Overall, we view the recent announcements and earnings surrounding Khiron Life Sciences (TSXV: KHRN) as very positive news. The numbers assure that Khiron will have the funding needed to move forward, while also having the supply to meet its previously announced strategic goals. As such, we believe the Company is progressing well through its strategy in providing low cost medical cannabis internationally.

By The Numbers Highlights

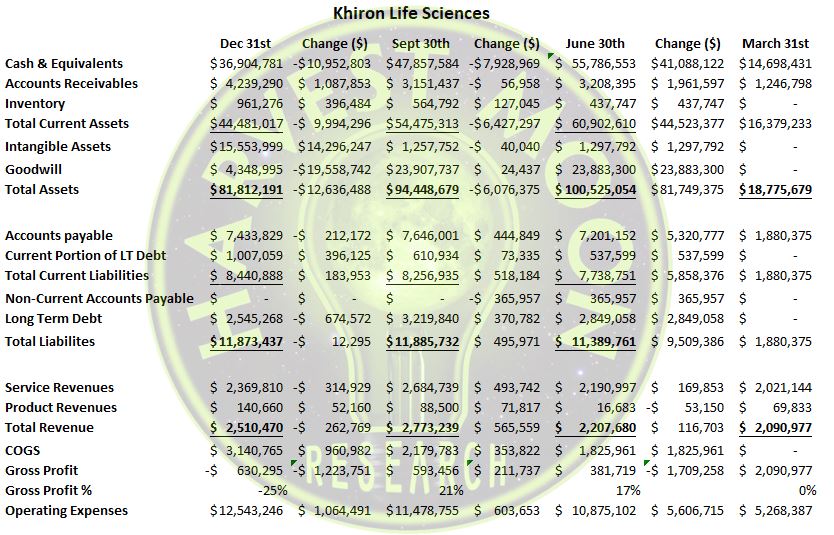

- Substantial revenue growth quarter over quarter with an increase of $1.7 million.

- Gross margins reaching 32% this quarter; an 11% increase over the previous quarter.

- Boasts a $36.9 million cash position with a $11 million drop from the previous quarter.

- Has just $8.4 million in total current liabilities with only a $183,000 increase from last quarter.

- Only $3.5 million in total cash commitments for 2020 with a total of $6.8 million in commitments.

- Only has $2.5 million of long term debt with a $600,000+ decrease from the previous quarter.

- Can pay off all their debt including all long term debt and still have a lot of cash left over.

Company Highlights

- Core businesses all remain fully operational despite COVID-19 pandemic.

- Only company in Colombia to manufacture high and low THC medical cannabis and expects to start filling low THC medical cannabis in the second quarter of 2020 after its dispensary gets authorized to do so.

- Only company to export THC products from Colombia operations internationally.

- Exclusive partnership with Project Twenty21, Europe’s largest medical cannabis trial with over 20,000 patients.

- Approved to grow 9.3 tons or 17% of the quota for Colombia in 2020.

- Continuing to build on it’s telemedicine operations to keep all their clinic’s open.

Quick Comparison to Pharmacielo

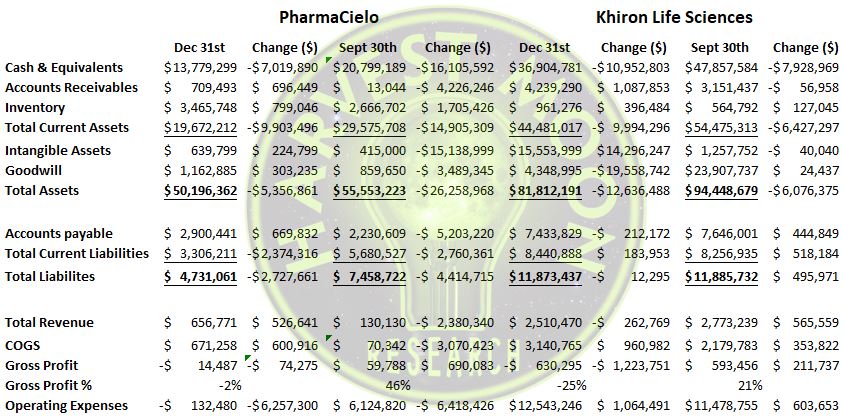

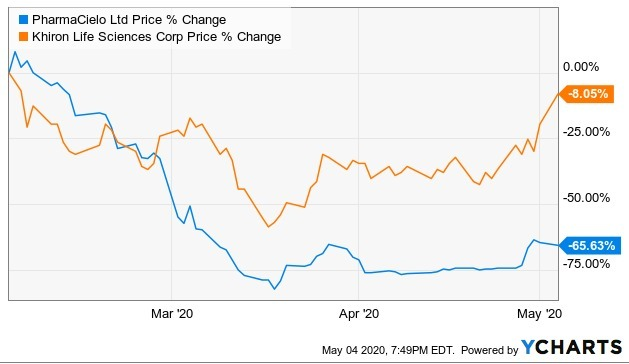

To highlight the fact that Khiron is moving in the right direction, one must compare it to one of its fellow LATAM peers. While KHRN is a much better equipped company than that of Pharmacielo (TSX: PCLO), one can conclude by comparing the numbers that KHRN is heading in a much more positive direction than that of its LATAM peers. While PCLO and other like-minded companies are spinning their wheels and seemingly heading backwards in these tumultuous times, Khiron remains thriving.

Content provided via Harvest Moon Research, LLC.

FULL DISCLOSURE: Khiron Life Sciences is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Khiron Life Sciences on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

2 Responses

Blue sky for KHIRON. Can’t wait to see what this company can do

Why we comparing these guys to PCLO?

This is like Aphria comparing themselves to RavenQuest Bio…