After a vicious ~64% correction over the past two months of trading, Hut 8 Mining Corp. (TSX: HUT) shares are beginning to look attractively valued on a fundamental basis. All cryptocurrency miners, including Hut 8, have been buffeted by the decline in the price of Bitcoin. Hut 8 now seems to be priced more like a value stock than a growth name.

As of mid-May, Hut 8 owned 3,522 Bitcoin, which is worth around US$140 million at the digital asset’s current price of around US$39,700. This, combined with the company’s cash balance of C$39.8 million as of March 31, 2021, means that Hut 8’s combined cash plus cryptocurrency holdings equals around C$209 million.

Hut 8 has 118.575 million shares outstanding, so that at its current stock price of about C$4.90, its stock market capitalization is C$585 million. Furthermore, after subtracting out its crypto and cash holdings and adding C$1.3 million of total debt, Hut 8’s enterprise value is approximately C$377 million.

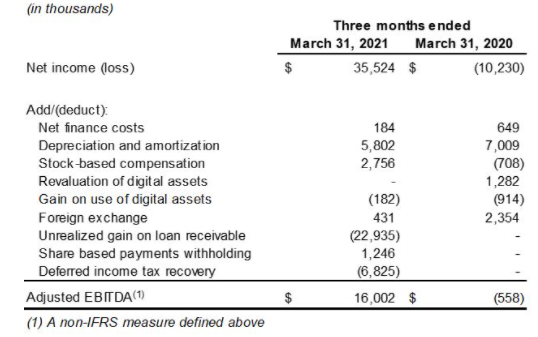

Hut 8’s adjusted EBITDA in the quarter ended March 31, 2021 was C$16.0 million. Importantly, the price of Bitcoin averaged US$45,300 in the quarter, so this level of cash generation was predicated on Bitcoin prices reasonably close to the current level, not on prices in the US$60,000 vicinity. (The average Bitcoin price in the second quarter to date is in the low- to mid-US$50,000 range.)

Annualizing Hut 8’s 1Q 2021 adjusted EBITDA suggests an annualized adjusted EBITDA run rate of around C$64 million. In turn, the ratio of the company’s EV to run rate EBITDA is only around 5.9 times (C$377 million divided by C$64 million).

A 5.9x EV/EBITDA ratio is considered quite low for a growth company. Indeed, the average EV/EBITDA ratio for every industry in 2019, the most recent non-pandemic “normal” year, was well above that level.

Extremely Strong Balance Sheet

Hut 8’s cash and digital assets totaled C$282 million as of March 31, 2021 against only C$1.3 million of debt. As noted above, the company’s adjusted EBITDA reached C$16 million in 1Q 2021. As recently as 3Q 2020, that measure was negative.

| (in thousands of Canadian dollars, except for shares outstanding) | 1Q 2021 | 4Q 2020 | 3Q 2020 | 2Q 2020 | 1Q 2020 |

| Adjusted EBITDA | $16,002 | $1,403 | ($2,904) | ($86) | ($558) |

| Operating Income | $6,380 | ($1,530) | ($841) | $2,460 | ($5,388) |

| Operating Cash Flow | ($14,877) | $1,629 | ($486) | ($969) | ($1,466) |

| Cash, Including Digital Assets | $282,223 | $104,778 | $43,223 | $45,300 | $28,216 |

| Debt – Period End | $1,301 | $25,757 | $27,006 | $27,583 | $28,700 |

| Shares Outstanding (Millions) | 118.6 | 97.2 | 96.7 | 96.7 | 90.5 |

The shares of Hut 8 and other cryptocurrency miners have been quite weak over the last two months, in most cases declining even more rapidly than Bitcoin. If the price of Bitcoin were to continue to decline from current levels, the shares of the miners could continue to follow Bitcoin lower.

Hut 8 Mining shares rose dramatically over the approximate six-month period from September 2020 through mid-March 2021 and have declined quite steeply over the last two months. The stock significantly outpaced the price of Bitcoin both on the way up and on the way down. At Hut 8’s current price, the stock’s valuation, as measured by its EV/EBITDA ratio, has reached a level associated with value, or slow-growing companies, not rapidly growing companies — a subset of companies to which the company thinks it belongs.

Hut Mining Corp. last traded at $4.75 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.