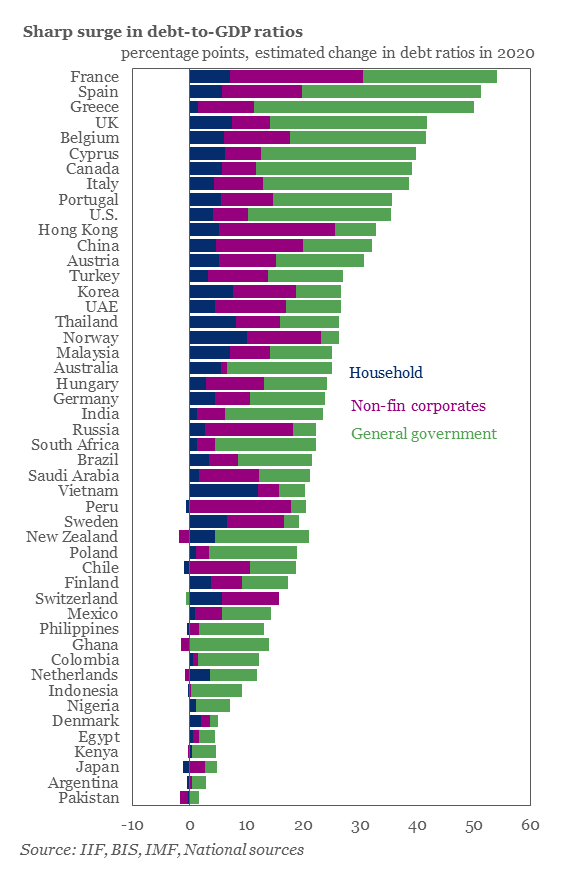

The coronavirus pandemic created an unprecedented level of economic contractions around the world, sparking record levels of government stimulus spending in response. As a result, global debt levels increased by an additional $24 trillion in the past year, totalling a record $281 trillion.

According to recent data published by the Institute of International Finance (IIF), government spending in 2020 contributed to an increase of $5.4 trillion to the total global debt load, meanwhile banks and households accounted for $3.9 trillion and $2.6 trillion, respectively.

With global debt now bursting at a record $281 trillion, the ratio of debt to global GDP has increased by 35 percentage points, surpassing 355%. In fact, the rise in debt is larger than the increase recorded during the global financial crisis, which saw debt-to-GDP levels grow by 15% in 2009. The report found that debt levels increased substantially in Europe, particularly in France, Spain, and Greece.

Going forward, the IIF projects that borrowing levels will continue to remain elevated across numerous countries and sectors in 2021, fuelled by historically-low interest rates. “We expect global government debt to increase by another $10 trillion this year and surpass $92 trillion,” the report said. However, the IIF warns that a premature withdraw of economic support by governments could lead to a sudden increase in bankruptcies, as well as a surge in non-performing loans.

Information for this briefing was found via the IIF. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.