Developing cannabis extractor Heritage Cannabis (CSE:CANN) had $10 million in cash at the end of April. A May private placement at $0.53 added $17 million, which was being spent on some very aggressive message management at a rate of $28,000 a month, on top of 1 million shares issued to outside comms firms out of the treasury. The Heritage promotion was covered at length back in August by Fundamental Hype, following a dust-up between the apparent rank and file of Heritage Cannabis’ twitter army and The Cannalysts.

The Heritage investor outreach team has surely been working for their money lately, as the weight of more than 7 million shares hit Heritage’s market over the past 3 trading days, driving it down -18% over that period. The most recent press from Heritage came after-market Friday. It told of the company’s issuance of 2 million options to “directors, officers, employees and/or consultants,” priced at $0.35. These options will be added to the 14.5 million options already outstanding in Heritage, with a weighted average price of $0.27, to form a fresh total in a much anticipated FQ3 quarterly, due to be filed by September 30th.

Retail shareholders are known to act cranky about options awards of any amount, because they’re effectively the insiders buying a dip that the retail crowd, who have to pay for their stock the day they buy it, can’t really afford.

On balance, 2 million options at $0.36 aren’t meaningful. If and when those shares hit the float, the effort they bought will have already pulled its weight. For Heritage Cannabis to be successful, the company has to make something out of the assets they printed most of this stock to acquire.

Heritage set out a timeline in their April MD&A that anticipated the securing of a licensing of their Voyage and Cannacure facilities for sales to the provincial distributors sometime before the end of October. With no known licensing forthcoming, Heritage isn’t likely to have created income in the July period that could get or keep the attention of this impatient market. They will need to convince the street to hold off a while longer while they build the infrastructure. That’s becoming a tough sell.

The Infrastructure

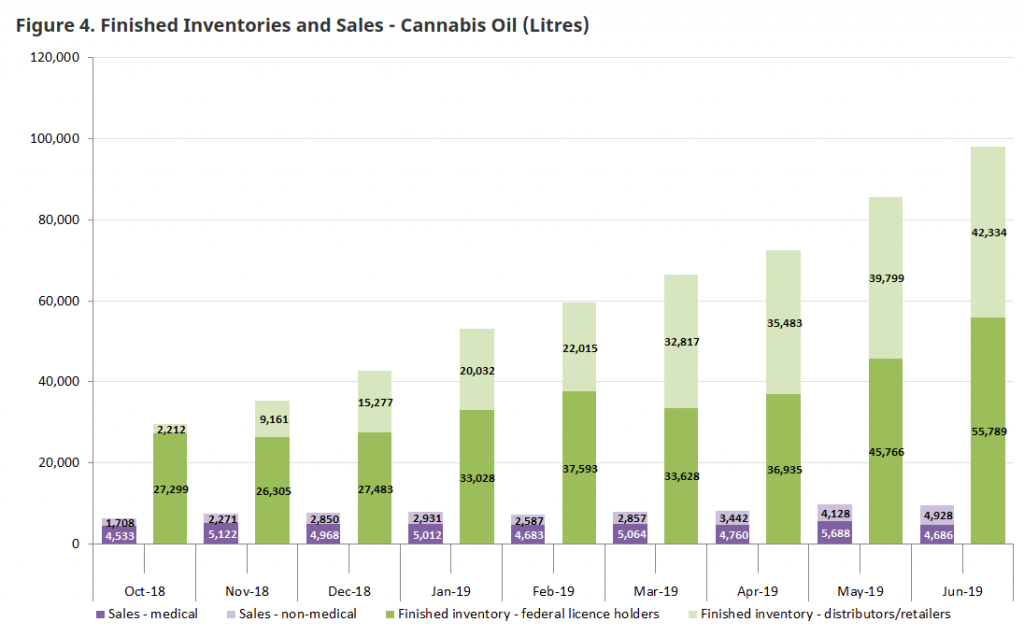

CANN’s licenses are in something of a Canadian regulatory purgatory; they are allowed to buy and sell product on the bulk market that exists between producers, and they’re allowed direct sales to patients, but not yet allowed to sell to the provincial distributors who, by Health Canada’s count, bought 68% of the country’s oil, and 87% of its dried flower in June. The press-profile of this high-visibility outfit is so full of details on deals they’ve done for extraction feed that one wonders if they’re reporting on every single one.

If and when Heritage is able to come up with an oil or extracts formula that achieves commercial success, there will be reason to believe in Heritage. Even low-margin sales to another LP would foreshadow higher-margin direct sales in a future where any one of these subsidiaries is licensed to do so.

But it might be a while before CANN gets enough product to market to be able to figure out what sells. Ultimately, the BC and Ontario extraction facilities are both likely to need a lot more throughput before they’re able to carry the stock that was issued for their purchase.

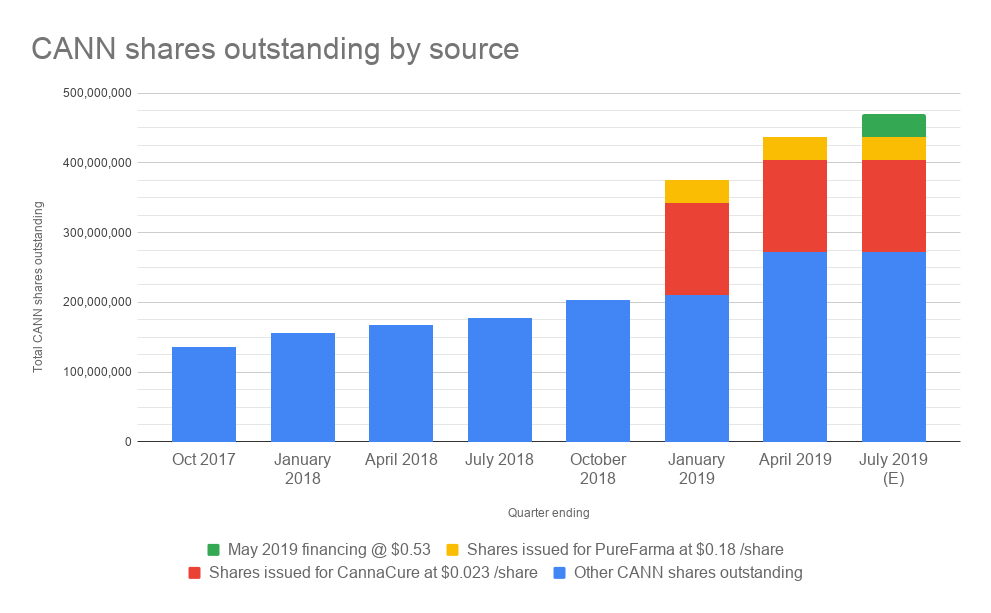

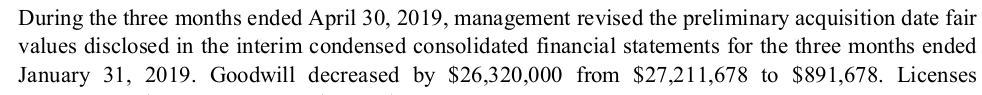

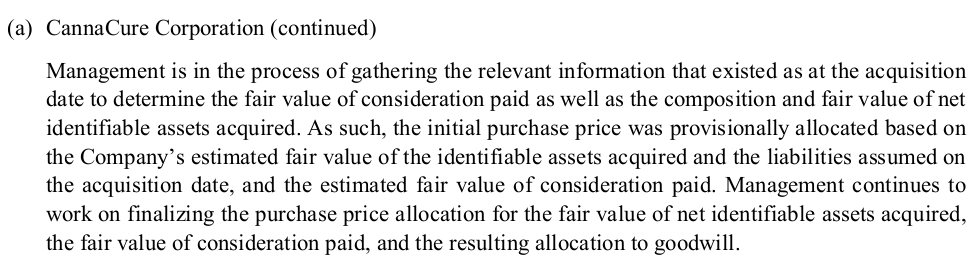

CannaCure and PureFarma represent 166.6 million of the 436 million outstanding shares in CANN. A sneaky re-valuation of the CannaCure purchase, from $27 million to $891 thousand in the April quarter is the type of thing a company might do to avoid an auditor mandated write-down of dead-weight goodwill at year-end, and it doesn’t show much faith in the asset from management’s perspective.

Heritage’s valuation methods are reminiscent of President Trump’s, whose net worth fluctuates depending on how he feels.

At any rate, CannaCure’s former owners sold the unfinished business to Heritage for 133M shares of CANN stock at a deemed value of $0.023/share. The company made a $2.2 million cash payment to complete their purchase of the Fort Eerie, ON facility in May of this year, and have plans to further invest in its expansion. That effectively makes the cost base on roughly 28% of CANN’s outstanding stock two point three cents per share.

PureFarma represents 33 million shares of Heritage’s outstanding total at a deemed cost base of $0.18 per share, and doesn’t look like it’s in a position to create any sales in the near term, either. They’ve announced processing agreements with Canntab Therapeutics (CSE: PILL), whose first crop of hemp is earmarked for Heritage to process into oil for use in gelcaps, and with Zenabis Global (TSX: ZENA), who have pledged to collaborate on a pilot project using 500 kg of dried flower, to be provided by ZENA before the end of the year. Heritage is mandated to return 150 litres of oil. Zenabis doesn’t presently offer any oil products in provincial dispensaries, but Aurora Cannabis (TSX: ACB)(NASDAQ: ACB) subsidiary Whistler Medical lists its Brandywine oil product for about $4 per ml retail. It’s the most expensive of 20 oil products presently listed on bccannabis.com, and the 15 ml units are the only oil product that BC currently lists as out of stock.

Health Canada inventories show large and increasing inventories of both finished and un-finished oil through the month of June, while total oil sales fell by 200 litres.

The Competition

Heritage’s peers have been able to develop a significant toe hold in the oil market. Medipharm Labs (TSX: LABS), whose facilities are already licensed operations, sold $31 million worth of oil in their most recent period at a 36% gross margin to create a bottom line profit. In the process, they’ve developed relationships with producers who are inclined to become repeat clients if they deliver as expected, including Cronos Group (TSX: CRON)(NASDAQ: CRON), whose agreement to try Heritage’s yet-to-be-built extraction services, was something Heritage found newsworthy enough to halt trading over. Medipharm inked a 2 year processing and packaging agreement with Cronos this past Thursday.

Heritage shareholders will soon find out more about how much of the $27 million in cash the company was implied to have in May had been burnt through July, and will surely try to get a feeling about how far the remaining cash will carry Heritage’s planned build out and licensing in BC and Ontario.

Information for this analysis was found via Sedar and Heritage Cannabis. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

Canopy’s Quarter in Charts

Whenever there’s a negative margin, those of us in the financial content biz like to...