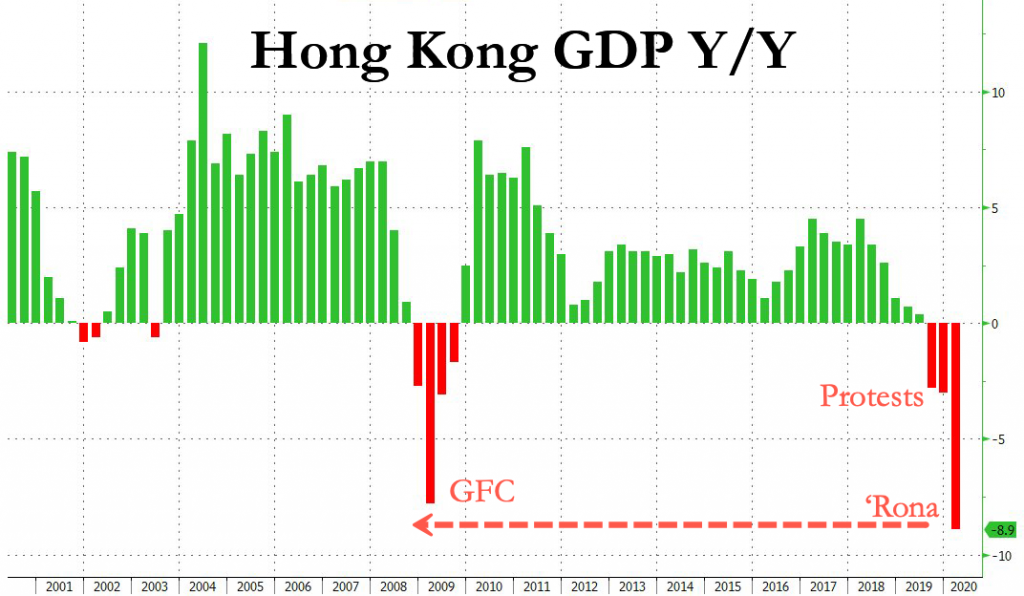

As the first data results pour in from around the world, it becoming increasingly evident the grim destruction the coronavirus pandemic has been leaving behind. Briefly shining the spotlight on Hong Kong’s economy, the first quarter has been the subject of the steepest GDP decline on record, with a drop of 8.9% year-over-year.

Although such a drastic decline in GDP can be largely attributed to implications stemming from the pandemic, a sizable portion also stems from Hong Kong’s preceding anti-government protests in late 2019. Nonetheless, such a decrease of 8.9% has not been witnessed since the Asian financial crisis, when in the third quarter of 1998 GDP levels fell by 8.3%. Back then, there were 5 consecutive quarters of economic decline, which according to recent data, Hong Kong is treading on very much the same path with a decrease over 4 quarters thus far.

The coronavirus pandemic has destabilized the city’s main economic growth contributors, including retail, investments and exports – which have decreased by 9.7% in the first quarter on a year-over-year basis, which is indicative of significant supply chain disruptions across most of Asia. Back in February, Beijing predicted that Hong Kong’s GDP would decline by 4%; however given the current grim outlook, that prediction has been further downgraded to -7%. The government is basing its updated GDP prediction on consumer spending habits for the rest of year, which will most likely remain stagnant given employment uncertainty.

It is also being predicted that Hong Kong’s budget deficit is going to hit a record high of $35.68 billion, which translates to roughly 9.5% of the city’s GDP. A sizable portion of the impending deficit is attributed to the government’s allocation of financial stimulus for households and businesses. However, according to the Hong Kong Retail Management Association, even despite the generous amount of government financial relief, there is still a good chance that almost 25% of the city’s brick-and-mortar stores may close by the end of the year.

Information for this briefing was found via CGTN and Zero Hedge. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.