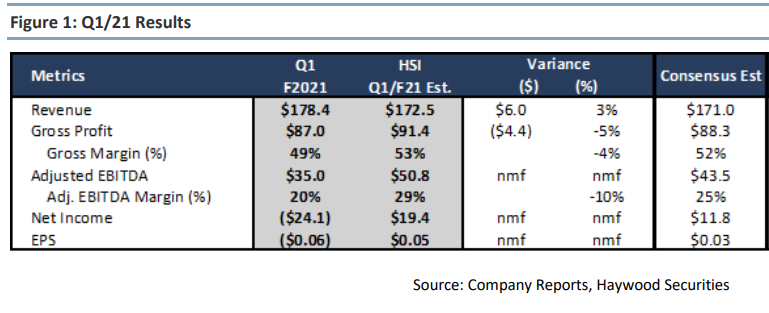

Cresco Labs (CSE: CL) reported its first-quarter financial results this past week. The company announced revenue of $178.4 million, a 9.9% increase quarter over quarter. Gross profit margin came in at 48.8% and the company experienced record revenue in both its wholesale and retail segments.

Two out of the 16 analysts lowered their 12-month price target on Cresco Labs, bringing the average 12-month price target down to C$22.74 from C$23.36 prior. The company has 16 analysts covering the stock with four of them having strong buy ratings, 11 have buy ratings and one analyst has a hold rating. The street high comes from Stifel-GMP with a C$34 price target, and the lowest target comes from Echelon Wealth with an C$18 price target.

Haywood’s Neal Gilmer reiterated his buy rating but lowered their 12-month price target to C$24.50 from C$29.50, saying that the top line was impressive but due to the IFRS to GAAP change this quarter the EBITDA results could not be compared to Haywood’s prior estimate.

Gilmer says that this quarter showed that the company is improving efficiencies with Cresco reporting an average quarterly revenue per store up from $3.5 million to $3.8 million. The 10% quarter over quarter total revenue growth mainly came from the companies retail store revenue being up 16% for the same period.

Below you can see the new 2021 and 2022 estimates on Cresco Labs, Gilmer says he has lowered the estimates after hearing management commentary as well as the IFRS to GAAP change.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.