On October 18th, IAMGOLD Corp (TSX: IMG) filed their third quarter updates. The company reported 153,000 ounces of production for this quarter, up from 139,000 ounces last quarter, bringing the year-to-date production to 448,000 ounces. The company reiterated its full-year production guidance between 565,000 and 605,000 ounces.

Additionally, in another news release, the company released its third quarter project updates. The company said that the project at Côté Gold is 36% complete and remains on track to be in commercial production by the second half of 2023. Detailed engineering is 85%, while the permanent camp installation is 95%. In their technical report update, they say that after-tax NPV5% is $1,597 million, or a 19% IRR with an annual average production of 489,000 ounces per year for 5 years, with the mines life expected to be 18 years.

IAMGOLD currently has 10 analysts covering the stock with an average 12-month price target of C$4.10, or a 15% upside. Out of the 10 analysts, 2 have buy ratings, 7 have holds and 1 analyst has a sell rating. The street high price target sits at C$6 from TD Securities while the lowest comes in at C$3.16.

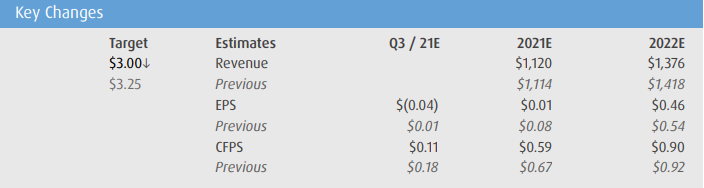

BMO Capital Markets reiterated their market perform rating but lowered their 12-month price target to C$3 from C$3.25, saying that they are remaining cautious of the unknown unknowns. They say that the project is progressing well and potentially Gosselin could add mine life. But warns that this also showed that IAMGOLD might have a hard time meeting its own capital cost, ramp up, and operating costs.

BMO has elected to slightly tweak their 2021 and 2022 estimates, primarily changing their CAPEX as there is an US$84 million contingency or 5.5% of the amount left to spend. They call this contingency small. They also raise CAPEX due to COVID-19 headwinds and inflation.

BMO additionally warns that there might be some technical risks and challenges at the site since the plant layout is uncommon, but believe that development should remain fairly normal with the technologies that will be deployed to the mine.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.