Unbelievably, iAnthus Capital Holdings (CSE: IAN) filed their first quarter 2020 financial results this morning, revealing revenues of $30.4 million and a comprehensive loss of $237.3 million for the period ended March 31, 2020. The massive loss is the function of significant impairments of assets that the company was required to take.

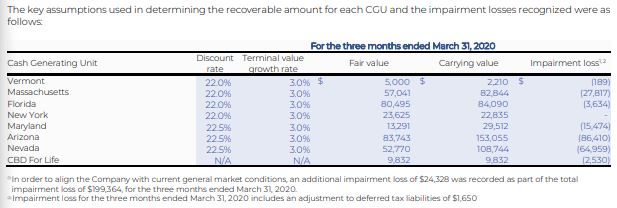

With revenues of $30.4 million, the company realized a gross profit before adjustments of $15.0 million. Operating expenses by comparison however came in at $232.0 million, with the largest expense being that of impairments of $199.4 million. This was followed by salaries and employee benefits of $11.1 million, general and administrative expenses of $6.5 million, depreciation and amortization of $6.8 million, and finally professional fees of $4.4 million. The short of it, is that the company was in a losing position before impairments were even factored into the equation.

In terms of impairments, the company saw its goodwill effectively wiped out. Beginning the quarter with roughly $201.0 million worth of goodwill, the company made an adjustment of $1.7 million to this figure for deferred tax liabilities, followed by an impairment of $199.4 million to bring this number to $0. It should be noted that the company still has a total of $174.1 million in intangible assets on the books, with the company taking minimal amortization on this figure during the quarter.

Looking to the balance sheet, its clear why the company was in a position that forced it to look to strategic alternatives. As of March 31, the company had just $6.5 million in cash on the books, a decline from $34.8 million at the start of the quarter. Inventory rose to $27.8 million from $25.2 million, while receivables rose to $8.1 million from $7.6 million. Total current assets amounted to $63.7 million, down from $87.1 million.

Payables and accrued liabilities meanwhile climbed to $40.6 million, up from $25.4 million, while lease liabilities rose from $5.3 million to $6.6 million. The major change here however was its current portion of long term debt, which climbed from $10.8 million to $143.0 million as a result of defaults. Total current liabilities currently sit at $191.3 million, up from $44.2 million in the prior quarter.

This long term debt and its associated default has been a point of contention for certain shareholders, whom argue that the company had the funds required to pay the interest associated with debt, and thus could have avoided a default. However, this fails to take into consideration other covenants by which the company was bounded by.

For instance, the company was required to maintain a ratio value of asset values being 1.75 times the total net debt at each quarter end and also maintaining a minimum cash balance of $1.0 million while its secured notes remain outstanding. The company did not meet this covenant as a result of the market capitalization of the company, which forced a writedown in the value of goodwill on its balance sheet. As a result, it was in default of its debt.

This default triggered a cross-default on its unsecured notes.

iAnthus Capital Holdings remains halted on the CSE.

Information for this briefing was found via Sedar and iAnthus Capital Holdings Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.