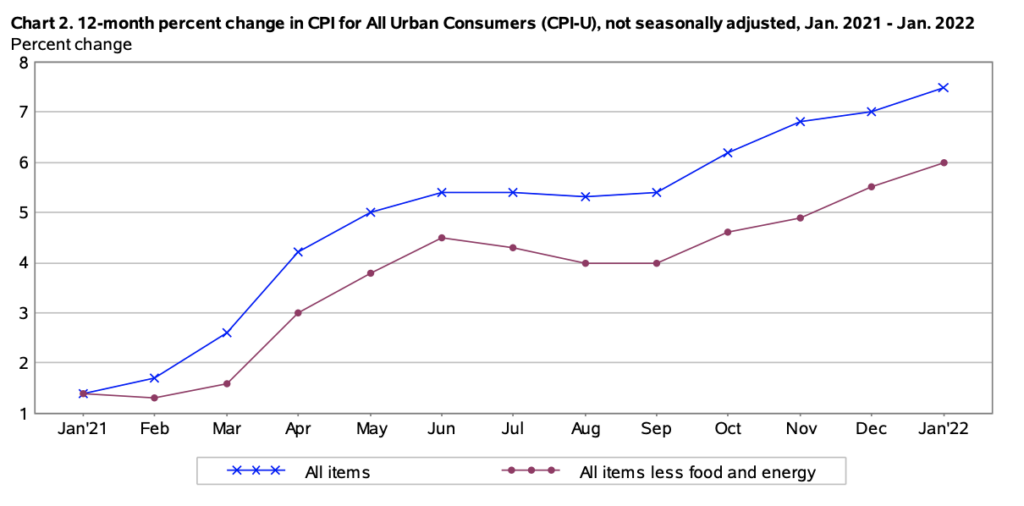

Following what has been yet another eye-watering CPI print showing consumer prices at the highest since 1982, Wall Street is scrambling to upgrade rate hike forecasts in preparation of a substantially more hawkish stance from the Federal Reserve.

With inflation running well above the Fed’s 2% target rate with each passing month, Goldman Sachs now sees monetary policy makers raise rates at least 7 times this year, up from a previous forecast calling for 5 rate hikes. According to the Goldman analysts, borrowing costs will likely increase 25 basis points during each of the remaining FOMC meetings.

But, even though the latest CPI print showed US consumer prices soared 7.5% in January, while wage growth and short-term inflation expectations remained significantly high, the case for a 50 basis-point increase come March is likely not substantiated, the bank thinks. “Most Fed officials who have commented have opposed a 50 basis points hike in March,” the analysts wrote in their note. “We therefore think that the more likely path is a longer series of 25 basis points hikes instead.”

Goldman’s updated predictions regarding the scope of forthcoming interest rate increases come on the heels of similar remarks made by former Treasury Secretary Larry Summers, whom also warned markets to brace for a rate hike at each of the seven remaining policy meetings, with an increase of over a quarter point in one meeting alone.

Still, despite the broad consensus among Fed officials’ reluctance to raise rates by larger increments, St Louis Fed President James Bullard is pushing for an even more aggressive stance on calming runaway inflation pressures. “I’d like to see 100 basis points in the bag by July 1,” Bullard told Bloomberg this week. “I was already more hawkish but I have pulled up dramatically what I think the committee should do.”

OUCH! Markets now pricing 100% probability of 50bp hike in March after Federal Reserve Bank of St. Louis President James Bullard said he supported raising rates by a full percentage point by July. Markets now see Fed Funds Target Rate at 1.77% by year-end. pic.twitter.com/qo0JWbR6ky

— Holger Zschaepitz (@Schuldensuehner) February 10, 2022

According to Bullard, the Fed should spread out the rate hikes across three FOMC meetings, begin reducing its balance sheet come the second quarter, and then revaluate the direction of further increases in borrowing costs once corresponding economic data becomes available. Bullard also raised concern regarding the latest CPI reading, and suggested that the Fed should be more proactive in its approach to taming consumer prices. “You have got the highest inflation in 40 years and I think we are going to have to be far more nimble and far more reactive to data.”

In fact, the St. Louis Fed president went as far as to suggest a rate hike could even happen in between the central bank’s monthly meetings. “There was a time when the committee would have reacted to something like this to having a meeting right now and doing 25 basis points right now,” he told Bloomberg. “I think we should be nimble and considering that kind of thing.”

Fed officials have thus far remained content with a gradual move on interest rates, with Bullard himself at one point declaring during a speech that a “shock and awe” approach is almost never warranted. However, the Fed official quickly reverted his stance from a decade ago, and on Thursday said that the out-of-control inflation data over the past four months certainly calls for a more aggressive response. “I do not think it is shock and awe,” he explained. “I think it is a sensible response to a surprise inflationary shock that we got during 2021 that we did not expect.”

In the meantime, the Fed’s asset-buying program is slated to end in the beginning of March before the scheduled policy meeting, with discussions regarding a reduction of the balance sheet slated to commence during forthcoming policy meetings. But, according to Bullard, the Fed should also be more hawkish on shrinking its asset pile, and reduce the balance sheet at the same rate it was accumulated. “As a general principle, I see no reason why you can’t remove accommodation just as fast as you added accommodation, especially in an environment where you have the highest inflation in 40 years,” he asserted.

Following Bullard’s comments, the two-year Treasuries continued their upwards climb to the highest since January of last year, while the yield on the 10-year Treasury jumped to around 2.04%, the highest since August 2019.

But, according to one Wall Street investor, splitting hairs over the frequency and extent of interest rate increases in 2022 is not relevant, because the stock market will likely plummet either way. Hayman Capital founder Kyle Bass predicts that stocks are slated for a sharp drop, because even raising short-term borrowing costs by merely 100 or 125 basis points could lead to a 25% decline in the stock market. “There’s no way the stock market goes up this year, and it probably goes down pretty aggressively, if they stick to that plan,” Bass told CNBC in an interview back in January.

According to Bass, the magnitude of the stock market decline could potentially lead to panic amongst Fed officials, who would then be forced to abandon their plans for additional market tightening.

Information for this briefing was found via Bloomberg, CNBC, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.