Osisko Mining (TSX: OSK) has found a joint venture partner for its Windfall gold project found in the Abitibi greenstone belt in Quebec.

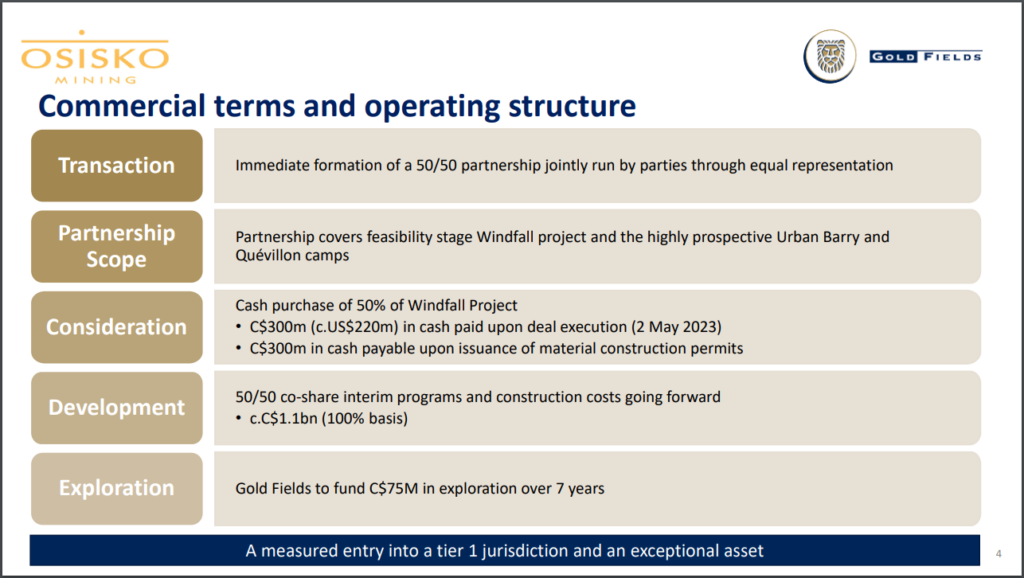

The arrangement will see Gold Fields (NYSE: GFI) take a 50% stake in the Windfall project, agreeing to pay upwards of $600 million for its stake in the project, plus additional exploration spend of up to $75 million.

An initial cash payment of $300 million is to be made on signing, with $300 million in additional cash to be paid on issuance of permits for construction, operation, and mining of the project.

“This partnership further strengthens our strong balance sheet, allows us to significantly de-risk Windfall and brings us a very important step closer to realizing our objective of becoming a leading Canadian gold producer. With the proceeds from this Transaction, Osisko is fully-funded for our share of development capital to bring Windfall into production,” commented John Burzynski, CEO of Osisko.

Gold Fields under the terms of the arrangement is to also share all pre-construction costs and construction costs on a 50/50 basis going forward. With total pre-construction and construction costs estimated at $1,039 million, its expected that all-told, Gold Fields will invest approximately $1.2 billion into the Windfall project.

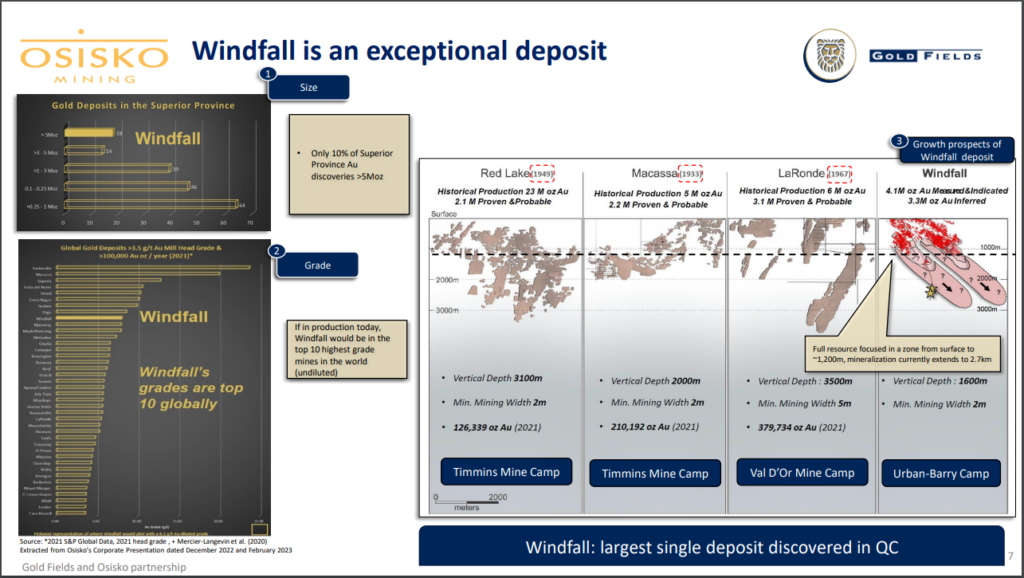

The Windfall project, found between Val-d’Or and Chibougamau, Quebec, currently has a resource estimate of 297,000 ounces of measured gold at 11.4 g/t, 3.75 million ounces of indicated gold at 11.4 g/t, and 3.3 million ounces of inferred gold at 8.4 g/t. The project also has reserves of 3.2 million ounces of probable gold at 8.06 g/t.

Osisko Mining last traded at $3.77 on the TSX.

Information for this briefing was found via Sedar and Osisko Mining. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.