General Motors (NYSE: GM) has completed its second tranche subscription agreement for Lithium Americas (TSX: LAC), following the completion of a separation agreement that saw the latter split into two corporations.

Under the terms of the second tranche investment, GM, subject to the fulfillment of certain conditions precedent, will purchase US$329.85 million worth of shares in Lithium Americas, who’s sole focus is now the Thacker Pass project. The tranche is part of an overall $650 million transaction announced in January.

READ: Lithium Americas Reportedly Close To Receiving US$1 Billion From U.S. DOE For Thacker Pass

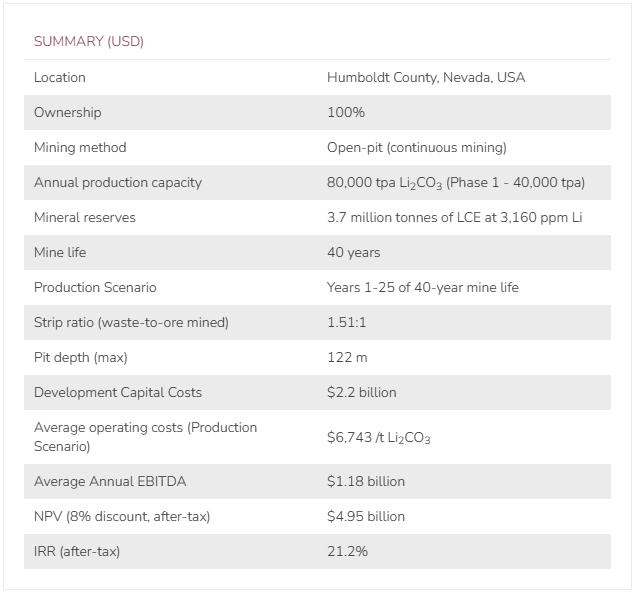

The Thacker Pass project is anticipated to produce 80,000 tonnes per year of lithium carbonate, with the mine life estimated at 40 years. As part of its investment, General Motors has also entered into an offtake arrangement for the project which will see it have exclusive access to to lithium carbonate produced under phase one production at the mine, and will retain the right of first offer on phase two production.

The separation meanwhile saw the firms Cauchari-Olaroz project in Argentina, which is in the process of entering production, along with other Argentinian assets parts ways, forming Lithium Argentina. Cauchari-Olaroz, which Lithium Argentina has a 44.8% interest in, is expected to produce 40,000 tonnes per annum of lithium carbonate. The project is 46.8% owned by Ganfeng Lithium, while JEMSE owns the remaining 8.5%.

READ: Lithium Americas Slated To Complete Separation Of Business On October 3

Lithium Americas will continue to trade on the TSX and the NYSE under the symbol “LAC”, while Lithium Argentina will trade on both exchanges under the symbol “LAAC” as of October 4. General Motors remains the largest investor in both corporations, with current ownership of 9.4% in each entity.

Lithium Americas last traded at $22.19 on the TSX.

Information for this briefing was found via Edgar, Bloomberg, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.