Grizzly Research this morning took aim at TuSimple Holdings (NASDAQ: TSP), a Chinese autonomous vehicle firm that has reportedly partnered with Navistar and Traton. Within, Grizzly alleges that TuSimple has many similarities to the now-disgraced Nikola Corp (NASDAQ: NKLA), in that its reported pre-orders are not as they seem, management has a poor track record, and that some of its major investors are actually the same.

In terms of funding, Grizzly comments that both companies were “financed by the same bad actors.” In this instance, the reported bad actor being Stephen Girsky’s VectoIQ, which invested in Nikola in March 2020, and then TuSimple in November of the same year. Girsky reportedly participated in the firms Series E financing as the lead investor, with Navistar and Traton acting as follow-on investors in the round – just two months after Girsky was impact by the Hindenburg Research report on Nikola.

This data is then used as evidence that the firms management is ill-equipped to run TuSimple as a whole, commenting that the due diligence conducted was insufficient by management. On the topic of management, also highlighted is the lack of experience in the autonomous vehicle space – founders Mo Chen and Xiaodo Hou are experienced in online digital casinos, digital used car sales, and image recognition tech used for advertising purposes. They also reportedly have a history of bankruptcies and suspended business licenses.

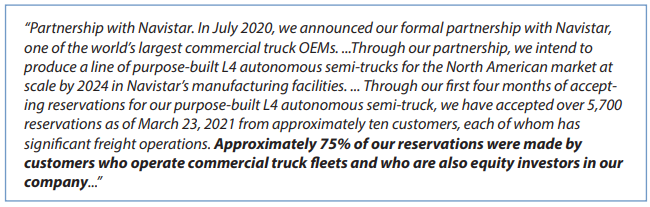

Perhaps the hardest-hitting aspect of the report however is that as it pertains to TuSimple’s pre-orders. The company, via multiple releases, has indicated that it has a total of 5,700 pre-orders that potentially equate to $420 million in revenue.

However, Grizzly highlights that these pre-orders consist of a $500 deposit that is fully refundable. Even more significantly, 4,000 of those orders come from equity partners that required no deposit.

Also highlighted is that TuSimple refers to Navistar as a “key customer”, yet is unlikely to receive any return from this customer for a number of years. Effectively, TuSimple has paid the company $10.0 million to reimburse certain expenses, which results in the arrangement amounting to what is essentially a paid-for partnership. Despite this, Navistar has reportedly made $200 million from TSP from its pre IPO investments.

Grizzly concludes the report by referring to TSP as “nothing but an empty box that was nicely packaged and irresponsibly dumped on US investors.”

TuSimple Holdings last traded at $33.21 on the Nasdaq.

Information for this briefing was found via Grizzly Reports and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.