As many countries around the world are struggling to uphold their economies in face of the deadly coronavirus pandemic, India in particular is experiencing devastating financial consequences. In its attempt to mitigate the effects of the pandemic, the Indian government has left the economy in shambles. As a result, many Indians are unable to get credit from their banks, because the fear of defaults are imminent. So, many are resorting to gold as a means of securing loans.

Some Indian farmers are struggling to purchase seed and supplies for their crop season, and have no other choice but to resort to gold as a store of value since it’s nearly impossible to secure a loan through the bank otherwise. According to Reuters, India’s loan growth is declining significantly, especially during times of uncertainty like the coronavirus pandemic. Some analysts are projecting loan growth will fall to 0 or 1% by the end of 2020 as a result.

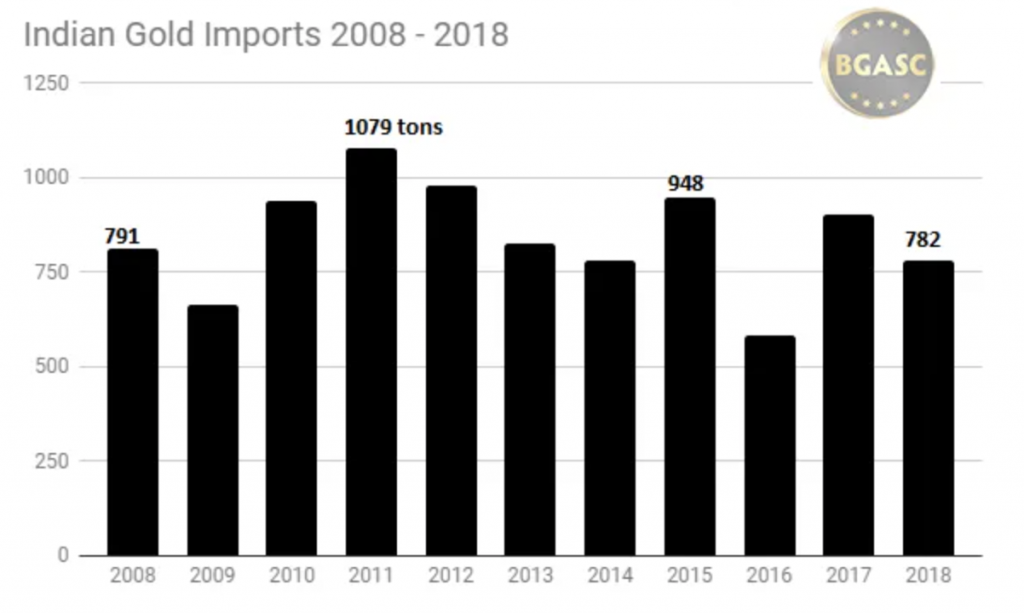

Unlike in Western countries, gold is a commodity popular among low income households in India, or those that live outside the tax system. Gold is considered a predominant store of value in the country, especially in its poorest regions, and accounts for two-thirds of India’s demand for gold.

Information for this briefing was found via Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.