On January 5th, GoGold Resources Inc. (TSX: GGD) announced its production data for the fiscal first quarter ending December 31st, 2021. The company announced that it produced 195,678 ounces of silver, 2,558 ounces of gold and 123 tonnes of copper, which equates to 444,071 ounces of silver equivalent. This is down from the 526,044 equivalent ounces produced during the September quarter.

GoGold currently has 4 analysts covering the stock with an average 12-month price target of C$4.71, or a 75% upside to the current stock price. Out of the 4 analysts, 1 has a strong buy rating while the other 3 have buy ratings. The street high sits at C$5 while the lowest 12-month price target comes in at C$4.30.

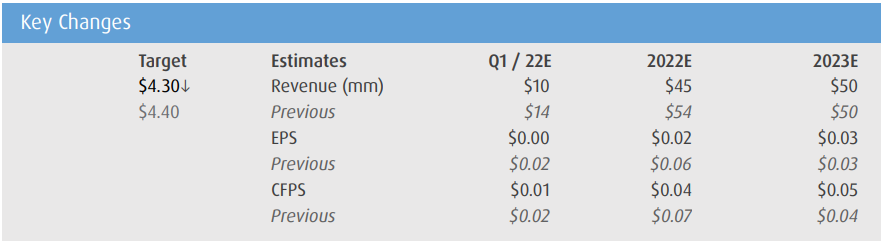

In BMO Capital Markets’ note, they reiterate their Outperform rating, but lower their 12-month price target from C$4.40 to C$4.30 and say that the production numbers came out somewhat light as a transition between zones was the cause for the production miss.

For the production results, total production missed their estimate by 29%. This was mainly due to silver production missing by 38% and gold by 23%. BMO’s original estimates were 315,000 ounces of silver and 3,300 ounces of gold for this quarter. BMO blames the recent transition between different zones as the reason for the production miss.

BMO believes that GoGolds 2022 guidance suggests strong production. The company reported full-year production guidance of 2,000,000 to 2,200,000 ounces of silver equivalent in 2022. This equates to roughly 550,000 ounces per quarter over the next three quarters.

Lastly, GoGold is looking to accelerate its drill program at Los Ricos while the main focus will be at El Favor East and Gran Cabrera. BMO believes that the Pre-Feasibility Study will be completed at Los Ricos South by the end of this year.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.