This morning, short selling research firm Grizzly Reports released a report on that of cannabis sector darling Trulieve Inc (CSE: TRUL). Within, the report alleges that numerous transactions have strong connections to JT Burnette, the husband of CEO Kim Rivers who is currently under investigation by the FBI for racketeering conspiracy and extortion charges among other claims. Further claims include that Trulieve has conducted undisclosed related party transactions, that their “indoor product” has been grown in simple hoop houses and that the initial cannabis licensing of the firm “stinks of corruption.”

The report, which is approximately 26 pages in length, outlines numerous accusations against the firm, many of which are centered around Burnette’s numerous connections and dealings with Trulieve. The report identifies that Burnette’s construction firm, Burnette Construction and Development Inc, whom is the subject of FBI investigations, is a key provider for the public issuer.

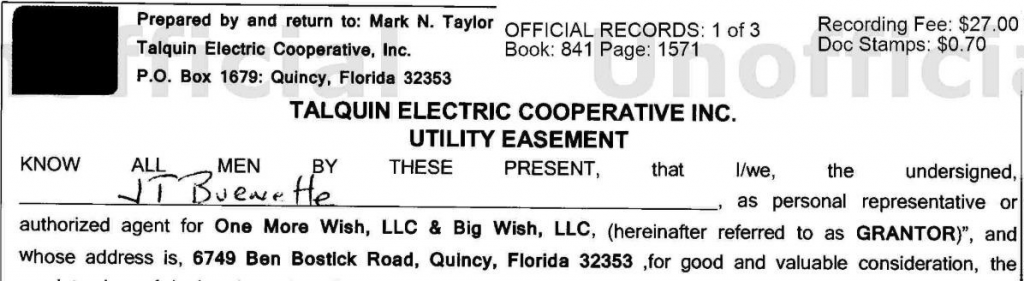

Grizzly has identified through Florida county records that at least $8.7 million in construction fees were paid to Burnette’s construction firm in 2018, and that 2019 has seen amounts of approximately $28 million in the first three months. The report goes as far as proving so via snippets of signed documents with Burnette’s name being used for permits prior to property being sold to Trulieve from a shell entity.

Other connections to the ongoing FBI investigation exist as well according to the report, with certain named entities, such as Inkbridge, LLC providing early funding to Trulieve. The entity also evidently links to Scott Maddox, the disgraced Tallahassee city commissioner that has since plead guilty to fraud.

Outside of links to the Burnette and his ongoing FBI investigation, the report alleges that the nature in which Trulieve acquired its initial cannabis license within the state was under a shady approval process. According to the report, Trulieve’s insider connections within the local and state government are believed to have played a role in the issuer acquiring its coveted vertical license within the state, as well as last minute rule changes that turned the application process in Trulieve’s favor.

With regards to cannabis production, drone footage conducted by the firm has indicated that their “indoor production” is largely comprised of low quality hoop house operations versus true indoor production. With Florida being the most humid state in the country, the report alleges this will result in many hurdles for growing any quality product.

The full report published by Grizzly Reports can be found here.

Trulieve Inc last traded at $15.69 on the CSE.

Information for this briefing was found via Sedar and Trulieve Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.