The images are burned in many of our imaginations. The Klondike. The California Gold Rush. Boomtowns, excitement, fortunes created overnight. Many of the great gold rushes of history are associated with a time and place.

I believe that history’s next great gold rush is here, today. I believe this rush will not be associated with one discovery, one region, but one continent. I predict that North America will experience a continent wide gold rush in this decade.

Before I begin my argument, a few items of disclosure are necessary. First, I am not a “Gold Bug.” In fact, I attended a Berkshire Hathaway AGM a few years ago, where Warren Buffet questioned the sanity of digging up a rare metal with relatively few practical applications, and I shared much of his skepticism. Second, I am an economist by education, and many of my arguments come from this point of view. Third, I am a mining company investor, and have invested and will invest in companies I mention. Fourth, I sit on the board of a mutual fund company that invests in early stage mining companies. My views are my own.

Why am I calling for a North American Gold Rush in the 2020s?

There’s a lot to my argument.

Let’s start with gold. As an economics student, I truly regarded gold as a “barbarous relic,” in the words of John Maynard Keynes. I was really confused by its value, and dubious that it would remain relevant in a rapidly changing world. Boy, was I wrong. Like Buffet, like Keynes, I overlooked one important historic principle: gold is money.

In simple terms, gold miners are literally minting money right now.

Don’t get me wrong. I still really don’t “get it!” Gold as currency in ancient history made sense to me, but I did not, and still don’t, fully understand why it persists today. It does though, and over time, I have come to accept this fact: Gold will likely be highly valued long after I am gone.

Gold is rare, difficult to find, and even harder to extract and refine.

More importantly, in my Gold Rush thesis, gold is currently facing a confluence of positive factors that is unparalleled in my study of economic history.

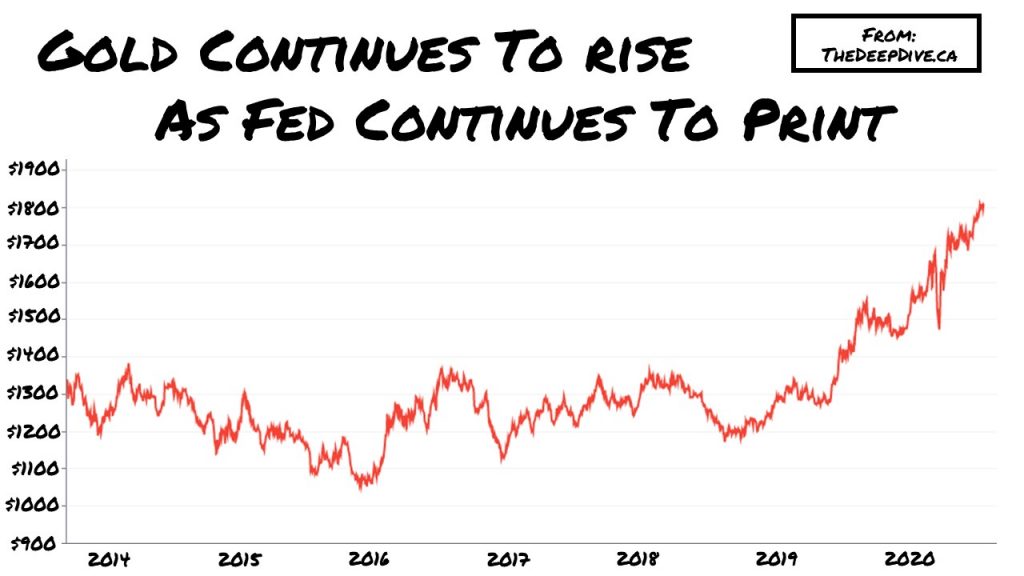

Gold prices are on an absolute tear. Many casual observers may point out that we have yet to exceed the price peak of over $1900 US achieved last decade, but this is truly a narrow view. In virtually every other major currency, gold is at an all time high. The relative strength of the US dollar distorts the reality: for much of the world, gold has never been more highly valued, and most technicians and researchers will agree that the US Dollar peak is likely to fall as well.

Let’s look at gold in Canadian terms. At it’s all time high, our dollar was near parity with the US. In other words, gold is worth about thirty percent more than it was at it US Dollar zenith. Oil, the largest input cost in most gold mines, is less than half the price it was back then.

Is the recent price surge over?

I truly doubt it, and here are the reasons why.

Let’s start with actual jewelry demand. After years of relative stability, the current pandemic has obliterated short term jewelry demand, according to the World Gold Council. This demand destruction seems unlikely to be permanent, particularly given the apparent disparity in impact between wealthier jewelry consumers, and the poorer members of society. When luxury buyers return, watch for a price surge.

The World Gold Council has also reported record ETF (exchange traded fund) inflows into the gold investment market. This is important, first because it explains gold’s surge in the face of the aforementioned jewelry demand destruction. Further, there are some important nuances to gold ETFs, and this impacts future pricing. Some require physical gold delivery, but some also use “paper gold” including futures contracts, and these contracts create future demand for physical gold. As I write this, the current month contract for gold is $1806 US, while December 2020 is nearly $1835, and August 2021 is $1857. This “contango’ is indicative of a continuing trend higher for physical gold.

This monetary demand for gold is further supported by a pattern of increased gold purchases by a number of central banks. In fact, Forbes last month referred to this trend as a “buying binge.” Given that most central banks have a mandate to purchase gold when it represents good value, and that many central banks are facing massive deficit driven headwinds to their purchasing power, this bullish sentiment bodes extremely well for gold price appreciation.

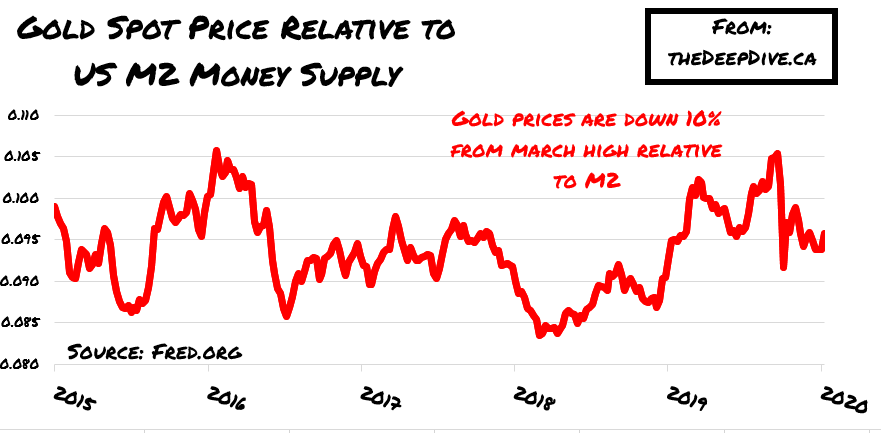

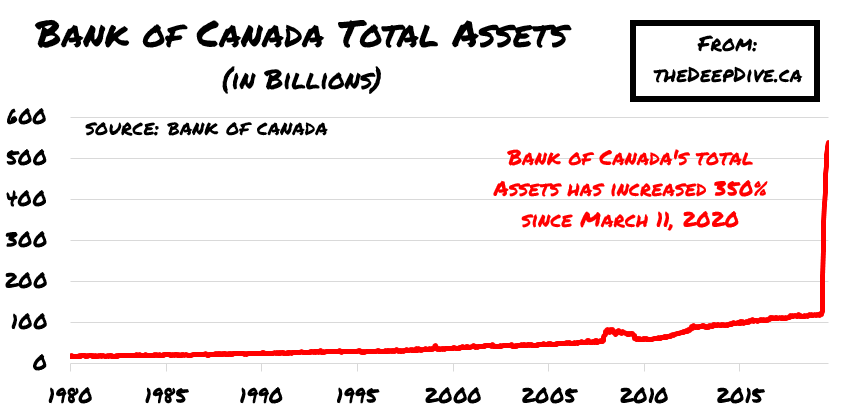

Now let’s talk deficits. Canada just forecast a three hundred forty five billion dollar deficit. The US is spending trillions on stimulus, and governments around the world are following suit. Most major governments are borrowing at near zero interest rates, and their currencies are protected from relative devaluation by the fact that every other developed nation is in the same boat. This massive global expansion of federal balance sheets is like rocket fuel for gold. As a currency, without the burden of massive stimulus demand facing national currencies, gold virtually must surge, as a simple function of supply and demand. The world is flooded with paper currencies, while gold supply is relatively unchanged. Gold appreciation is pretty well baked in as governments print new debt to meet the needs of the pandemic.

Another traditional consideration is the carrying cost of gold, which is partly a function of global interest rates, which are at or near zero. It is an easy time to own gold.

Gold supply is the next major bullish factor. Major gold producers rarely do much of their own exploration work. They generally pick and choose among the best discoveries of junior exploration companies. These exploration companies rely primarily on speculative money from mining focused markets like Canada and Australia. Amazingly, the TSX Venture, Canada’s junior exchange, where a meaningful piece of global mining exploration is funded, hit an ALL TIME low earlier this year. It has been a very tough time for junior miners, as money has chased an unprecedented large cap rally, and speculative alternatives like cannabis and cryptocurrency.

As a result, many junior exploration companies have dropped their mining claims entirely, and become public shells to chase the opportunities in these alternative markets. What juniors remain often languish at a fraction of the value they would have attracted with similar assets in years past, despite record gold prices. This is a huge problem for the major gold producers, who depend on these exploration activities to replenish dwindling reserves. On the plus side, the majors are likely to begin acquiring what assets remain in the public markets at relatively discounted prices. There are numerous Canadian listed juniors with proven reserves that could easily be acquired for a fraction of their historic high prices, and I expect this process to ramp up quickly as majors balance surging incomes with depleting ounces.

I believe investors should own undervalued juniors with proven assets.

Let’s talk about the importance of North America, in my Gold Rush thesis. Globalization has taken a major blow this year, as the pandemic has caused many to rethink security of supply chains, and gold is a part of this story. Many producing gold mines are in complex political jurisdictions, and a global pandemic only clouds this already challenging picture. Governments around the world are being destabilized, and unstable governments do not make for better mining conditions. Further, North America’s economy has taken a hit, and many regional governments have declared mining an essential industry, to mitigate the impact on supply chains. The massive surge in demand creates a need to ensure sound domestic supply. Many North American jurisdictions have long established, well developed mining infrastructure, and generally transparent, if sometimes onerous, regulatory systems. More importantly, North America has some outstanding prospective gold regions, many of which have had decades of exploration and development. I believe Canada, the US, and possibly Mexico, will see a meaningful prospecting boom.

So is this an opportunity for you?

If you are a professional prospector, perhaps it’s time to grab your pick and bug spray, and head for the bush. For the rest of us, I offer these thoughts as you search for opportunities

First, look for projects “in the shadow of a head frame.” In other words, exploration projects near existing mines are often successful. Not only is it possible that the geological trend that led to the existing mine continues beyond the mine’s borders, you may also have a neighbor looking to acquire your property.

Second, look for projects that may be redevelopment opportunities of old mine sites. There are lots of old mine rock piles which may be easily reprocessed by low cost means, like heap leaching, and I really like projects that combine such redevelopment opportunities with further exploration potential. These projects exist, and are often led by seasoned, savvy mining entrepreneurs.

This leads to a third key point. Bet on mining executive teams with proven discoveries to their name. I know many of these people, and I can tell you that just about every one of them has a pet project that they’ve been keeping alive, just for an opportunity like the Gold Rush that I see coming. One veteran of the industry told me a number of years ago, “Markets change, but the rocks don’t go anywhere.” Watch for successful leadership groups bringing forward projects to capitalize on this bull market.

Fourth, Canadian investors should give serious consideration to investing in domestic projects through flow through shares. As I mentioned earlier, I sit on the board of a flow through share fund company, because I believe in this approach to investment in the market. Flow through shares are a way to reduce the risk of investing in junior companies, because the tax savings that you get help reduce the cost of acquiring the shares. The challenge of raising capital in these current markets makes the space extremely attractive, because share prices of juniors are depressed, and the premium that they are able to charge on flow through shares seems to be extremely low at this moment.

If you’re considering this, be sure to talk to an investment advisor.

Finally, I would suggest the diversification among several names as a great way to participate in this market. I would particularly encourage choosing different regions across North America.

Hopefully, I have opened your eyes to the opportunity I believe exists for North American gold investment. Mark my words: The 2020 Gold Rush is here.

The Deep Dive, and it’s parent company Canacom Group, has not reviewed the above content and is hereby not responsible for statements made within. The Deep Dive and it’s parent company Canacom Group has no securities or affiliations related to any organization mentioned within the content, unless otherwise stated. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The Deep Dive and it’s parent company Canacom Group holds no licenses.

2 Responses

Thanks Jeff!

I will…Jeff

Check out Otso Gold: OTSO. Gold production next spring, 90000 ounces/yr, ~$900/oz aisc, 1.5mm ounce resource open in all directions for expansion, Finland, all built, experienced team, $15mm market cap.