Heliostar Metals (TSXV: HSTR) this morning released an updated economic assessment on their La Colorada Mine, highlighted by a base case net present value of US$66.2 million and an IRR of 24.4% at $2,300 gold, alongside a payback period of 3.4 years.

At $3,500 gold, that net present value is said to climb to US$243.3 million, while the IRR jumps to 168.4% and the payback period falls to just 2.0 years.

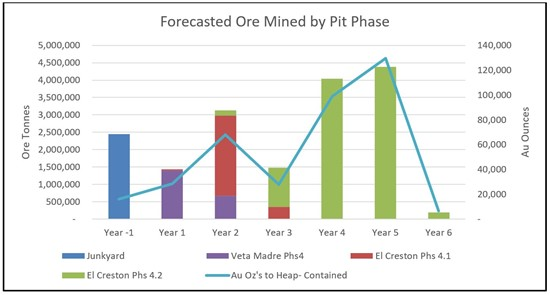

The estimate is based on an open pit operation that would produce 46,106 ounces of gold annually for a six year period, at average gold grades of 0.68 g/t. The current mine plan calls for three deposits to be mined sequentially, starting with the Junkyard Stockpile, before moving to the Veta Madre and El Crestion pit expansions.

Veta Madre specifically is expected to have a mine life of 1.3 years, while El Creston has an estimated life of 4.6 years, with those estimates followed revised mineral resource and reserve estimates, which totaled out at 376,200 ounces.

Cash operating costs are estimated at $1,533 an ounce, with all in sustaining costs slightly higher at an estimated $1,626 an ounce. Initial capital costs meanwhile are estimated at $44.5 million, alongside sustaining capital costs of $12.5 million.

“Today’s results show that the La Colorada mine can continue to be a high-margin, low CAPEX operation with a 6.1-year mine life. This updated study is focused on the open pits at La Colorada, demonstrating positive economics at conservative gold prices and a compelling opportunity at current gold prices. The Company aims to continue to maximize cash generation from stockpiles in the near term and internally fund capital requirements for open-pit production planned in 2027,” commented Charles Funk, CEO of Heliostar.

In terms of next steps, the Junkyard Stockpile is expected to continue to be mined through the remainder of the year, while additional stockpile material is expected to be mined ahead of production from Veta Madre. Heliostar is currently waiting to receive a change of land use permit by the end of the year, which will allow the company to transition to Veta Madre.

While Heliostar does not expect to need funding for new equipment and facilities, pre-stripping for the two deposits is capital intensive and will need to be funded. Cash generated from operations and potentially non-dilutive project financing are expected to cover the funding shortfall at this time.

Heliostar last traded at $2.09 on the TSX Venture.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.