Gold Lion Resources (CSE: GL) has completed its 2020 soil and rock sampling program at its properties located near Dixie, Idaho. Results released this morning from the program were comprised of data from both the South Orogrande Property, as well as the Dixie Properties.

A total of 76 rock grab samples and 1158 soil samples were collected as part of the 2020 exploration program across the two different properties. Results released this morning comprised largely of data on the Dixie Properties, which were acquired earlier this year by the company and consist of the Doc, Mammoth, Red Cloud and Majestic Properties. The properties themselves include eight past producing gold mines which previously operated in the early 1900’s.

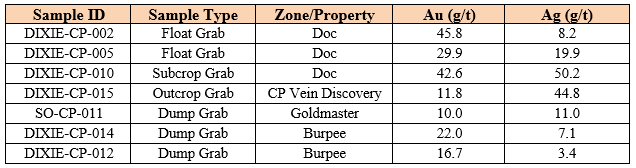

In terms of rock grab samples, results ranged as high as 45.8 g/t gold, of which 11 returned values with higher than 5 g/t gold. Some of the grab samples came from the CP Vein discovery, with additional ground staked on the 300 metre long strike. Highlight values from this region returned values as high as 11.8 g/t gold and 44.8 g/t gold.

Soil sampling conducted at the new Dixie properties resulted in three anomalies, which includes 600m x 200m at Mammoth, 600m x 400m at Red Cloud, and 1000m x 350m at Doc. All of the anomalies also remain open along strike.

Soil sampling meanwhile conducted at South Orogrande Property resulted in a new 700m long anomaly near a historic mine, along with a 600m long anomaly in the northeast portion of the property. The latter is not associated with previously known mineralization. Finally, the company also extended the 5 kilometre long gold in soil anomaly by 2.6 kilometres, with the anomaly remaining open towards the CP Vein discovery.

Finally, the company has also expanded its claims at the South Orogrande Property as a result of soil coverage extending the anomaly to the border of claims staked on June 12. The company as a result staked additional claims to the south of the property, which cover the new CP Vein discovery.

Gold Lion Resources last traded at $0.40 on the CSE.

FULL DISCLOSURE: Gold Lion Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Gold Lion Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.