Hexo Corp (TSX: HEXO) (NYSE: HEXO) announced this afternoon that it will be delaying its fourth quarter financials, which were originally expected to drop tomorrow during premarket hours. The delay is a result of the firm announcing a $70 million debenture financing, in which insiders are expected to take slightly over 10% of the total financing.

The financing is to take the form of unsecured convertible debentures, which will bare interest at a rate of 8.0% per annum. The debentures are for a period of three years, and will have a conversion price of $3.16 per share. A forced conversion clause is in effect as well, with the company having the right to force the conversion of the debentures if the volume weighted average price of the equity exceeds $7.50 for a period of fifteen trading days. No warrants will be attached to the debentures.

Insiders of the company, including CEO Sebastien St-Louis, are expected to subscribe for up to $8.676 million.

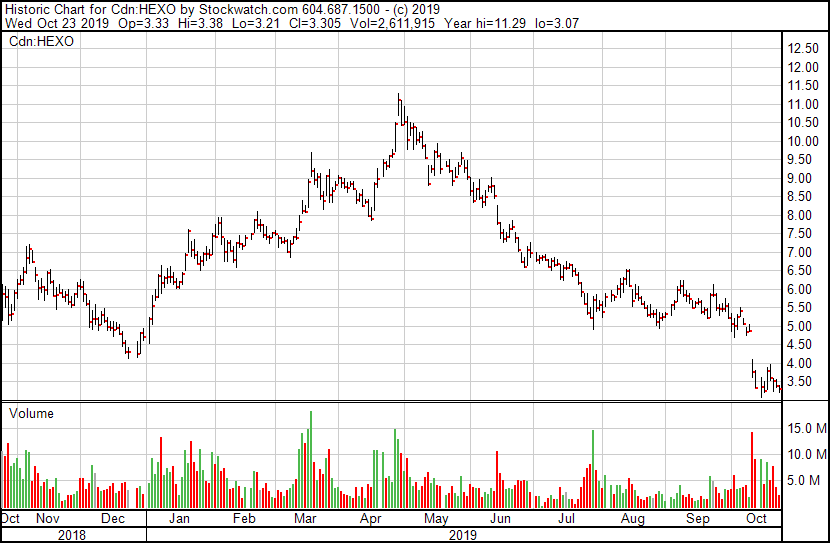

The financing, which is expected to close on November 15, comes at a pecular time for the firm. As of the last reporting period, Hexo Corp had $173.09 in cash, plus additional funds marked as being restricted. Yet, the firm is electing to conduct a financing of debt at effectively $3.16 per share, which is only pennies off of the 52 week low for the firm at $3.07.

Financial results for the fourth quarter are now expected to be released on October 28, 2019. Hexo had previously announced preliminary figures that indicate a miss on guidance.

Hexo Corp last traded at $3.31 on the TSX.

Information for this briefing was found via Sedar and Hexo Corp. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.