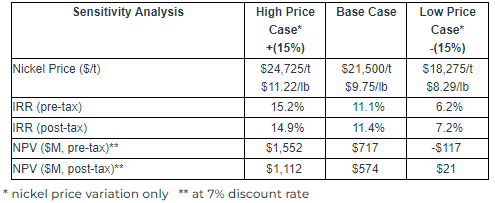

Giga Metals (TSXV: GIGA) has released a pre-feasibility study for its Turnagain Nickel-Cobalt project in British Columbia. The study outlines a post-tax NPV (7%) of US$574 million for the project, along with an estimated internal rate of return of 11.4%.

The study outlines a 30 year project life with average annual production of 37,288 tonnes per year of nickel and cobalt in concentrate. The high grade concentrate is estimate to average 18% nickel and 1.1% cobalt, with low impurities.

The positive economics are based on a long term nickel price of $9.75 per pound, with site operating costs estimated at $3.85 per pound nickel in concentrate before byproduct credits.

“The success of the extensive geometallurgical studies conducted by Blue Coast Research gives confidence in the metallurgical response of the entire deposit. This engineering study shows that the Turnagain Project has a low-risk flow sheet that will consistently and predictably deliver a high-grade, high-quality concentrate similar to concentrates successfully treated by nickel processing companies for decades,” commented CEO Mark Jarvis on the study.

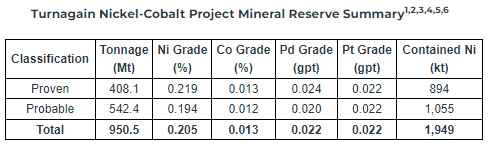

As part of the study, the company updated its mineral resource estimate, with the Turnagain project now estimated to have 3,381 kt of contained nickel, at an average grade of 0.21% on a measured and indicated basis, along with inferred resources of 2,405 kt of contained nickel at 0.206% nickel. Proven and probably reserves meanwhile are estimated to consisted of 1,949 kt contained nickel at 0.205%.

“We see a nickel project like Turnagain with low carbon intensity in a stable jurisdiction has a key role to play in the future of the nickel industry, in particular for the battery industry. We look forward to Turnagain’s potential to be further verified in works ahead,” stated Kota Ikenishi, General Manager of the Battery Minerals Office for Mitsubishi Corp.

The Turnagain project is owned by Hard Creek Nickel Corp, a joint venture that is 85% owned by Giga Metals and 15% owned by Mitsubishi Corp.

Giga Metals last traded at $0.265 on the TSX Venture.

Information for this briefing was found via Sedar and Giga Metals. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.