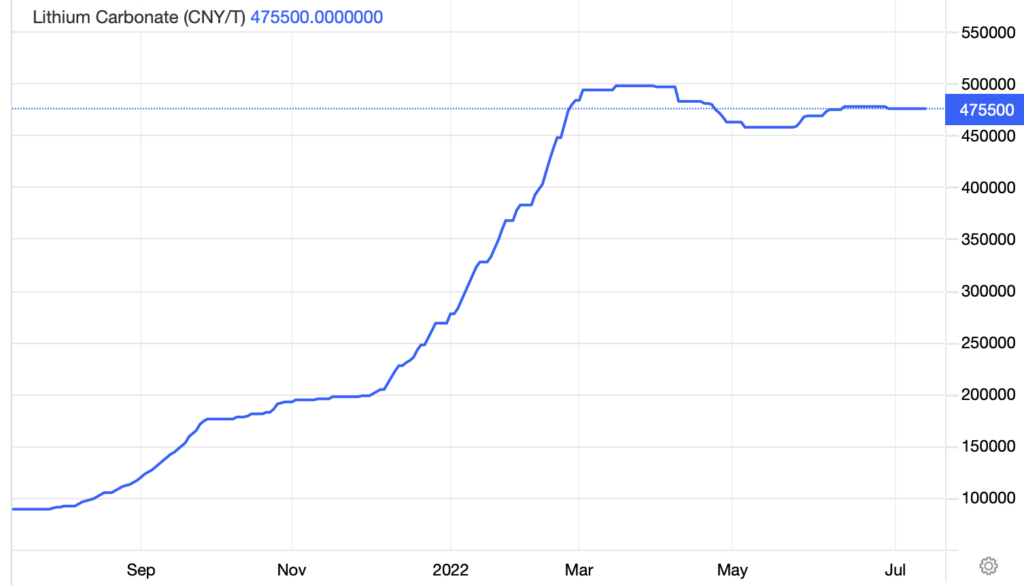

Despite the disappointing recent performance of most lithium stocks, from top lithium producer Albemarle Corporation (NYSE: ALB) to start-up producers like Lithium Americas Corp. (NYSE: LAC), each down around 30% in just six weeks, lithium carbonate prices remain near all-time highs and are more than 400% higher over the last year. Demand for the silvery metal in the electric vehicle (EV) battery industry remains high.

So far this summer, lithium stocks have been unable to shake off a downbeat report on the industry issued by Goldman Sachs in late May. The firm expects “lithium prices to continue to correct for the rest of the year and remain under pressure from increasing supply over the next few year.”

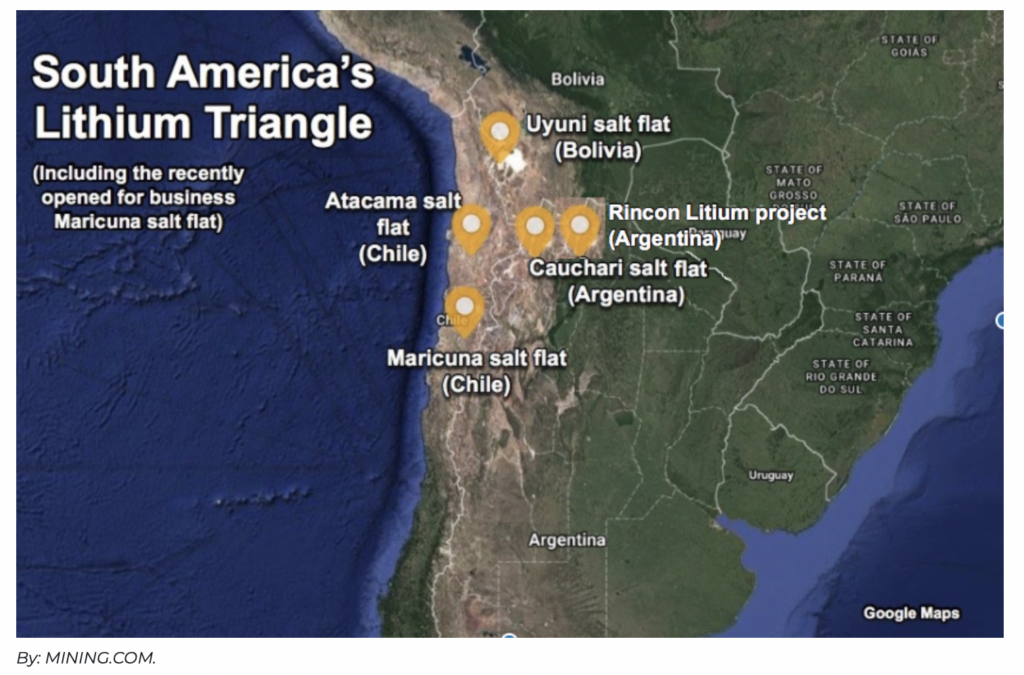

Recent anecdotal evidence suggests that the demand for developable lithium projects remains robust. On July 11, Ganfeng Lithium, China’s largest lithium compounds producer, agreed to buy the private company Lithea, Inc. for US$962 million. Lithea owns the rights to two lithium salt lakes in Argentina’s Salta Province. Ganfeng also owns a 51% stake in Lithium Americas’ flagship Cauchari-Olaroz lithium brine project in Argentina; Cauchari is expected to start commissioning in 2H 2022.

In addition, Rio Tinto (NYSE: RIO) completed its US$825 million acquisition of the Rincon lithium brine project in Argentina in late March 2022. Rincon is also located in the Salta Province and is situated fairly close to Lithium Americas’ Cauchari project.

Finally, in late May 2022, GCL Energy Technology, a developer of clean energy projects and owner of an EV battery swap service, paid around US$437 million (including transaction commission fees and debt related to the transaction) for a 54.3% stake in the Dechenonba lithium mine in the Sichuan province of China. This equates to about US$1,112 per tonne of Dechenonba’s lithium carbonate equivalent (LCE) reserves.

This price paid for reserves, which will take many years to develop and require substantial capital expenditure dollars, represents fully 40% of Lithium Americas’ total enterprise value. Keep in mind that Lithium Americas’ flagship lithium project could enter commercial production in perhaps nine months, plus the company is simultaneously working to develop another lithium project — the 100%-owned Thacker Pass lithium project in the U.S. state of Nevada.

Clearly, lithium suppliers to the EV battery industry are valuing the lithium commodity much more dearly than stock market investors. Since industry participants likely have access to timely information about supply-demand dynamics, it seems reasonable to believe that the valuations of lithium stocks may catch up to the commodity.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.