On March 31st, Greenlane Holdings (NASDAQ: GNLN) announced their fourth quarter and full-year financial results. Additionally, they announced that they would be merging with KushCo Holdings (OTC: KSHB) to create “the leading ancillary cannabis company and house of brands.”

For the financial results, the company announced full-year revenue of $138.3 million, down from the $185 million they made in 2019. The company tries to make the news release as great sounding as possible, but with no luck as they highlight odd segments to intentionally show growth.

Onto their merger with KushCo, the company is paying a premium of ~6% on KushCo shares but will barely retain control over the resulting company with a 50.1% ownership and KushCho owning 49.9% of the company. The company announced that they expect $15-20 million in cost synergies within the first two years.

Greenlane currently has four analysts covering the company with a weighted 12-month price target of U$7.25. This is up from the average before the results, which was U$5.40. Two analysts have strong buy ratings and the other two have buy ratings. Street high comes from Roth Capital with a U$8 price target, while Canaccord has the lowest target at U$6.

Canaccord Genuity increased their 12-month price target to U$6, up from U$4, on the news of the merger and reiterated their speculative buy rating. It should be noted that Canaccord is acting as financial advisor to the special committee of the board of Greenlane. Derek Dley writes Greenlane is “well-positioned, in our view, to generate robust growth across multiple channels over the long term.”

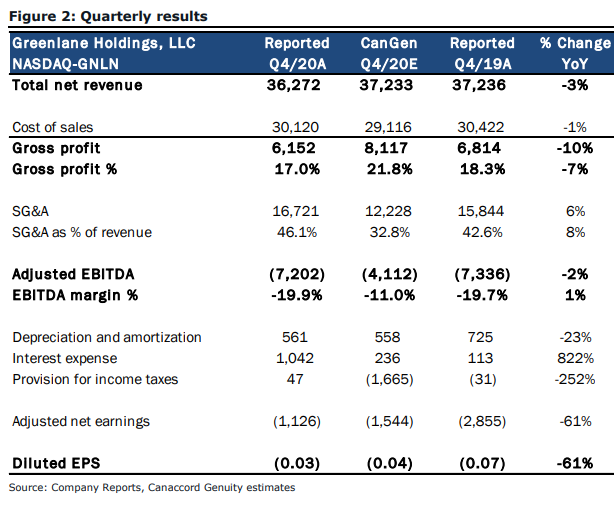

Below you can see how Greenlane did compared to Canaccord’s full-year estimates. Most importantly, they slipped slightly below all estimates.

Dley writes, “we believe there should be ample cross-selling opportunities available to the combined company, as KushCo and Greenlane have what we view as complementary product offerings,” and believes that this merger will lead to a stronger and more stable business model going forward.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.