This morning Canaccord Genuity raised their 12-month price target on Green Thumb Industries (CSE: GTII) from C$27 to C$34 and reiterated their speculative buy rating on the company. This comes after Green Thumb reported third quarter revenues of $157.1 million, a 31% quarter over quarter increase. They also reported a positive net income of $9.6 million and a diluted EPS of $0.04. It also reported positive cash flow from operations for the third consecutive quarter.

A number of analysts also changed their price targets on the equity following the estimate-beating performance of the company:

- Cormark Securities raises target price to C$37 from C$23

- Eight Capital raises target price to C$38 from C$26

- Needham raises target price to $39 from $23

Matt Bottomley, Canaccord’s cannabis analyst, headlines “Q3/20 review: Significant top-line beat as GTI remains the steady hand in the sector.” Bottomley’s revenue estimate was $140.5 million. He says that the beat came from organic growth and higher foot traffic in key markets and a sizeable rebound in Nevada and Massachusetts.

Bottomley notes that Green Thumb’s 55.4% gross margin is up 220bps from last quarter. This is primarily due to “increased operating leverage after ramping up its production capacity – most notably in IL, NJ and OH.” Another exciting point Bottomley says is that after the 31% revenue growth, operating expenses were flat, which allowed Green Thumb’s adjusted EBITDA to grow 50% quarter over quarter to $53.2 million compared to their estimate of $41.4 million.

Bottomley comments, “Favorable balance sheet vs. many of its peers.” Green Thumb had $78.1 million of cash on hand, and after the quarter, Green Thumb raised another $25 million via a real estate financing. Bottomley adds, “we note the business continues to show one of the stronger cash flow profiles in the industry, which when coupled with its current cash balance, continues to suggest that GTI is one of the best capitalized US players in the space today.”

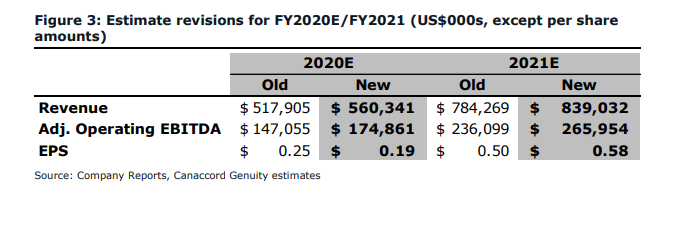

Bottomley has increased its fiscal 2020 and 2021 estimates, as seen below.

Stifel also raised their price target from C$44 to C$46 and reiterated its buy rating.

Andrew Partheniou, Stifel cannabis analyst, commented, “GTII reported strong Q3/20 results, above every estimate including our street high forecasts, representing its 7th consecutive beat.” Green Thumb demonstrated “ongoing impressive execution to cement its position as the best-in-class operator in the industry,” off the back of the positive net income.

He makes a note of the great retail sales growth Green Thumb put out. Partheniou says, “Retail sales grew 27.9% QoQ, with sequential SSS growth of 17.9% more than doubling Q2/20’s rate of 8.3%, wholly driven by increased productivity.” He then says that “Demand outpacing supply expected to continue in Northeast,” saying that management has indicated the level of demand continues to outpace the supply that is coming to the market.

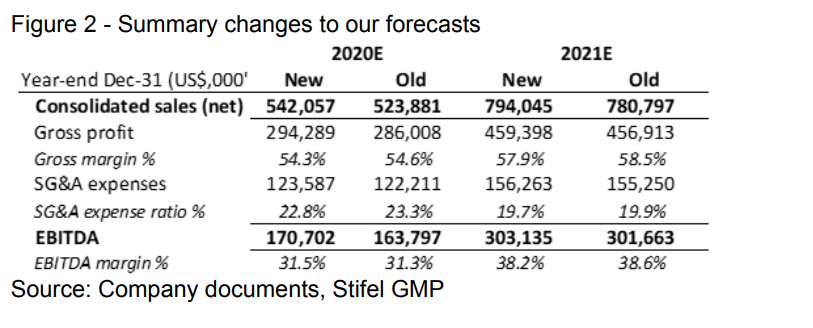

Partheniou also raised their 2020 and 2021 estimates, seen below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.