Galen Weston Jr. has generated massive wealth during the pandemic while trying to PR us into thinking he is ‘the billionaire for the people.’ Not to mention avoiding taxes via offshore vehicles and fighting employees’ potential to earn a live-able wage at every turn.

Here’s how.

Have you been to a Loblaw-owned store lately? People are starting to share some of the new prices.

After raising food prices in Canada for two and a half years since the pandemic began, Galen thought he’d be a nice guy by announcing a price freeze on No Name Products for 3.5 months.

At first, the mainstream media ate up the Mr. Rogers' PR stunt.

But then we started asking questions.

How high were Loblaws prices before the freeze? How would we even know if they actually froze prices during this period? Did it even happen?

Negative headlines started to grow.

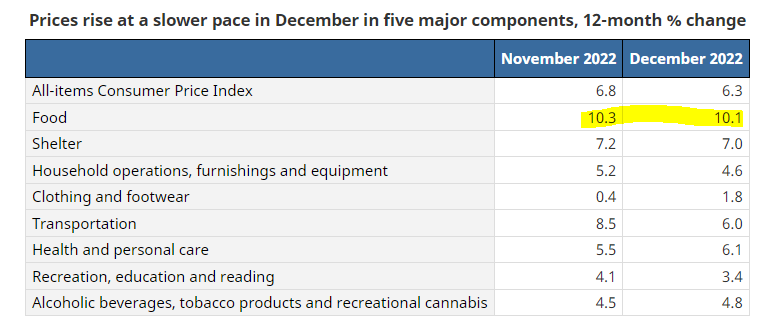

CPI data showed food prices across Canada were up over 10% annually from October to December.

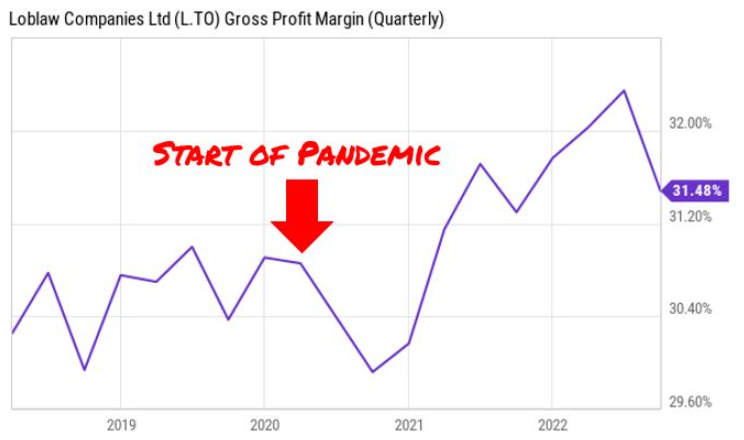

Sure, Loblaws froze prices at the end of the pandemic, but let’s take a look at what happened during the pandemic.

Loblaws saw their gross margins INCREASE over the course of the pandemic!

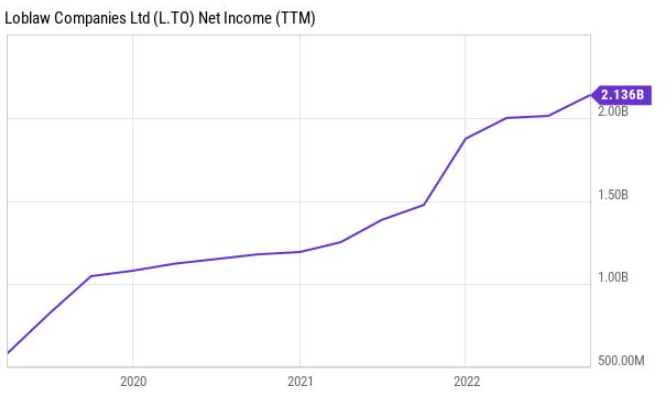

Since 2019, the company has generated a compounded annual growth rate of 13.9% on top line revenue, while averaging over 30% gross margins. But get this, as consumers struggled to pay for food, the company generated a compounded annual growth rate of 31.7% on net income.

Galen makes BANK

How much did Galen make during this period?

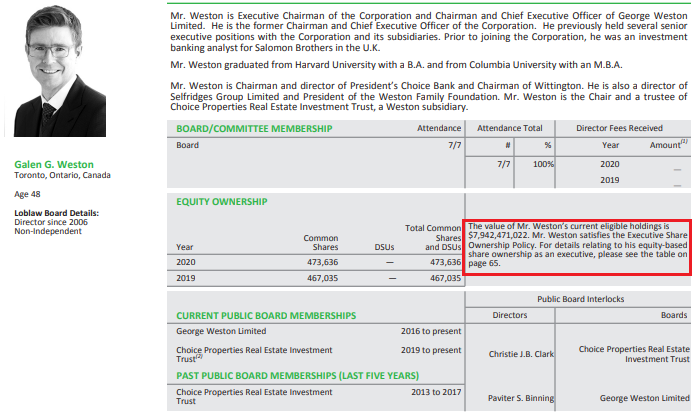

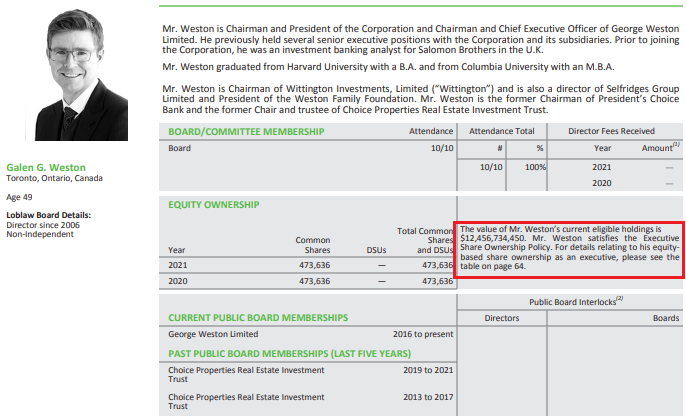

From the Management Information Circular for Loblaw Companies Limited it shows Galen’s related holdings to Loblaws went from $7.9B to $12.5B between 2021 and 2022.

His Loblaw-related equities position gained $4.5B in a year!

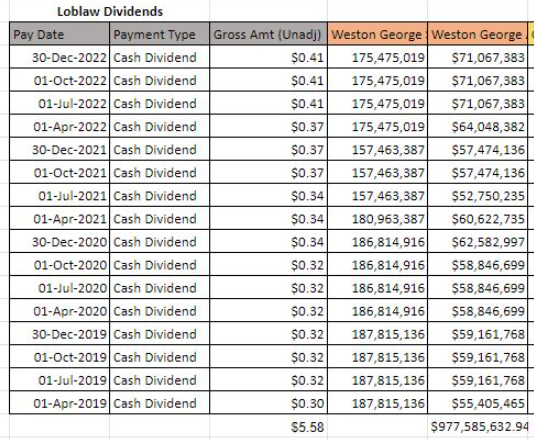

Galen Weston is the largest shareholder of George Weston Limited, which has received nearly $1.0 billion in dividends from Loblaw since the start of 2019. Galen’s stake would represent $529 million of that.

George Weston is a holding company that owns Loblaw and Choice Properties.

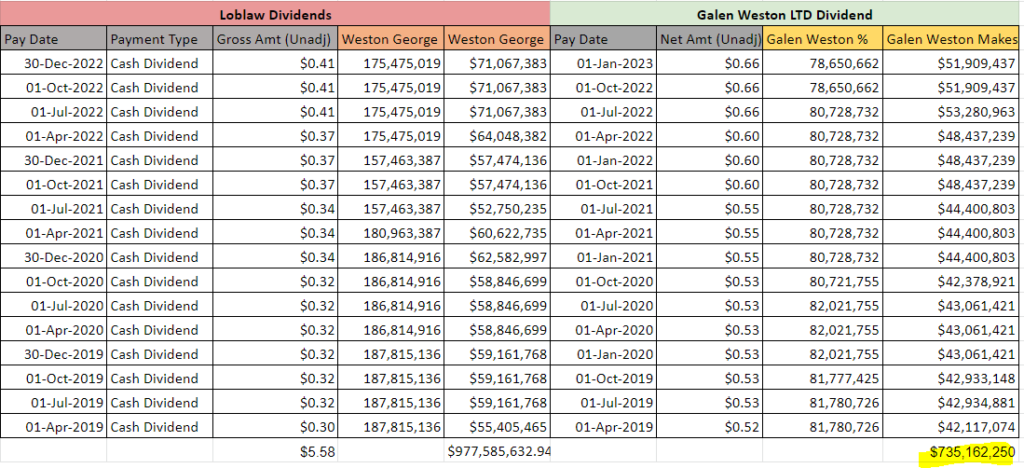

During this time his George Weston position paid him $735 million in dividends.

The man of the people?

You’re probably thinking a guy earning all that wealth off the back of his workers must want to treat them well. Right?

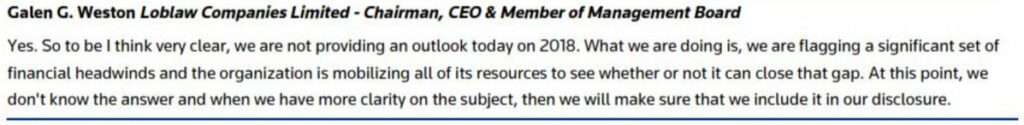

Nope. On a conference call in 2017, he spoke of Ontario’s minimum wage hikes by suggesting it would cost Loblaws $190 million in expenses and he would meet the minimum wage hikes by reducing manual bookkeepers and installing self-checkouts.

In 2018, Loblaw’s shareholders, led by Mr. Weston, voted down a live-able wage proposal for all employees. Weston told shareholders the program “is a national public policy question.”

I guess that the largest private employer in Canada doesn’t want to be a part of that debate.

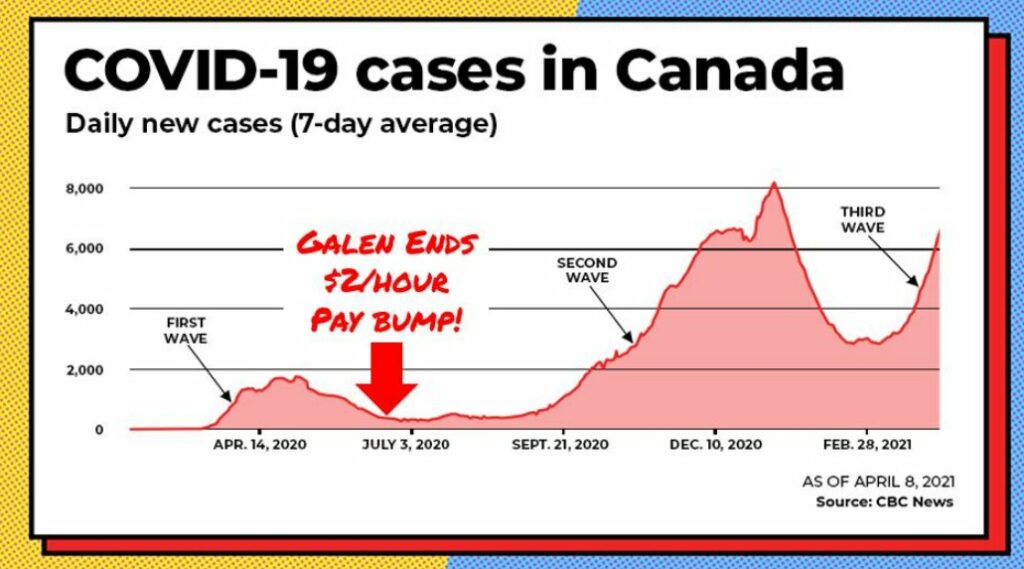

During the pandemic Weston recognized the people working at his stores were vital and facing increased risk, so he increased worker pay by $2/hour. When Covid Cases ebbed in July of 2020, Galen decided that the pay bump wasn’t needed anymore, and he took it away… but the pandemic wasn’t over. Canada experienced the most severe waves of the pandemic immediately after Galen took away Loblaws workers’ COVID pay.

He didn’t give it back.

Loblaw defeats the tax man

Galen’s $735 million in dividend income is his share of $4.3 billion in after-tax profits that Loblaws made from 2019 through 2021. Any company that earns that much money is always looking for a way to keep it, and the tax man is always looking for a way to keep them from keeping it.

Loblaw’s innovation was to set up a bank in Barbados and use it to manage the investment capital from their non-Canadian subsidiaries.

Wholly owned Loblaw subsidiary “Glenhuron Bank” did a brisk business in money management, generating so much revenue from 2000 through 2013 that, if it had been earned in Canada, Loblaw would have owed hundreds of millions of dollars in taxes to the Canada Revenue Agency.

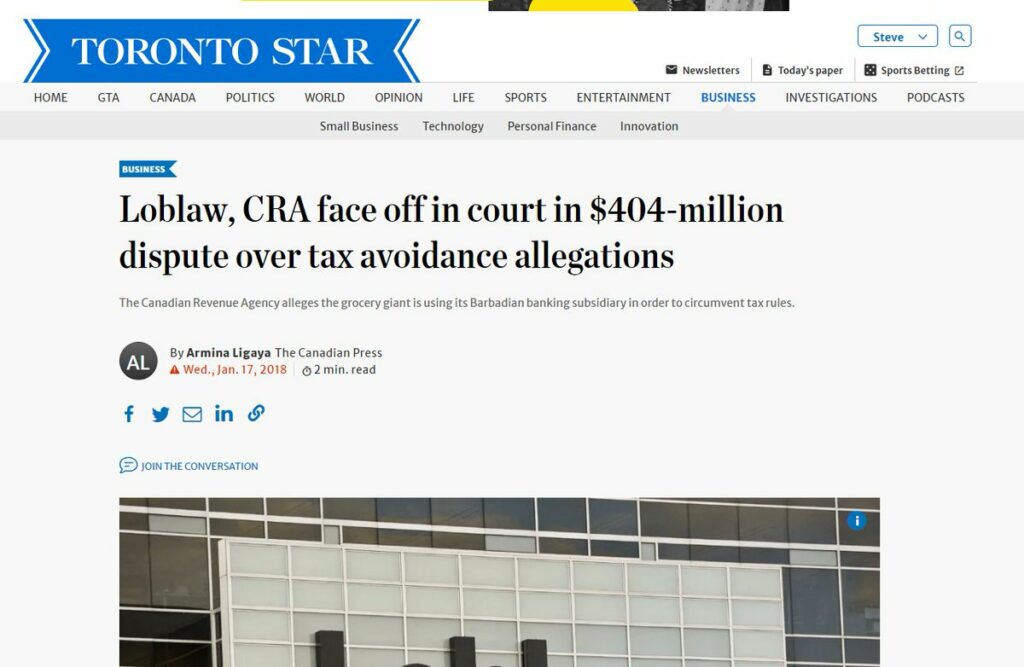

The CRA took Loblaw to court and said: “Wait a minute, you aren’t running a bank… you’re running a tax dodge! That money is being managed in Barbados specifically to avoid Canadian taxation!”

And Loblaws was like: “Well… ya. OBVIOUSLY!”

The army of lawyers and accountants who set up Glenhuron Bank got to work fighting the CRA in court. The Loblaws Lawyers dragged it out a bunch and ended up losing at first, but then appealed, and won.

So the Canada Revenue Agency took it all the way to the Supreme Court, where Loblaws won a 7-0 decision that let them keep their $400 million, and opened up the prospect for future cash-rich companies to do an end-run around on the CRA for the money being made by their money.

The bread fixing scandal

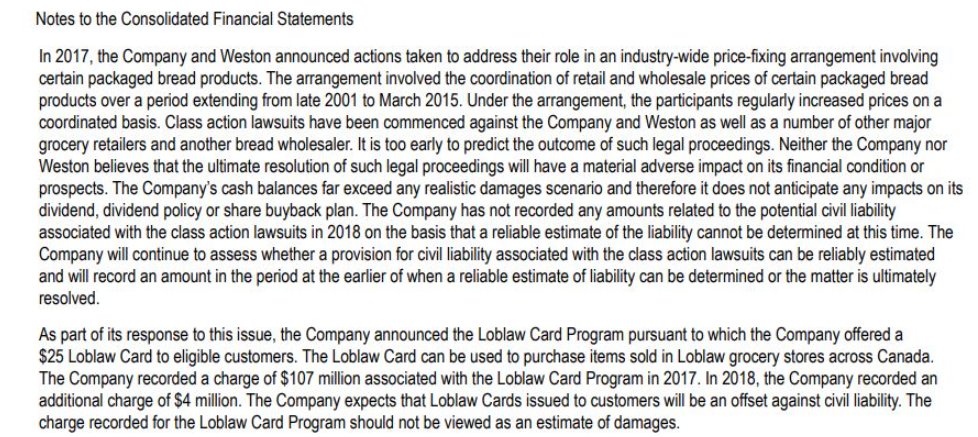

While Galen’s Grocery Co. made plenty of money off its money during that period, it also made plenty of money off of bread, by fixing its price.

We know, because they told us.

Loblaw came to the Canada Competition Bureau in 2017 to tell them that, from late 2001 through March 2015, Loblaws’ bakeries had colluded with other grocery retailers to fix the retail and wholesale prices of bread in Canada. By coming clean, Loblaws and its executives and employees secured immunity from criminal prosecution for the price fixing.

The sweet deal appears to have let Loblaws write its own re-compensation plan: Anyone who could prove they bought a loaf from Loblaws prior to May of 2015, and registered in time, got a $25 gift card, that they could use to buy some more over-priced bread.

Loblaws took a $107 million dollar charge in Q4 2018, and acted real sorry about it, which sounds pretty cheap for 14 years of selling a daily staple at an inflated price.

If someone paid $2 too much for one loaf of bread a week for 14 years, Loblaws basically took $1,456 of their money to the Barbadian investment bank, and gave the interest to Galen… then paid them off with $25 in store credit.

To be fair: a shopper who used that $25 card wisely could earn an extra fifty cents or so in PC Optimum points.

Originally tweeted by SmallCapSteve (@smallcapsteve) on February 1, 2023.

Information for this briefing was found via Sedar, CBC News, Toronto Star, Reuters, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

3 Responses

I don’t have any problem with Galen Weston trying to make a dollar! EVERYone is trying to make a dollar, just to keep their heads above water. The problem is – he’s not just making “a dollar”, he’s making millions – off the backs of hardworking middle-class people who can barely make ends meet. And he has no qualms about it. I would love to see the man (and his family) try to live on the Canadian minimum wage (which is probably what many employees of No Frills, Loblaws, etcetera are being paid), or even on the average/median wage of middle class Canadians. THAT would be a sh*t show people would pay to watch! IF they had any money left after paying the grocery bills!

I strongly object to this article.. I’m just a man of the people trying to make a dollar..

I strongly object to you. I’m just trying to eat but you’ve made the groceries cost so much that eating the rich and going cannibal almost seems like the only, yet very unappetizing, option left available… plus, you probably taste like shit.