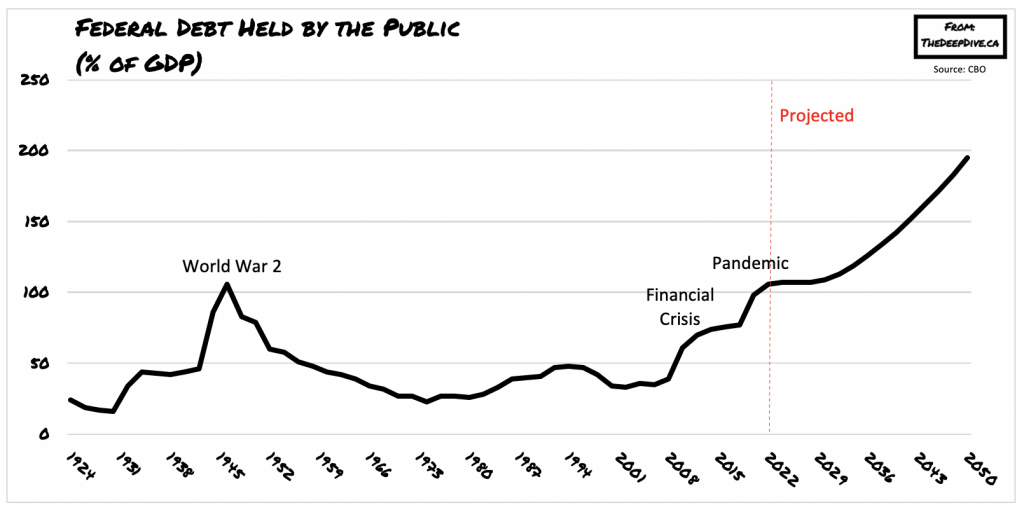

As the Federal Reserve continues to spend into oblivion via bottomless quantitative easing and fiscal stimulus, the economic recovery for the US is not going to be as bright and as hopeful as it is being imagined. The Congressional Budget Office (CBO) recently released its dreaded long-term debt forecast, and it appears the results are far from comforting. Now that the US has fully embraced unlimited money printing and spending, debt held by the public is expected to grow to a staggering 195% of GDP by 2050.

If that isn’t scary enough going into the month of gouls and goblins, the CBO has outright admitted that deficits are expected to grow from an average of 4.8% of GDP to a whopping 10.9% of GDP between 2041 to 2050, which will further drive debt to astronomical levels. However, the biggest driver behind the government’s exorbitant spending will be ironically interest on existing Federal debt, which is expected to outpace mandatory spending by 2030, and exceed both social security and discretionary spending by the time 2040 rolls around.

Then by 2050, government spending on interest will be so high it will become the second biggest outlay following healthcare programs. If that is not frightening though, 2055 will certainly be uncanny, as the governments number one largest outlay will be soaring interest on the already Mount Everest-size heaping pile of debt. So how much debt exactly is all this interest going to be affixed to? The CBO projects that federal debt held by the public will outpace its record high of 106% over the next three years, and then continue rising until, well, the end of time.

By the time the US makes it to 2050, the debt as a percentage of GDP will be almost 2.5 times the debt levels of 2019. The exact amount of debt that the next generation will be faced with however will certainly depend on the scope of the current economic collapse from the pandemic, and the government’s response in dollar terms. So far, the government has already contributed $3 trillion in stimulus spending alone and given its minimal effects in terms of lifting the economy out the recession, there will likely be more government spending on the horizon.

Nonetheless, as Peter Schiff points out, the US economy is currently one giant bubble, with the Federal Reserve deliberately designing policies to keep that bubble as inflated as possible. The Fed’s unlimited spending to maintain the asset bubble is going to continue adding to the growing pile of debt, all while exhausting real economic growth. Schiff also noted that additional infrastructure spending is not the answer to get the economy out of the recession either, given that the US cannot afford to continuously create money while continuously spending it.

Information for this briefing was found via the CBO and RT News. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.